Summary Bank Indonesia started a tightening cycle with a 25 bp hike to 4.5%. Jailed Malaysia opposition leader Anwar Ibrahim was released by new Prime Minister Mahathir. Malaysia scrapped the controversial 6% goods and services tax (GST). Violent protests shook Israel as the relocated US embassy opened in Jerusalem. Argentina committed to fiscal tightening as part of a comprehensive IMF program. Brazil central bank delivered a hawkish surprise and kept rates steady at 6.5%. Mexico has started its annual oil hedging program. Stock Markets In the EM equity space as measured by MSCI, Qatar (+2.5), Czech Republic (+0.8%), and Turkey (+0.4%) have outperformed this week, while Brazil (-8.2%), Mexico (-5.8%), and

Topics:

Win Thin considers the following as important: 5) Global Macro, Argentina, Brazil, emerging markets, Featured, Indonesia, Israel, Malaysia, Mexico, newslettersent, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Summary

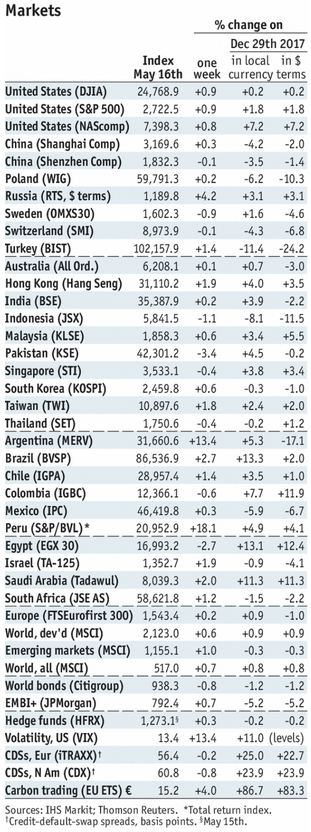

Stock MarketsIn the EM equity space as measured by MSCI, Qatar (+2.5), Czech Republic (+0.8%), and Turkey (+0.4%) have outperformed this week, while Brazil (-8.2%), Mexico (-5.8%), and Indonesia (-5.1%) have underperformed. To put this in better context, MSCI EM fell -2.4% this week while MSCI DM fell -0.5%. In the EM local currency bond space, Korea (10-year yield -4 bp), Pakistan (flat), and China (+1 bp) have outperformed this week, while Turkey (10-year yield +125 bp), Hungary (+30 bp), and South Africa (+28 bp) have underperformed. To put this in better context, the 10-year UST yield rose 11 bp to 3.07%. In the EM FX space, PHP (flat vs. USD), PKR (-0.1% vs. USD), and ILS (-0.4% vs. USD) have outperformed this week, while ARS (-5.5% vs. USD), TRY (-3.8% vs. USD), and BRL (-3.8% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -1.4% this week. |

Stock Markets Emerging Markets, May 16 |

IndonesiaBank Indonesia started a tightening cycle with a 25 bp hike to 4.5%. This was the first rate hike since November 2014. BI also pledged stronger measures to stabilize the rupiah, though no further details were given. Next policy meeting is June 28 and another hike then seems likely. MalaysiaJailed Malaysia opposition leader Anwar Ibrahim was released by new Prime Minister Mahathir. He was imprisoned for more than three years by former Prime Minister Najib. Mahathir said he may remain Prime Minister for “one or two years” after earlier agreeing to step aside once Anwar was freed. He added that Anwar may join the cabinet for a while before taking the top post. Malaysia scrapped the controversial 6% goods and services tax (GST). This was a central campaign promise from Prime Minister Mahathir. The tax will be eliminated starting June 1, according to the Ministry of Finance. The incoming government plans to replace it with a sales-and-services tax. IsraelViolent protests shook Israel as the relocated US embassy opened in Jerusalem. Forty thousand Palestinian protesters from Gaza gathered at the border with Israel. When violence broke out and some tried to cross the border, Israeli snipers responded with live ammunition, killing dozens and wounding thousands. ArgentinaArgentina committed to fiscal tightening as part of a comprehensive IMF program. President Macri said he will reduce the budget deficit at a faster pace, and also acknowledged that the central bank’s inflation targeting had been too ambitious. IMF official said that “Our shared goal is to reach a rapid conclusion of these discussions.” BrazilBrazil central bank delivered a hawkish surprise and kept rates steady at 6.5%. A 25 bp cut was widely expected. The central bank noted that while the inflation outlook remained favorable, the global outlook had become more challenging. This signals the end of the easing cycle, but many (including us) believe that COPOM had already cut too much already in light of growing political risk. MexicoMexico has started its annual oil hedging program. The Finance Ministry has reportedly been asking counterparties this week for quotes to hedge the nation’s oil output, with some reports that some trades have already been executed. With oil at multi-year highs, it makes sense for Mexico to lock in some sales at these elevated prices. |

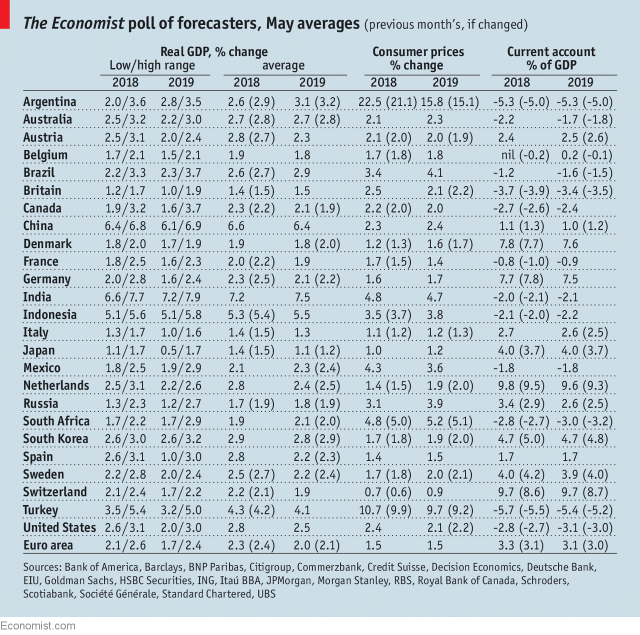

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2018 Source: economist.com - Click to enlarge |

Tags: Argentina,Brazil,Emerging Markets,Featured,Indonesia,Israel,Malaysia,Mexico,newslettersent,win-thin