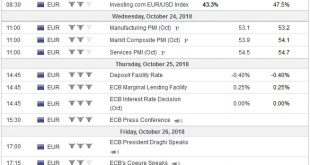

Several major central banks will meet next week, including the European Central Bank, but it is only the Bank of Canada that is expected to hike rates. The flash PMIs and the first official estimate of Q3 US GDP are among the data highlights. Beyond the events and data, the volatility from global equity markets from Shanghai to New York will continue to have a strong influence on other capital markets. Also, the...

Read More »FX Daily, October 18: China’s Angst Stays Local

Swiss Franc The Euro has fallen by 0.07% at 1.1436 EUR/CHF and USD/CHF, October 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Asian equities were lower, led by a nearly 3% drop in Shanghai, while European shares shrugged it off and the Dow Jones Stoxx 600 is up about 0.4% in late morning turnover. The S&P 500 is off by about 0.25%. Global bond yields...

Read More »FX Daily, October 16: Semblance of Stability Returns

Swiss Franc The Euro has risen by 0.32% at 1.1461 EUR/CHF and USD/CHF, October 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Although the S&P 500 was unable to sustain early gains yesterday, the largely consolidative session was part of the stabilization of equities after last week’s jump in volatility. Asia and European stocks are also cautiously...

Read More »Macro Cheat Sheet

Key considerations and price for selected currencies distilled into four bullet points.US Dollar The dollar’s recovery ahead of the weekend was aided by the stabilization of the stock market, where the S&P 500 managed to close back above the psychologically important 200-day moving average. Interpolating from prices, the market does not expect the President’s criticism to alter the Fed’s course. US data highlights...

Read More »FX Weekly Preview: Forces of Movement

There are three broad forces of movement in the week ahead: the equity market performance, political developments, and economic data. United States It was a tumultuous week for equities, and there was not clear or obvious trigger. With US bond yields and equities trending higher this year, there does not seem to a reason why it ended last week. Similarly, the recovery before the weekend, which lifted the S&P 500...

Read More »FX Daily, October 11: Equity Swoon Takes Spotlight, Pushes Dollar to Backfoot

Swiss Franc The Euro has risen by 0.24% at 1.1429 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is one story today, and that is the sell-off in global equities. Although the narratives put the US at the center, the fact of the matter is that US equities have been among the best performers this year, despite the rise of...

Read More »FX Daily, October 10: US Dollar Pullback may Continue in North America

Swiss Franc The Euro has risen by 0.19% at 1.1416 EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US Dollar: The euro bottomed yesterday near $1.1430 and reached $1.1515 in Asia. Support is seen near $1.1480 and should hold if the euro’s upside correction is to continue. There are options struck $1.1500-$1.1510 for nearly 1.4 bln euros...

Read More »FX Daily, October 09: A (Short) Reprieve For China while the Dollar Stays Firm

Swiss Franc The Euro has fallen by 0.10% at 1.1393 EUR/CHF and USD/CHF, October 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The small gains in China’s Shanghai Composite and the yuan is helping sentiment today. News that Italy’s budget watchdog may reject the government’s fiscal plans has helped stabilize Italian assets initially, but renewed pressure...

Read More »Cool Video: Clip from CNBC Squawk Box

Marc ChandlerMarc Chandler - Click to enlarge The combination of divergence and the US policy mix is underpinning the dollar and I was invited to share my views on CNBC’s Squawk Box earlier today. It dovetailed nicely Matthew Diczok (from Merrill Lynch) views on Fed policy and US interest rates. In addition, I note the troubled spot Europe finds itself with German industrial output unexpectedly falling for a third...

Read More »FX Daily, October 08: China and European Woes Weigh on Equities but Buoy the Dollar

Swiss Franc The Euro has fallen by 0.24% at 1.1395 EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org