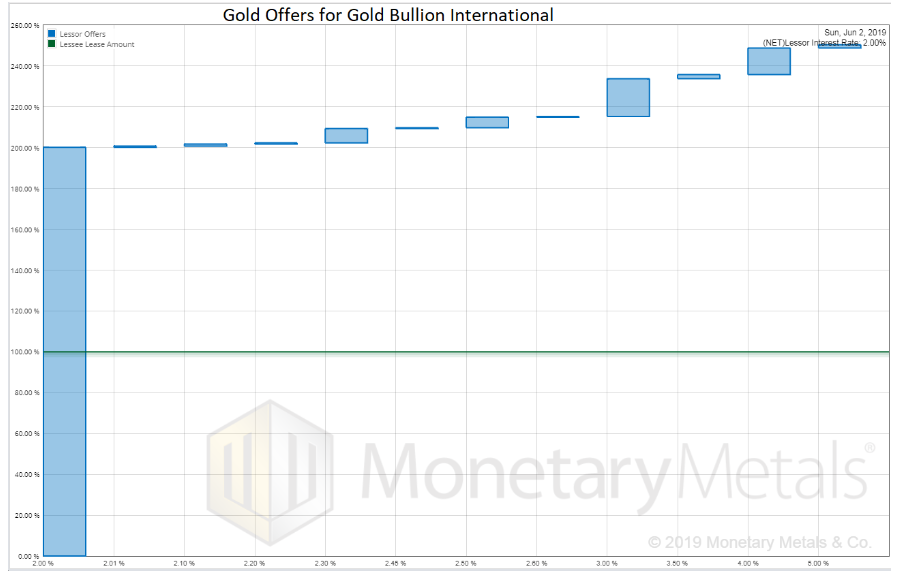

Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository. For more information see Monetary Metals’ press release. Metal: Gold Commencement Date: May 29, 2019 Term: 1 year Lease Rate: 2.0% net to investors The lease is 260% oversubscribed. The graph of the offers is less illustrative than others, as there was no rate-setting auction phase. We used only the call for metal phase, with the rate pre-determined at 2% based on comparable leases. Even in the call for metal, investors have the right to offer at higher interest rates–this is why there are some offers going up to higher rates. Gold Offers

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Closed Leases, Featured, gold fixed income, gold interest, gold interest rate., gold lease, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Monetary Metals leased silver to Gold Bullion International, to support the growth of its gold jewelry line. The metal is held in the form of inventory in a third party depository.

For more information see Monetary Metals’ press release. Metal: Gold The lease is 260% oversubscribed. The graph of the offers is less illustrative than others, as there was no rate-setting auction phase. We used only the call for metal phase, with the rate pre-determined at 2% based on comparable leases. Even in the call for metal, investors have the right to offer at higher interest rates–this is why there are some offers going up to higher rates. |

Gold Offers for Gold Bullion International |

Tags: Closed Leases,Featured,gold fixed income,gold interest,gold interest rate.,gold lease,newsletter