Swiss Franc The Euro has fallen by 0.07% to 1.1064 EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The large block trade (~ bln) before the weekend, apparently from a family office, continued to have ripple effects today, but the MSCI Asia Pacific Index barely noticed. It extended its pre-weekend rally of 1.3%, and only South Korea and Australia fell among the major markets. Europe’s Dow Jones Stoxx 600 edged to new highs since last March but struggled to sustain the upside momentum. Financial and real estate sapped the strength that had been coming from consumer staples and information technology. US futures indices are nursing 0.3%-05% losses. The US 10-year yield is a

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, China, Currency Movement, EU, Featured, infrastructure, newsletter, Recovery Fund, USD, vaccine

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

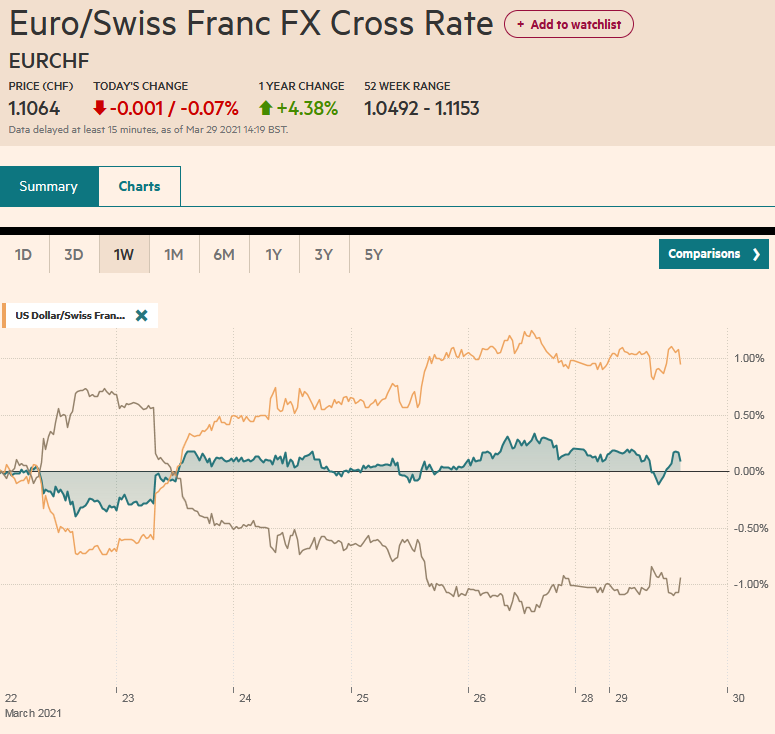

Swiss FrancThe Euro has fallen by 0.07% to 1.1064 |

EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

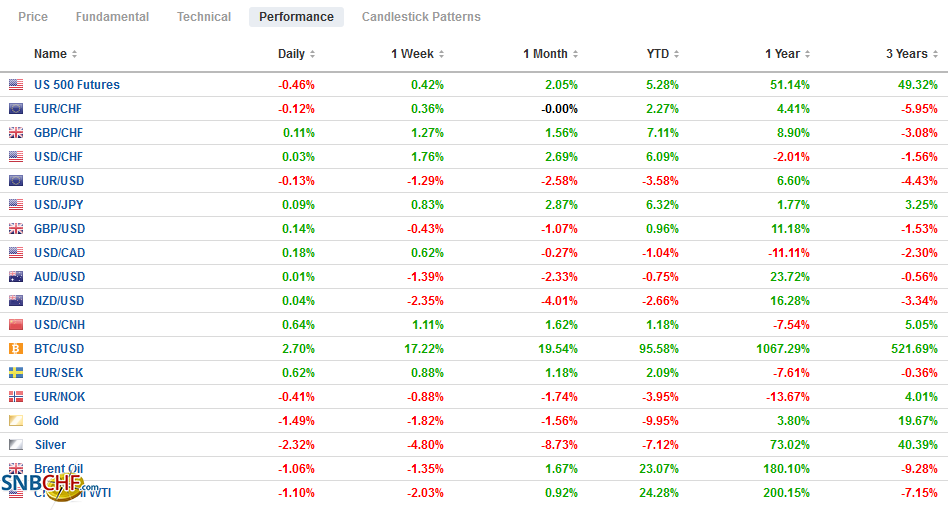

FX RatesOverview: The large block trade (~$20 bln) before the weekend, apparently from a family office, continued to have ripple effects today, but the MSCI Asia Pacific Index barely noticed. It extended its pre-weekend rally of 1.3%, and only South Korea and Australia fell among the major markets. Europe’s Dow Jones Stoxx 600 edged to new highs since last March but struggled to sustain the upside momentum. Financial and real estate sapped the strength that had been coming from consumer staples and information technology. US futures indices are nursing 0.3%-05% losses. The US 10-year yield is a little softer at 1.65%, while European yield benchmarks have edged slightly higher. The dollar is stronger against most currencies today. Sterling and the Australian dollar, among the majors, are showing a little resilience, while the Swedish krona is off around 0.6%. Emerging market currencies, except for a few from East Asia, are lower, led by the 0.7% fall of the Mexican peso, followed by around a 0.65% loss of the Turkish lira. The JP Morgan Emerging Market Currency Index is lower for the fifth time in the past six sessions. Gold is trading heavy, around $1725 near midday in Europe. It continues to trade within the $1719.30 and $1755.5 range set on March 18. Progress on moving the ship blocking the Suez Canal was reported, and oil prices softened after last week’s choppy action ended with a 4.1% gain to almost $61. The May WTI contract found support a little below $59.50 and recovered more than a dollar in the European morning to approach $61.00 a barrel. |

