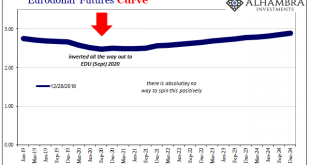

I’m going to break my personal convention and use the bulk of the colors in the eurodollar futures spectrum, not just the single EDM’s (June) contained within each. The current front month is January 2019, and its quoted price as I write this is 97.2475. The EDH (March) 2019 contract trades at 97.29 currently and it will drop off the board on March 18. Three-month LIBOR was fixed yesterday at a fraction higher than...

Read More »The Crisis of Capital

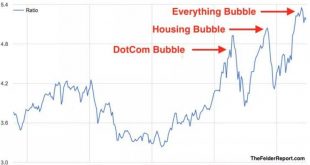

These three dynamics render capital increasingly vulnerable to catastrophic losses as backstops and distorted markets fail. The undeniable reality of the 21st century economy is that capital has gained while labor has stagnated. While various critics quibbled about his methodology, Thomas Piketty’s core finding–that capital expanded faster than GDP and wages/salaries (i.e. earned income from labor)–is visible in these...

Read More »Wasting the Middle: Obsessing Over Exits

What was the difference between Bear Stearns and Lehman Brothers? Well, for one thing Lehman’s failure wasn’t a singular event. In the heady days of September 2008, authorities working for any number of initialism agencies were busy trying to put out fires seemingly everywhere. Lehman had to compete with an AIG as well as a Wachovia, already preceded by a Fannie and a Freddie. If Lehman was the personification of...

Read More »The net result is capital is impaired in eras of uncertainty.

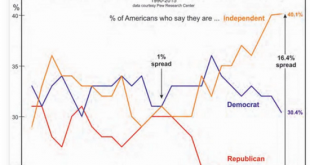

As we look ahead to 2019, what can we be certain of? Maybe your list is long, but mine has only one item: certainty is fraying. Confidence in financial policies intended to eliminate recessions is fraying, confidence in political processes that are supposed to actually solve problems rather than make them worse is fraying, confidence in the objectivity of the corporate media is fraying, and confidence in society’s...

Read More »Just In Time For The Circus

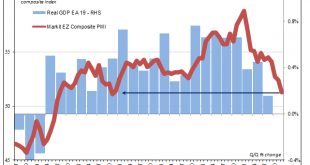

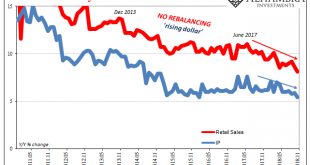

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness. Globally...

Read More »Das: “The Bubble Is Losing Air. Get Ready For A Crisis”

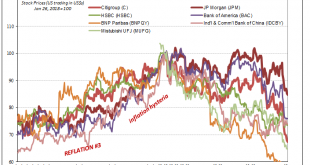

The shift to tighter monetary policies in the West is weakening credit markets. Over-indebted emerging markets face headwinds from rising borrowing costs and dollar shortages… Investors need to focus on their response to financial stresses in an era in which policymakers will be constrained. The “everything bubble” is deflating. The fact that it’s happening relatively slowly shouldn’t blind us to the real threat: The...

Read More »Xi Jinping’s Pretty Consistent Message

It seems many were disappointed by the speech delivered by Xi Jinping. China’s supreme leader spoke at the Great Hall of the People in Beijing today on the 40th anniversary of his country’s first embrace of economic reform. Commentators had been expecting Xi to use the occasion to recommit to liberalization, further opening China to free market forces. Some others, as we’ve noted, were hoping China’s President would go...

Read More »Powell: Still Strong; Markets: AYFKM

The official statement that accompanies each every FOMC policy action is by nature bland and sterile. Still, despite the sparseness of printed words those that are included can say a lot. Here’s its essence for what just wrapped up in December 2018: The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity,...

Read More »Why Everything That Needs to Be Fixed Remains Permanently Broken

Just in case you missed what’s going on in France: the status quo in Europe is doomed. The status quo has a simple fix for every crisis and systemic problem: 1. create currency out of thin air 2. give it to super-wealthy banks, financiers and corporations to boost their wealth and income. One way these entities increase their wealth and income is to lend this nearly free money to commoners at much higher rates of...

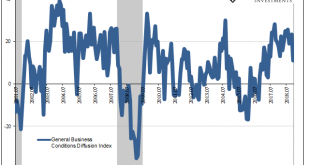

Read More »Industrial Fading

It is time to start paying attention to PMI’s again, some of them. There are those like the ISM’s Manufacturing Index which remains off in a world of its own. The version of the goods economy suggested by this one index is very different than almost every other. It skyrocketed in late summer last year way out of line (highest in more than a decade) with any other economic account. For that reason alone, it has been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org