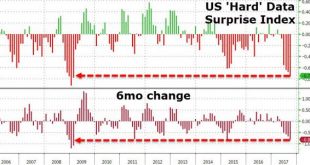

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

Read More »Risk Off: Global Stocks Slide As “Fire And Fury” Results In “Selling And Fear”

US futures are set for a sharply lower open (at least in recent market terms) following a steep decline in European stocks and a selloff in Asian shares, following yesterday’s sharp escalation in the war of words between the U.S. and North Korea. In a broad risk-off move U.S. Treasuries rose, the VIX surged above 12 overnight, while German bund futures climbed to the highest level in six weeks. The Swiss franc gained...

Read More »Bi-Weekly Economic Review

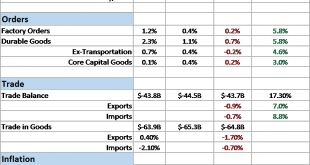

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched. I said during that entire time that while the problems in the energy...

Read More »Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates. At least not without making a commitment like the...

Read More »FX Weekly Review, March 13 – March 18: Fed Disappoints, Dollar Losses

Swiss Franc Currency Index The Swiss Franc index recovered this week against the dollar index. The franc improved against both dollar and euro, given that the SNB was not dovish enough, Trade-weighted index Swiss Franc, March 18(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency...

Read More »FX Weekly Review, March 06 – March 11: CHF loses against the euro

Swiss Franc Currency Index The Swiss Franc lost this week in particular against the euro, given that Mario Draghi was less dovish than expected. If the stronger euro is driven only by speculators, or also by “real money” (investments in cash, bonds, stocks) will be visible in Monday’s sight deposits release. Trade-weighted index Swiss Franc, March 11(see more posts on Swiss Franc Index, ) Source: markets.ft.com...

Read More »FX Weekly Review, February 27 – March 04: Dramatic Shift in Fed Expectations Spurs Dollar Gains, but Now What?

Swiss Franc Currency Index The Swiss Franc index remained in its ranges. It is now trending downwards, while the dollar index is strengthening Trade-weighted index Swiss Franc, March 04(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three years...

Read More »FX Weekly Review, February 20 – 25: Ranges in FX: Respect the Price Action

Swiss Franc Currency Index After a certain recovery in the last month, the Swiss Franc index lost ground again in this month. It is down one percent for this month, while the dollar index is up one percent. Trade-weighted index Swiss Franc, February 25(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the...

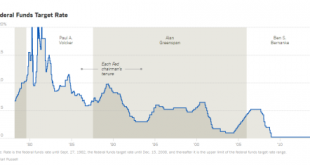

Read More »Are Rate Hikes Bad For Gold?

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

Read More »FX Weekly Review, February 13 – 18: Why still long the dollar?

Swiss Franc Currency Index The Swiss Franc index was mostly unchanged against the U.S. Dollar Index in the last week. One word about Marc Chandler’s argumentation below: Three types of investors are long the dollar: FX investors/speculators are long the dollar because of the difference in monetary policy (e.g. higher US rates). Cash investors, for example rich people from China and other Emerging Markets, currently...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org