There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s...

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

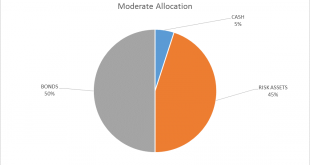

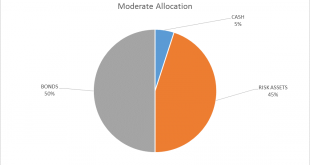

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

Read More »Bi-Weekly Economic Review: One Down, Three To Go

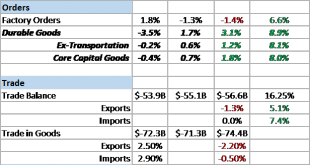

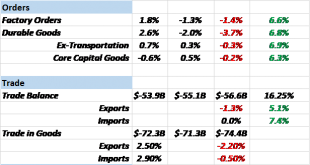

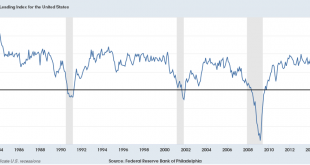

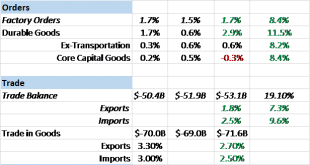

Economic Reports Economic Growth & Investment We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of...

Read More »The Future of Copper – Incrementum Advisory Board Meeting Q1 2018

Copper vs. Oil The Q1 2018 meeting of the Incrementum Fund’s Advisory Board took place on January 24, about one week before the recent market turmoil began. In a way it is funny that this group of contrarians who are well known for their skeptical stance on the risk asset bubble, didn’t really discuss the stock market much on this occasion. Of course there was little to add to what was already talked about extensively...

Read More »China: Inflation? Not Even Reflation

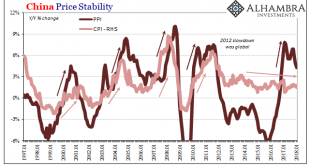

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference. There was, to me anyway, a lot of Japan in it, even still if “globally...

Read More »Bi-Weekly Economic Review

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

Read More »Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

Read More »Bi-Weekly Economic Review: Markets At Extremes

Economic Reports Production Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on...

Read More »Forget It, China’s Not Booming

Jeffrey Snider Jeffrey Snider, head of global investment research at Alhambra Investments, says China is in fact not growing rapidly, which sounds disheartening for commodity investors. He reckons a crucial investment metric has weakened, pointing to slower economic expansion: https://www.bnn.ca/video/forget-it-china-s-not-booming-money-manager~1310003...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org