Digital Gold On The Blockchain – For Now Caveat Emptor – Bitcoin surpasses gold price – a psychological and arbitrary headline – Royal Mint blockchain gold asks you to trust in the UK government – Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers – Invest in a gold mine using cryptocurrency – but wait until 2022 for your gold...

Read More »Bitcoin Unlimited

On Bloomberg, Yuji Nakamura and Lulu Yilun Chen report about conflicting views in the Bitcoin community on how to address capacity limits in the blockchain. Bitcoin Unlimited is essentially a software upgrade to the blockchain. Years ago, bitcoin’s early developers imposed a cap on the amount of data it could process. While that slowed down the network, it was seen as a necessary safety measure against potential attackers who could overload the system. Now, Unlimited supporters say the...

Read More »Digital Gold – For Now Caveat Emptor

Digital Gold On The Blockchain - For Now Caveat Emptor - Bitcoin surpasses gold price - a psychological and arbitrary headline - Royal Mint blockchain gold asks you to trust in the UK government - Royal Canadian Mint and GoldMoney blockchain product asks you to trust in government and the technology, servers, websites etc of the providers - Invest in a gold mine using cryptocurrency - but wait until 2022 for your gold and trust the miners that it is there - Blockchain and gold will...

Read More »Money, Banking, and Dreams

In another excellent post on Moneyness, J P Koning likens the monetary system to the plot in the movie Inception, featuring a dream piled on a dream piled on a dream piled on a dream. Koning explains that [l]ike Inception, our monetary system is a layer upon a layer upon a layer. Anyone who withdraws cash at an ATM is ‘kicking’ back into the underlying central bank layer from the banking layer; depositing cash is like sedating oneself back into the overlying banking layer. Monetary...

Read More »Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

Gold Investing 101 - Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II) Investors looking to gold again but gold buyers need to exert caution Royal Mint - a royally expensive way to help the government Unallocated gold - unsecured creditor of a bank? If you cannot hold it, you do not own it Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth Conclusion - Reduce counter parties, Don’t over complicate Yesterday we...

Read More »Importance of Hiding Gold Creatively and Securely If Taking Delivery

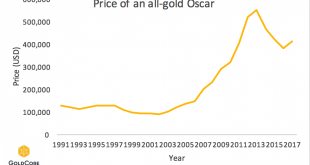

Why gold retains value? Interesting unknown gold facts “Prepare your jaws for a sizeable drop!” History, finite, rare and peak gold “It is beautiful to look at…” ‘Heavy metal’ – Thud sound of a gold bar (kilo) ‘Going for gold’ – Olympic gold medals to Chelthenham ‘Gold Cup’ Peak gold … “Hard work to get gold out of the ground…” How much an Oscar is actually worth? Importance of hiding gold creatively and securely if...

Read More »Importance of Hiding Gold Creatively and Securely If Taking Delivery

Importance of Hiding Gold Creatively and Securely If Taking Delivery Why gold retains value? Interesting unknown gold facts "Prepare your jaws for a sizeable drop!" History, finite, rare and peak gold "It is beautiful to look at..." 'Heavy metal' - Thud sound of a gold bar (kilo) 'Going for gold' - Olympic gold medals to Chelthenham 'Gold Cup' Peak gold ... "Hard work to get gold out of the ground..." How much an Oscar is actually worth? Importance of hiding gold creatively and securely...

Read More »The Oscars – Gold Plated and Debased Like Dollar

The Oscars - Worth Their Weight in Gold? 89th Oscars to air this weekend Oscars have been dipped in 24 karat gold since 1929 If the Oscars were made of solid gold they would weigh 330 ounces 330 ounces of gold is worth $408,210 at today's prices (nearly €400k & £330k) Oscars cannot be sold, making them a tricky investment piece Steven Spielberg keeps his gold Oscar with the Academy for ‘safe-keeping’ Shows importance of owning gold in safest ways Price of gold has climbed from $20.67...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

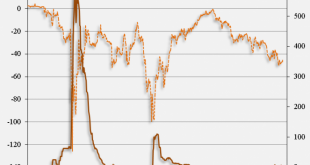

Read More »Switzerland’s Gold Exports To China Surge To 158 Tons In December

Switzerland’s Gold Exports To China Surge To 158 Tonnes In December Switzerland’s gold bullion exports to China saw a huge jump in December, climbing to 158 tons versus a much lower 30.6 tons in November – a jump of 416%. According to Eddie van der Walt as reported on the Bloomberg terminal this morning, total Swiss gold exports surged to 287.6 tons in December (valued at CHF 10.8b) according to data on the website of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org