Summary Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly. Moody’s cut its 2018...

Read More »As Emerging Market Currencies Collapse, Gold is being Mobilized

In recent weeks, global financial markets have been increasingly spooked by an intensifying crisis in emerging market currencies including those of Turkey and Argentina. Add to this the ongoing currency crisis in Venezuela and the currency problems of Iran. While all of these countries have economy specific reasons that explain at least some of their currency weakness, there are some common themes such as a stronger US...

Read More »Emerging Markets: Preview of the Week Ahead

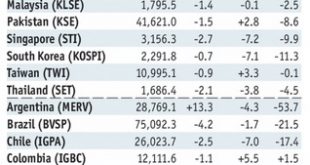

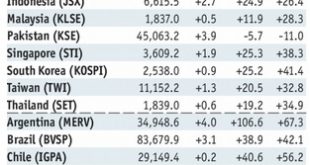

Stock Markets EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.Yet it’s worth noting that the five best...

Read More »Emerging Markets: What Changed

Summary US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned. Chile central bank signaled...

Read More »Emerging Markets: What Changed

Summary The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF. Brazil central bank signaled more aggressive FX intervention ahead. Mexico trade tensions with US are rising. Peru has a new Finance Minister. Stock Markets In the EM...

Read More »Emerging Markets: What Changed

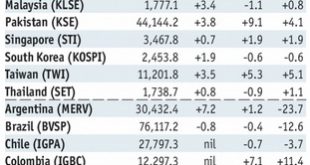

Summary Bank Indonesia started a tightening cycle with a 25 bp hike to 4.5%. Jailed Malaysia opposition leader Anwar Ibrahim was released by new Prime Minister Mahathir. Malaysia scrapped the controversial 6% goods and services tax (GST). Violent protests shook Israel as the relocated US embassy opened in Jerusalem. Argentina committed to fiscal tightening as part of a comprehensive IMF program. Brazil central bank...

Read More »Emerging Markets: Preview of the Week Ahead

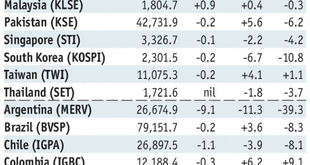

Stock Markets EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX. Stock Markets Emerging Markets, May 08 - Click to enlarge India India reports April WPI and...

Read More »Emerging Markets: What Changed

Summary Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia’s central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate...

Read More »Government Debt with State Contingent Coupons

On VoxEU, Myrvin Anthony, Narcissa Balta, Tom Best, Sanaa Nadeem, and Eriko Togo discuss the history of government debt with state contingent coupons and offer some lessons. In the mid-19th century, the Confederate states issued cotton-linked bonds In the late 1970s, Mexico issued oil-linked bonds In the 2000s, Turkey issued revenue-indexed bonds Since 2014, Uruguay issues nominal wage-issued bonds Some other examples (figure taken from the column): Obviously, confidence in data quality...

Read More »The Economics in “The Jewish State”

On his blog, Tyler Cowen summarizes the economics in Theodor Herzl’s “The Jewish State.” Herzl favored selling European homes and businesses of departing Jews and buying land in Argentina or Palestine, at a profit, through a land acquisition company incorporated in London. Poor Jews from Romania and Russia would supply cheap labor and be rewarded by their own houses eventually. Herzl favored short working weeks, a democratic monarchy or the aristocratic republic of Renaissance Venice....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org