Now that the slowdown is being absorbed and even talked about openly, it will require a period of heavy CYA. This part is, or at least it has been at each of the past downturns, quite easy for its practitioners. It was all so “unexpected”, you see. Nobody could have seen it coming, therefore it just showed up out of nowhere unpredictably spoiling the heretofore unbreakable, incorruptible boom everyone was talking about...

Read More »House View, December 2018

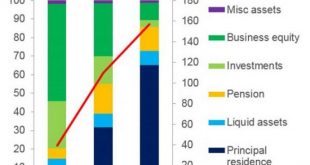

Pictet Wealth Management’s latest positioning across asset classes and investment themes. Asset Allocation We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage. We have moved from underweight to neutral in US Treasuries, as the...

Read More »The View from the Trenches of the Alternative Media

What’s scarce in a world awash in free content and nearly infinite entertainment content? After 3,701 posts (from May 2005 to the present), here are my observations of the Alternative Media from the muddy trenches. It’s increasingly difficult to make a living creating content outside the corporate matrix. The share of advert revenues paid to content creators / publishers has declined precipitously, shadow banning has...

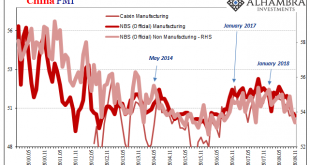

Read More »China’s Global Slump Draws Closer

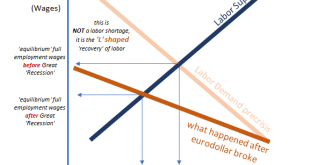

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity. Late 2015 was not a fun time in China. The idea of economic...

Read More »Truth Is What We Hide, Self-Serving Cover Stories Are What We Sell

The fact that lies and cover stories are now the official norm only makes us love our servitude with greater devotion. We can summarize the current era in one sentence: truth is what we hide, self-serving cover stories are what we sell. Jean-Claude Juncker’s famous quote captures the essence of the era: “When it becomes serious, you have to lie.” And when does it become serious? When the hidden facts of the matter might...

Read More »Bearish on Fake Fixes

This systemic vulnerability is largely invisible, and so the inevitable contagion will surprise most observers and participants. The conventional definition of a Bear is someone who expects stocks to decline. For those of us who are bearish on fake fixes, that definition doesn’t apply: we aren’t making guesses about future market gyrations (rip-your-face-off rallies, dizziness-inducing drops, boring melt-ups, etc.),...

Read More »America Needs a New National Strategy

A productive national Strategy would systemically decentralize power and capital rather than concentrate both in the hands of a self-serving elite. If you ask America’s well-paid punditry to define America’s National Strategy, you’ll most likely get the UNESCO version: America’s national strategy is to support a Liberal Global Order (LGO) of global cooperation on the environment, trade, etc. and the encouragement of...

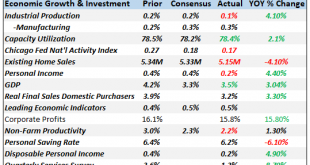

Read More »Monthly Macro Monitor – November 2018

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

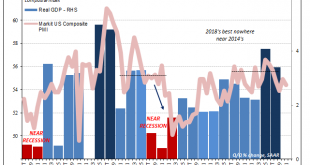

Read More »The Direction Is (Globally) Clear

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception. For November 2015, the composite index jumped to 56.1 from 55.0...

Read More »For The First Time In 25 Years, China Has To Make A Choice Between External Stability And Growth

Back in August 2 we reported of a historic event for China’s economy: for the first time in its modern history, China’s current account balance for the first half of the year had turned into a deficit. And while the full year amount was likely set to revert back to a modest surplus, it was only a matter of time before one of the most unique features of China’s economy – its chronic current account surplus – was gone for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org