All asset “wealth” in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to “wealth” in a bubble economy: it only remains “wealth” if the owner sells at the top of the bubble and invests the proceeds in an asset which isn’t losing purchasing power. Transferring “wealth” to another asset bubble that is also deflating doesn’t preserve the “wealth” from evaporation. All the ironclad promises made in bubble economies ultimately depend on credit-asset bubbles never popping–but sadly, all credit-asset bubbles pop. So all the promises–which are of course politically impossible to revoke–will be broken as all the credit-asset bubbles that created the “wealth” that was to be

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Meanwhile, back at the government ranch, the vast majority of tax revenues are also dependent on credit-asset bubbles never popping. Most of the capital gains taxes reaped in bubbles dry up and blow away, high-earners who pay most of the income taxes lose their jobs or bonuses, and absurdly overvalued real estate that generated outlandish property taxes loses half its value, slashing property tax valuations.

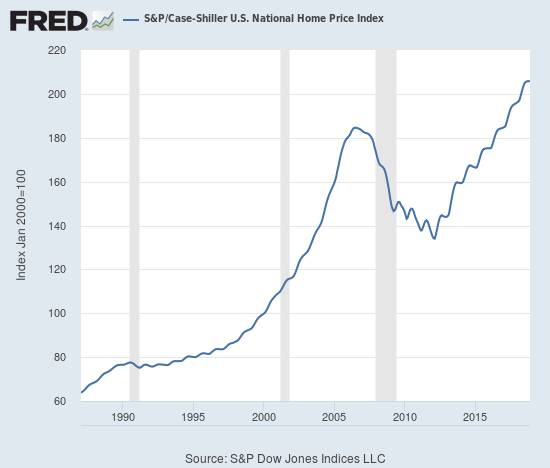

Two retracement levels beckon on the Case-Shiller Home Price Index: a retrace to the previous Bubble #1 lows–a roughly 33% decline–or a full retrace back to pre-Bubble #1 levels, about a 60% drop from current levels. In bubblicious regions that have seen decaying bungalows on postage-stamp lots rise 10-fold from $100,000 to $1 million, an 80% drop would be expected if history is any guide. This will be quite a shock to buyers who assumed that their home “wealth” would double from $1 million to $2 million. All asset “wealth” in credit-asset bubble dependent economies is contingent and ephemeral. “Sure things” become less sure when credit bubbles pop and self-reinforcing defaults topple an ever widening circle of dominoes. How much of your “wealth” is tied up in bubbles and impossible-to-keep promises? Only those who sell at the top before the herd panics and move their “wealth” into the few assets that are maintaining or gaining their purchasing power will still have their “wealth” after the conflagration turns credit-bubble “wealth”into ashes. |

S&P/Case-Shiller U.S. National Home Price Index, 1990-2015 |

Tags: Featured,newsletter