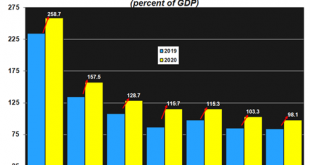

Governments are taking a page out of the play book that monetary policy began a decade ago – which will lead to even higher debt levels. During the throes of the financial crisis almost a decade ago Mario Draghi, then President of the European Central Bank (ECB) pushed the ECB’s mandate to the limits with his speech in July 2012: “within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” This was during a...

Read More »How High is Too High for Rising Government Bond Yields?

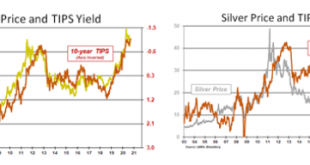

The two day rise in the gold price of more than US$50 fizzled out on Tuesday. The gold price is down about 7% (in US dollar terms) since its year-to-date high set on January 6. It is also down 13% from its all-time high set in August 2020. The silver price, boosted by social media attention, did not set its year-to-date high until February 1. Since then the silver price has slid about 5% from that high. Chairman Powell testified to Congress on Tuesday stating that...

Read More »Gold Price Forecast – LBMA Survey Published

The LBMA (London Bullion Market Association) annual forecast survey published last week shows that forecasters expect the average gold price to rise 11.5% in 2021 to US$1973.8 (forecasters’ average) from the actual average gold price in 2020 of US$1769.6, and for the silver price to rise 38.7% in 2021 to US$28.50 from the actual annual average of US$20.55 in 2020. These expected averages show silver might gain three times more percentage than that of gold in 2021....

Read More »Gold, the Tried-and-True Inflation Hedge for What’s Coming!

Global confirmed coronavirus cases surpassed 100 million this week. There is no denying that the coronavirus pandemic has caused tremendous hardship and loss. To mitigate new cases climbing further, stricter lockdown and travel restrictions are being announced and implemented, with the curfew in the Netherlands as an example. Lock-down fatigue, as evidenced by the riots against this implemented curfew, is growing. Through it all, hope is on the horizon as vaccine...

Read More »$1.9 Trillion American Rescue Plan Positive for Gold

The Massive $1.9 Trillion American Rescue Plan is Just the Start Massive $1.9 Tr. American rescue plan to affect markets Yellen takes over at US Treasury, what to expect More spending initiatives to come How all this is positive for gold and silver prices The Biden Administration’s policies are positive for gold and silver prices. The $1.9 trillion – American Rescue Plan released on January 14 is just the beginning of spending initiatives. The plan is chocked full...

Read More »Gold & Silver Charts Point to Higher Prices & Chris Vermeulen

Chris Vermeulen of TheTechnicalTraders.com joins Dave Russell of GoldCore TV. Chris discusses the chart patterns that the long term gold and silver charts are presenting and what he believe that this means for gold, silver and platinum for 2021. Chris is an expert technical analyst and also understands the fundamentals of the precious metals markets and how it acts as financial insurance for your portfolio. Click the video below to watch. [embedded content] You can...

Read More »Gold to $2,300 and Silver to $35 by Year End – 2021, the Year the Barometer Explodes?

The US dollar set for further dramatic declines? Negative interest rate policy spreading Increased global liquidity in attempt to ignite a recovery Democrats’ win paves way for massive stimulus packages Gold and silver set to rally strongly in a perfect storm As the current wave of Covid19 strongly takes hold, it has devastated the lives of individuals and families and created an uneasy anxiousness not just in individuals but also in financial markets. It has turned...

Read More »The Great Reset vs. The Great Reset

In baseball, there is a situation where a base runner is sprinting to home plate and can’t see what is happening behind him. Totally focused on scoring, he doesn’t know if the outfielder is throwing a ball that will reach home plate first. That’s where we get the phrase “out of left field.” (If the ball were coming from right field, the runner could actually see it.) COVID-19 was the ultimate ball out of left field. Yes, we knew viruses spread and pandemics were...

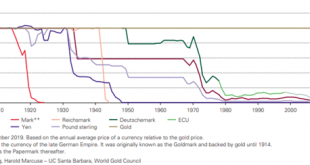

Read More »There is No Denying that Cash is Trash!

By Stephen Flood Governments are likely to continue printing money to pay their debts with devalued money. That’s the easiest and least controversial way to reduce the debt burdens and without raising taxes. Ray Dalio – Bridgewater Associates This is the only chart that matters in the world today. Consider the following: Gold can only be produced at a rate of 1.6% per annum. This is a relative constant. Gold has returned 8% per year in Euros and 9% in USD terms...

Read More »Biden Transition and Vaccine Hopes Weigh on Gold for Now

Today we are taking our monthly look at the charts for gold and silver. We have now received news of 3 Covid19 vaccines that are seeking approval following successful trials and markets have sat up and listened. Investors have moved in to “Risk On” mode as a result of the vaccine developments and also on signs that the transition to the Biden administration is now progressing better than previously. While stock markets, oil markets and cryptos have benefitted from...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org