Quizfrage: Was kurbelt den Schweizer Tourismus mehr an? Der Kauf von Hanf-Aktien in den USA für 80 Millionen Franken oder der Bau der Stoosbahn für 80 Millionen Franken? Welches ist Ihre Antwort, verehrte Leserin, verehrter Leser? Meine Antwort ist schon jetzt klar: Der Bau der neuen Stoosbahn ist ungleich viel effizienter, um den Schweizer Tourismus anzukurbeln. Warum? Gerne begründe ich das. Der Stoos ist eine...

Read More »Pound to Swiss Franc forecast: Investors flock to the CHF, will the Swiss National Bank curb demand for the Franc?

Sterling slides against the Swiss Franc as Brexit and the global economic outlook weigh on the Pound The pound to Swiss franc exchange rate has fallen lower below 1.20 for the GBP vs CHF pair with interbank rates currently sitting at 1.189. The slide in the pound against the Swiss franc has presented those looking to sell Swiss francs with an opportunity to convert when compared to recent months. Brexit is one factor...

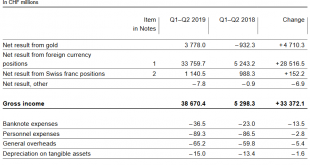

Read More »SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Swiss Central Bank under Pressure as Franc Rises

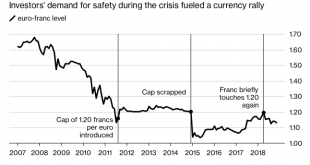

Yesterday, the Swiss franc reached its highest level against the euro in two years. The EUR/CHF exchange rate reached 1.097 on 24 July 2019, a rate not seen since early 2017. Source: Valeriya Potapova - Click to enlarge Upward pressure on the franc is partly being driven by expectations of interest rate cuts by eurozone and US central banks. In addition, the franc is considered a safe haven currency and...

Read More »BNS, les taux vont encore être baissés

Je vous ai parlé de long en large de la BNS : ici : https://www.crottaz-finance.ch/blog/tag/bns/ De son bilan démesuré supérieur au PIB suisse De ne pas avoir vendu les euros achetés quand elle le pouvait D’avoir dû abandonner le taux plancher de 1.2 CHF pour 1 EUR sous la pression du marché (je l’avais prévu, mais la BNS a quand même tenu 3 ans et demi) Qu’avec les taux négatifs, les caisses de pensions (donc les...

Read More »Hildebrand hatte SNB nicht verstanden: Sie muss zugunsten eigener Wirtschaft investieren

Bilderberg, Gerzensee und „Franken-Rütli“ – das sind alles Geschwister im Geiste: undurchschaubar, informell, nicht greifbar, gegen aussen, eine Versammlung der Macht, mit dem Vorspuren von Entscheiden grösster wirtschaftlicher und politischer Tragweite. Das Volk bleibt aussen vor. Es wird aber am Schluss allfällige Konsequenzen tragen müssen. Solche geheimen Konferenzen passen nicht in eine moderne Demokratie. Schon...

Read More »Pound to Swiss Franc forecast: Will GBP/CHF rates fall below 1.20?

The pound to Swiss Franc exchange rate has been on steady decline since May when it peaked at 1.3397. Since then, it has fallen to 1.2245 as Brexit uncertainties continue to weigh on sterling, with the market feeling the prospect of a no-deal Brexit has increased. The franc has also risen in value owing to its status as a safe haven currency, and the continued fears over the global economy. Swiss Franc enjoying the...

Read More »La BNS aspire l’épargne des Suisses. Entretien.

Les faits et leurs conséquences potentielles que décrit l’économiste vaudois dans son livre, paru il y a bientôt deux ans, n’ont à ce jour fait l’objet d’aucun démenti, ni d’aucune contestation. (Photo Blaise Kormann) Le calme avant la tempête. Par Christian Rappaz (Editorial) Depuis une année, il ne se passe pas un jour sans que Donald Trump critique violemment la politique monétaire de la banque centrale américaine,...

Read More »Hypothekarkredite: Selbstregulierung soll Risikoappetit bremsen

Die Kreditvergabepolitik der Banken im Segment der Wohnrenditeliegenschaften in der Schweiz wird von der SNB als besonders risikobehaftet beurteilt. (Bild: Denis Linine/Shutterstock.com) Die grössten Risiken für die Finanzstabilität gehen für die inlandorientierten Banken unverändert vom Hypothekar- und Immobilienmarkt aus, warnt die Schweizerische Nationalbank (SNB) im diesjährigen Bericht zur Finanzstabilität vom 13....

Read More »Swiss mortgages and bank profits rise as jobs scale down

The Swiss banking industry continues to turn in a profit despite low interest rates. Swiss commercial banks achieved higher profits last year, mortgage loans tipped the CHF1 trillion ($1.02 trillion) mark and costs were saved by reducing headcounts. These are the findings of an annual report from the Swiss National bank (SNB). The SNBexternal link’s “Banks in Switzerlandexternal link” annual report shows combined Swiss...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org