The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time. Something else is going on. . In America, the Fed Cult is out to take credit for this brewing downturn (Jay Powell seeking his place alongside Volcker, which...

Read More »Follow China’s True Line

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch. Where have we heard that before? Everywhere, actually, but especially in China. Whether early last year, last August, and now again...

Read More »ADP Front-Runs BLS and President Phillips

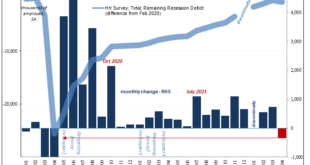

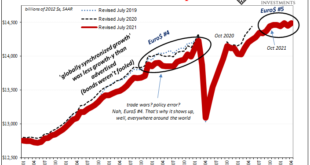

It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part. The destination, or depth, really, is what’s left to argue. As noted yesterday, even President...

Read More »Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal. But with case counts sharply rising once more, the whole thing was going to get shutdown instead. The government declared a holiday starting April 1 (no fooling) last year,...

Read More »President Phillips Emerges To Reassure On Growing Slowdown

Just the other day, President Biden took to the pages of the Wall Street Journal to reassure Americans the government is doing something about the greatest economic challenge they face. Biden says this is inflation when that’s neither the actual affliction nor our greatest threat. On the contrary, recession probabilities have sharply risen as the real economy slows down given the emerging downside to last year’s supply shock. One thing we might agree on, the...

Read More »Peak Policy Error

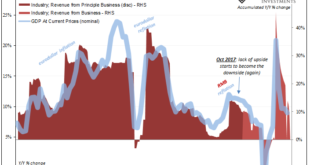

Another economic discussion lost to the eventual coronavirus pandemic mania was the 2019 globally synchronized downturn. Not just downturn, outright recession in key parts from around the world, maybe including the US. We’ll simply never know for sure because just when it was happening COVID struck and then governments overrode everything including unfolding history. What anyone can say for sure is that 2019 hit a rough patch where there was only supposed to have...

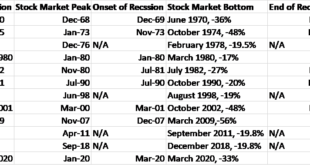

Read More »Weekly Market Pulse: Is The Bear Market Over?

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days. That still leaves the market 13.7% from the intraday high and most investors still down double digits on the year (-11.5% for the standard 60/40 portfolio)....

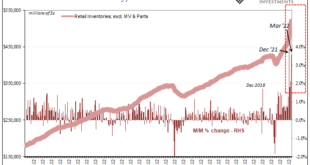

Read More »Inventory Flood Continues Just As Consumers Tap Out

If it continues to play out the same way, it would be all the worst scenarios lumped together all at the same time. A real unfortunate convergence, yet one that has been entirely predictable. Consumers reaching their absolute spending limits. Warehouse and storage capacity nationwide dwindling to long-time lows, leaving firms no options to store inbound goods. And, of course, the stream of goods into inventory that shows no signs (yet) of letting up. Taking the last...

Read More »‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?” The way the phrase has been inserted, it’s as if Congress today seeks to plant its members on some incorporeal higher plane than mere physical substance, too, diving deep into the moral consciousness of the nation and economy in order justify taking general action. Just last week, the House of Representatives passed a bill which...

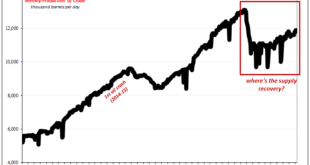

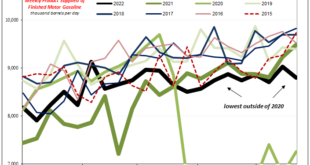

Read More »Is It Being Demanded?

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing. The bane of the logistical supply-side snafu-ing, it has been container redistribution mucking the goods economy up.The recent and sharp decline in container rates, according to Freightos, is because China’s been closed down by Xi’s pursuit of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org