Summary:

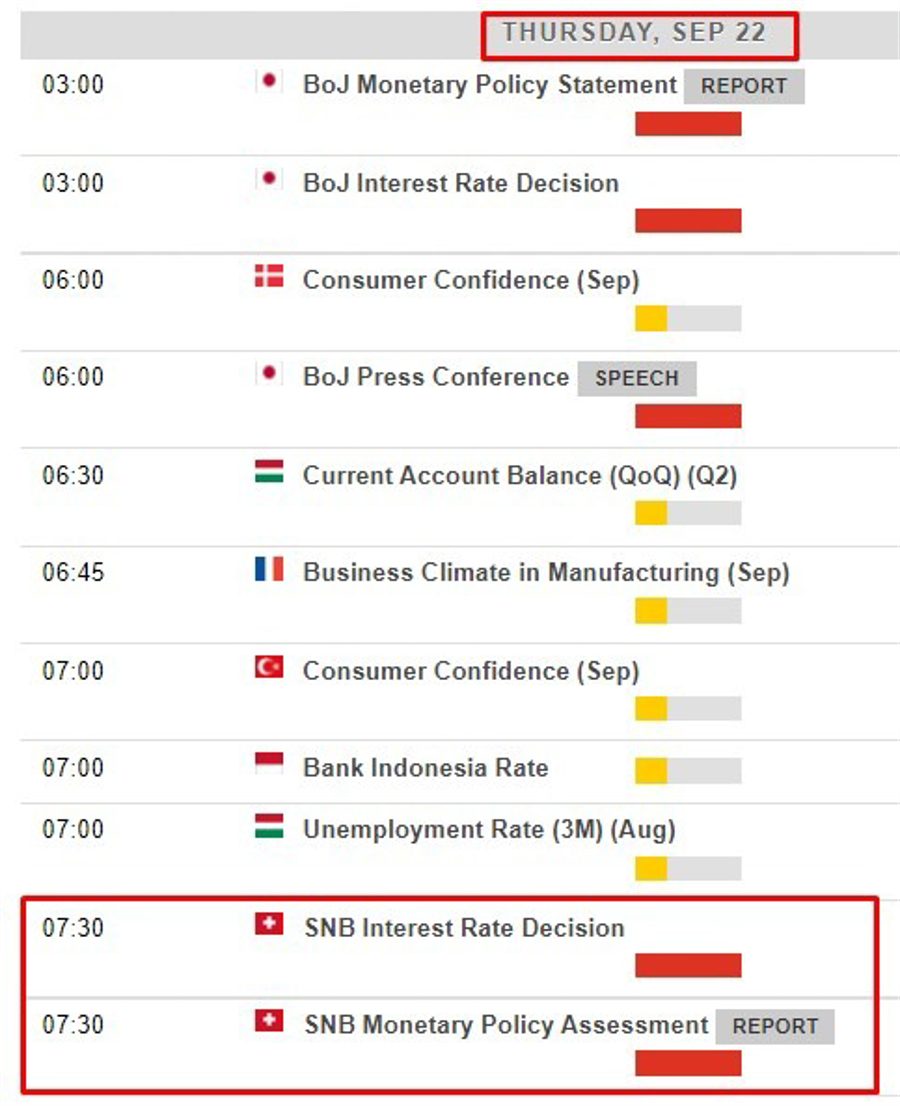

SNB monetary policy meeting preview The SNB policy decision is due on Thursday (see for timings) Via MUFG Bank: CHF has been the top performing G10 currency so far this month as it has strengthened sharply against both the EUR (+2.2%) and USD (+1.5%). It has regained upward momentum against our equally-weighted basket of other G10 currencies after a period of consolidation at higher levels between July and August. The CHF’s renewed upward has once again coincided with an abrupt hawkish repricing of SNB rate hike expectations similar to in June. Market participants are increasingly confident that the SNB will continue to play catch up with major central banks and deliver a larger 100bps hike in the week ahead (Thurs) to combat upside inflation risks. There are

Topics:

Eamonn Sheridan considers the following as important: 1.) Forex Live Based CHF SNB, Central Banks, Featured, newsletter

This could be interesting, too:

SNB monetary policy meeting preview The SNB policy decision is due on Thursday (see for timings) Via MUFG Bank: CHF has been the top performing G10 currency so far this month as it has strengthened sharply against both the EUR (+2.2%) and USD (+1.5%). It has regained upward momentum against our equally-weighted basket of other G10 currencies after a period of consolidation at higher levels between July and August. The CHF’s renewed upward has once again coincided with an abrupt hawkish repricing of SNB rate hike expectations similar to in June. Market participants are increasingly confident that the SNB will continue to play catch up with major central banks and deliver a larger 100bps hike in the week ahead (Thurs) to combat upside inflation risks. There are

Topics:

Eamonn Sheridan considers the following as important: 1.) Forex Live Based CHF SNB, Central Banks, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- SNB monetary policy meeting preview

The SNB policy decision is due on Thursday (see for timings)

Via MUFG Bank:

- CHF has been the top performing G10 currency so far this month as it has strengthened sharply against both the EUR (+2.2%) and USD (+1.5%).

- It has regained upward momentum against our equally-weighted basket of other G10 currencies after a period of consolidation at higher levels between July and August. The CHF’s renewed upward has once again coincided with an abrupt hawkish repricing of SNB rate hike expectations similar to in June.

- Market participants are increasingly confident that the SNB will continue to play catch up with major central banks and deliver a larger 100bps hike in the week ahead (Thurs) to combat upside inflation risks. There are currently 86bps of hikes priced in. The SNB has also become more tolerant of currency strength since their last policy meeting in June as it provides another channel to help dampen upside inflation risks.

- The CHF appears well positioned to extend its recent advance, especially against other high beta G10 currencies.

Tags: central-banks,Featured,newsletter