Summary:

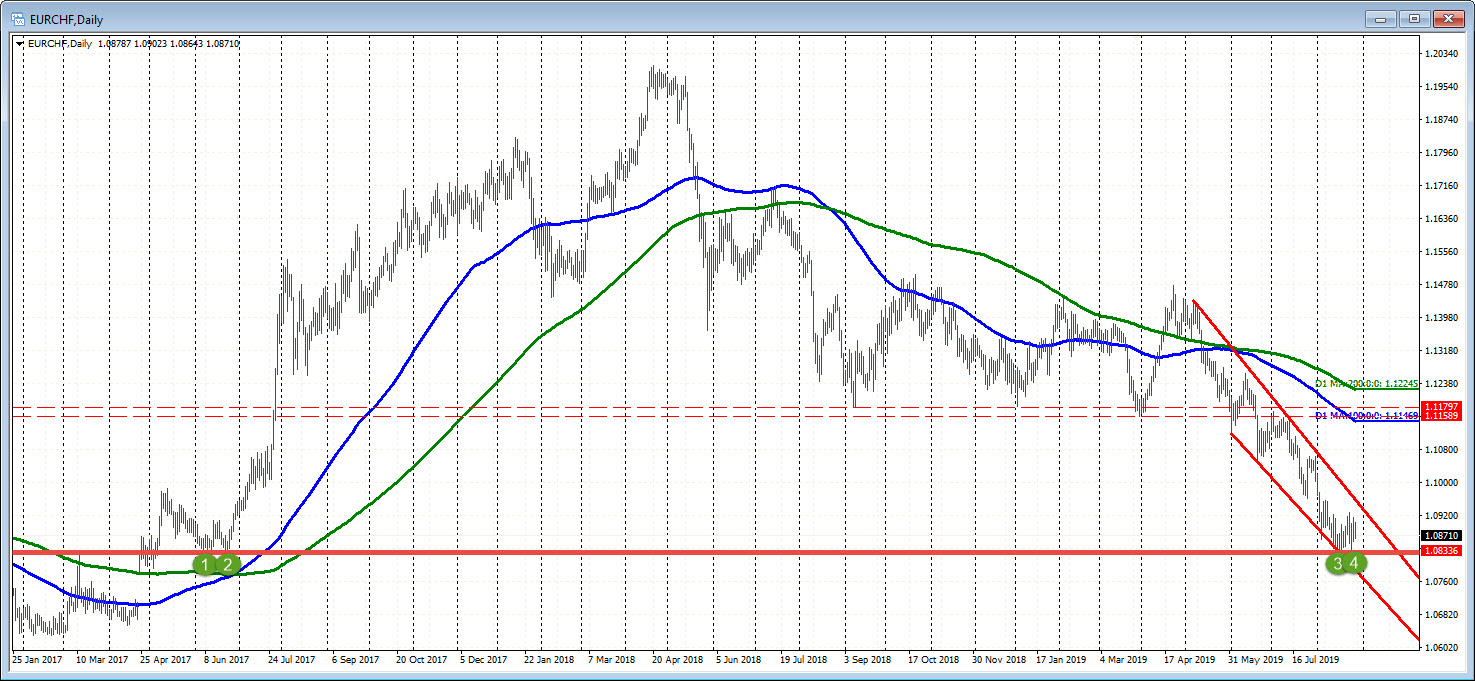

More from SNB Maechler Right now is still plenty of room for forex intervention as to negative rates are working, SNB’s Maechler says “absolutely” Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall. EUR/CHF, Daily - Jan 2017 - August 2019(see more posts on EUR/CHF, ) - Click to enlarge Drilling to the 4 hour chart below, the price of the EURCHF has been consolidating near the low support level. There is a floor at the 1.0834 to 1.0838 area. On the topside, a trend line cuts across at 1.09178 currently (and moving slowly lower). In between, the 100 bar moving average on the 4 hour chart comes in at 1.08849. We trade below that level currently

Topics:

Forexlive considers the following as important: 1.) CHF FX, 1) SNB and CHF, EUR/CHF, Featured, newsletter

This could be interesting, too:

More from SNB Maechler Right now is still plenty of room for forex intervention as to negative rates are working, SNB’s Maechler says “absolutely” Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall. EUR/CHF, Daily - Jan 2017 - August 2019(see more posts on EUR/CHF, ) - Click to enlarge Drilling to the 4 hour chart below, the price of the EURCHF has been consolidating near the low support level. There is a floor at the 1.0834 to 1.0838 area. On the topside, a trend line cuts across at 1.09178 currently (and moving slowly lower). In between, the 100 bar moving average on the 4 hour chart comes in at 1.08849. We trade below that level currently

Topics:

Forexlive considers the following as important: 1.) CHF FX, 1) SNB and CHF, EUR/CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

More from SNB Maechler

Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall. |

EUR/CHF, Daily - Jan 2017 - August 2019(see more posts on EUR/CHF, ) |

| Drilling to the 4 hour chart below, the price of the EURCHF has been consolidating near the low support level. There is a floor at the 1.0834 to 1.0838 area. On the topside, a trend line cuts across at 1.09178 currently (and moving slowly lower). In between, the 100 bar moving average on the 4 hour chart comes in at 1.08849. We trade below that level currently at 1.08716.If the SNB is a threat to intervene, traders should respect the lower floor. A move back above the 100 bar moving average would give more of an upside tilts as well. |

EUR/CHF, Hourly - July - August 2019(see more posts on EUR/CHF, ) |

Tags: EUR/CHF,Featured,newsletter