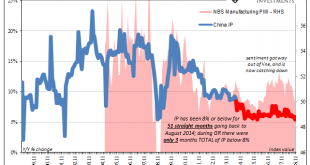

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation. If the Communist State...

Read More »“Yellow Vests” and the Downward Mobility of the Middle Class

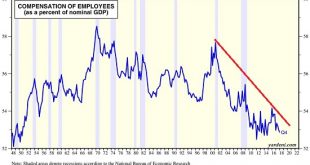

Capital garners the gains, and labor’s share continues eroding. That’s the story of the 21st century. The middle class, virtually by definition, is not prepared for downward mobility. A systemic, semi-permanent decline in the standard of living isn’t part of the implicit social contract that’s been internalized by the middle class virtually everywhere:living standards are only supposed to rise. Any decline is...

Read More »Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019). We won’t know the full details...

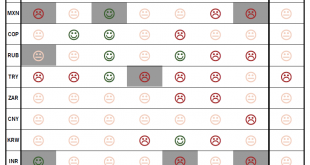

Read More »Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year. Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latest EM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single...

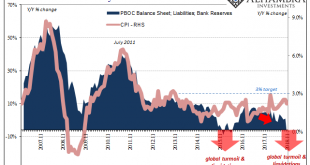

Read More »US Banks Haven’t Behaved Like This Since 2009

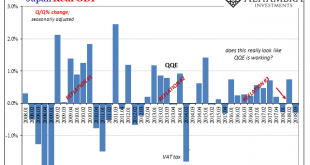

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in...

Read More »China Going Back To 2011

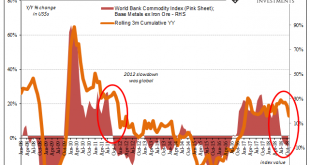

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of...

Read More »Are We in a Recession Already?

The value of declaring the entire nation in or out of recession is limited. Recessions are typically only visible to statisticians long after the fact, but they are often visible in real time on the ground: business volume drops, people stop buying houses and vehicles, restaurants that were jammed are suddenly sepulchral and so on. There are well-known canaries in the coal mine in terms of indicators. These include...

Read More »Economics Is Easy When You Don’t Have To Try

The real question is why no one says anything. They can continue to make these grossly untrue, often contradictory statements without fear of having to explain themselves. Don’t even think about repercussions. Even in front of politicians ostensibly being there on behalf of the public, pedigree still matters more than results. It’s actually worse than that since all that I’m talking about means it is these guys who...

Read More »Monthly Macro Monitor – December 2018 (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – August Monthly Macro Monitor – November 2018 Monthly Macro Monitor – October 2018 Monthly Macro Monitor – August 2018 Monthly Macro...

Read More »Converging Views Only Starts With Fed ‘Pause’

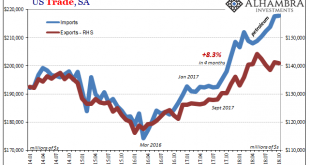

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise. That’s how these things go. Global synchronized growth, decoupling,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org