(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the...

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

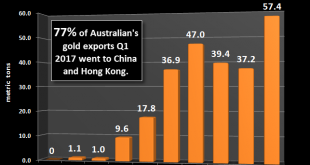

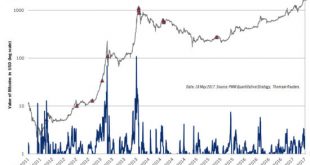

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term - Bitcoin volatility shows not currency or safe haven but speculation- Volatility still very high in bitcoin and crypto currencies (see charts)- Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900- Bitcoin least volatile of cryptos, around 75% annualised volatility- Gold much more stable at just 10% annualised volatility- Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »Fighting inflation with FX, a real traders market

(GLOBALINTELHUB.COM) Dover, DE — 7/18/2017 — Hidden in plain site, as the Trump administration finally released something of substance regarding the so called promised “Trade Negotiation” we see FX take center stage in the global drama unfolding. As noted on a Zero Hedge article: The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by...

Read More »Switzerland Opens Door To Bitcoin Asset-Management Business

Bitcoin and other cryptos have fallen sharply over the past month in a shakeout that saw some of the early longs decide to take their winnings and walk away. But a 20% drop from the all-time highs hasn’t done much to temper wealthy investors interest in bitcoin and other cryptocurrencies as alternative investments potentially worthy of diversification. And with the Greyscale Bitcoin Investment Trust still trading at a...

Read More »Negative Rates: The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other...

Read More »The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other valuables are ramping up their capacity to help cash in on the soaring...

Read More »Crypto-currencies in a bubble

Crypto-currencies like Bitcoin and Ripple are caught in a “bubble regime”, oscillating between extreme peaks and troughs. A new peak is close….Pictet’s inhouse quantitative analysis can provide ways of spotting certain kinds of bubble and predicting when they will burst (see article ‘Forecasting Financial Extremes’).One aspect of this analysis is focused on investor herding behaviour, as measured by the combination of super-exponential cycles and ever faster oscillations around those cycles....

Read More »Bitcoin’s Settlement Problems

On the FT Alphaville blog, Izabella Kaminska reports about delays, fees, and doubts.

Read More »History of Gold – Interesting Facts and Changes Over 50 Years

History of Gold - How the gold industry has changed over 50 years Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: - Gold market size- Gold mine production "peaked in 2015"- South African production collapse from 1,000 tonnes- South African gold was flown to London and Zurich and an airliner had its own designated...

Read More »Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist

Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist - Gold coin called ‘Million Dollar Gold Coin’ or ‘Big Maple Leaf’ stolen from Berlin museum early on Monday- World's purest gold coin and in the Guinness Book of Records for its purity of 99999 fine gold- Gold coin was legal tender, investment grade, bullion coin and only 5 other coins were minted- The other 'Million Dollar Gold Coin' is still available for sale by GoldCore safely stored in vaults in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org