Damned If You Do… After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was. The BoJ cannot manipulate the yen anymore. June yen futures, daily – taking off again – click to enlarge. Given the BoJ’s bizarre plan to push consumer price inflation to a 2% annualized rate within [enter movable goal post here] years, Mr. Kuroda...

Read More »With Fiat Money, Everything Is Relative

What Determines a Currency’s Value? At the end of March the price of the euro in terms of US dollars closed at 1.1378. This was an increase of 4.7 percent from February when it increased by 0.3 percent. The yearly growth rate of the price of the euro in US dollar terms jumped to 6 percent in March from minus 2.9 percent in February. EUR-USD, 2007 – today,monthly – click to enlarge. According to most experts currency rates of exchange appear to be moving in response to so many...

Read More »Political Pundits, or Getting Paid for Wishful Thinking

Bill Kristol – the Gartman of Politics? It has become a popular sport at Zerohedge to make fun of financial pundits who appear regularly on TV and tend to be consistently wrong with their market calls. While this Schadenfreude type reportage may strike some as a bit dubious, it should be noted that it is quite harmless compared to continually leading people astray with dodgy advice. To answer the question posed in the picture with the benefit of hindsight: not really…. (look at the...

Read More »Getting it Wrong on Silver

Erroneous Analysis of Precious Metals Fundamentals We came across an article at Bloomberg today, talking about silver supply troubles. We get it. The price of silver has rallied quite a lot, so the press needs to cover the story. They need to explain why. Must be a shortage developing, right? At first, we thought to just put out a short Soggy Dollars post highlighting the error. Then we thought we would go deeper. Here’s a graph showing the price action in silver since the beginning of...

Read More »Peak Data: When Not Enough Is Already Too Much

The Wild 1990s Not so long ago, during 1990’s, the connecting world of the connected world we now know was literally and comprehensively in the development stage during those wild crazy go go years before the crash in technology stocks in 2000. Nasdaq Composite, 1995 – 2003, The technology bubble and crash The infamous tech bubble of the 1990s – to this day the greatest stock market bubble ever seen in the US (in terms of multiple expansion, intensity, public participation, speed and...

Read More »Old School Investment Lessons

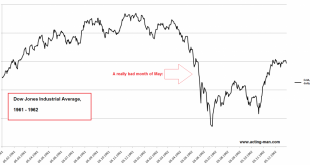

Laughing at Blue Monday On May 28, 1962 – dubbed “Blue Monday” – the market fell 6%… its worst single-day slide since 1929. Peter Stormonth Darling was an investment manager at investment bank S. G. Warburg & Co. at the time. He strolled in to tell his boss, Tony Griffin, how much the market had fallen. Dow Jones Industrial Average, 1961-1962 The DJIA in 1961 – 1962. March – June 1962 delivered quite a scare to investors – in May the decline accelerated, as panic began to spread –...

Read More »US Economy – Gross Output Continues to Slump

The Cracks in the Economy’s Foundation Become Bigger Decay… Photo credit: bargewanderlust Last week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but they used to be published only once every few years in the past, so the current situation represents a significant improvement. As Ned Piplovic summarizes in his update on the situation on Dr. Mark...

Read More »The “Canary in the Coal Mine” for Chinese Stocks

The Largest Online Marketplace in the World This company is twice the size of Enron at its peak ($100 billion). Pharmaceutical giant Valeant, which blew up in the last year, was only $90 billion at its peak. Before I get to what the stock is, let me tell you where it is: China. CEO Jack Ma, wagging a finger (bad sign) Photo credit: Kiyoshi Ota / Bloomberg I recently heard an excellent presentation by Anne Stevenson-Yang at Grant’s Spring Investment conference. Stevenson-Yang is the...

Read More »Affairs of State: Erdogan and Böhmermann

Insulting Mr. Erdoğan Can Be Dangerous Most of our readers are probably aware by now that the German government finds itself in a rather awkward situation over its relations with Turkey’s government again – with which the EU has just struck a widely criticized and very expensive deal to help it stem the flood of refugees. One thing is absolutely certain about Turkey’s president Recep Tayyip Erdoğan: He has no sense of humor whatsoever. As of early March 2016, 1,845 lawsuits were pending...

Read More »Russian Aggression Unmasked (Sort Of)

Provocative Fighter Jocks Back in 2014, a Russian jet made headlines when it passed several times close to the USS Donald Cook in the Black Sea. As CBS reported at the time: “A Pentagon spokesperson told CBS Radio that a Russian SU-24 fighter jet made several low altitude, close passes in the vicinity of the USS Donald Cook in international waters of the western Black Sea on April 12. While the jet did not overfly the deck, Col. Steve Warren called the action “provocative and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org