FX Performance, March 29 |

Asia Pacific

After announcing retaliatory sanctions on the EU and UK at the end of last week, Beijing announced over the weekend that it would sanction two Americans. The Chair and Vice-Chair of the US Commission on International Religious Freedom are now barred from visiting or doing business in China. The Chair, incidentally, is the wife of Senator Manchin. Beijing also sanctioned a member of the Canadian parliament too. A few months ago, Nike and H&M expressed concern about forced labor in Xinjiang’s cotton industry, and last week faced consumer boycotts and backlash in China. Some H&M stores were shut by landlords, according to press reports. These are mainly symbolic moves and will not change the behavior on either side. Former US Secretary of State Kissinger has characterized the broader confrontation as the “foothills of a Cold War.” This implies the likelihood of escalation. The Biden administration’s invitation to Xi (and Putin) to a global climate change summit is a polite gesture. Still, any agreement requires, as Reagan instructed, trust but verification, both of which are obstacles, especially given the poisoned atmosphere.

Separately, but not totally unrelated, China’s trade punishment of Australia is set to continue. Beijing’s temporary sanctions on Australian wine, in place for months, has formally been extended to five years. The tariff ranges from 116% to 218%. China was the largest buyer of Australian wine. China claims the wine was subsidized and dumped (sold below either the price in Australia or below “market value”). However, China has taken action on many commodities, including barley, coal, beef, and lobster. Australia has threatened to take the case to the WTO, but the Biden administration has continued to block appellate judges’ appointments, which undermines the conflict resolution mechanism. Australia ran A$5.7 bln trade surplus with China in January, as Canberra reported a record trade surplus. February trade figures are due out later this week. Japan is the only G7 country not to sanction China. Still, pressure appears to be mounting ahead of Japan’s Prime Minister Suga’s expected trip to Washington to be the first foreign leader to visit President Biden, possibly as soon as April 9.

The dollar rallied from JPY108.45 in the middle of last week to JPY109.85 ahead of the weekend. It is consolidating within the pre-weekend range and has remained above JPY109.35. Better support is seen near JPY109.20. The JPY110.00-area continues to offer psychological resistance. The Australian dollar closed last week on a firm note after recovering to a three-day high above $0.7635. Follow-through buying was limited, and so far, the Aussie has been consolidating in a narrow range above $0.7615 but below $0.7650. A break of the range could point to the direction of the next half-cent move. The PBOC set the dollar’s reference rate at CNY6.5416, which was in line with expectations. The greenback rose 0.3% against the yuan to a new high since last December near CNY6.5655. Although some attribute the yuan’s weakness to the large marginal call and huge block trades, note that the dollar has risen for the past five weeks against the yuan. This has spurred talk that there is a policy signal here. The next important area is near CNY6.60.

Europe

There are several moving parts of the vaccine rollout. The UK had secured favorable contracts but lacks the manufacturing capacity to produce sufficient vaccines. The EU has the manufacturing capacity but did not secure favorable contracts, and when they did, it appears they backed the wrong ones. The US has both the manufacturing capacity and favorable contracts. Indeed, the NY Times warned of a coming glut of vaccines in the US. The Biden administration has promised enough doses to immunize all US adults (~260 mln) by the end of May. In the following two months, through the end of July, the US has secured an additional 400 mln vaccines. This poses a political and moral dilemma. Meanwhile, an estimated 3/4 of all the vaccines have been administered in ten countries, and at least 30 countries reportedly have not vaccinated a single person. Reports over the weekend suggested that the Biden administration is considering waiving intellectual property rights for the vaccine, which would allow widespread production. The EU gave itself the power to block vaccine exports but so far has stopped short of pulling the trigger.

British financial services were largely left out of the trade agreement struck with the EU at the end of last year. The key issue is regulatory equivalence, which prevents UK-based financial services from operating in the EU. Assets and personnel have been redeployed to the Continent. A constructive step was taken before the weekend. A new forum was established. The UK Chancellor of the Exchequer will meet twice a year the EU representative in charge of supervision and enforcement. The trick is to ensure that the two sides continue to evolve rules equivalent to fair competition. A memorandum of understanding has been drafted that offers a framework for regulatory cooperation.

Last week, the Bundestag and Bundesrat approved the EU post-pandemic recovery plan and the Recovery Fund, heralded as the Hamiltonian moment of fiscal union in some quarters. Germany’s highest court has intervened to stop the ratification process, which now simply requires the president’s signature. The court is responding to claims the EU Treaty does not allow it to take on debt. However, there does appear to be some precedent, including SURE (Support to mitigate Unemployment Risks in an Emergency), which has raised more than 60 bln euros via social bond sales. We suspect that this will delay not destroy the agreement. The German court is the guardian over sovereignty, but it has not blocked the EU, EMU, and ECB’s continued evolution. Separately, German politics appears particularly fluid as the CDU/CSU has seen its support wane. Over the weekend, Chancellor Merkel was critical of state leaders, including the CDU Chairman Laschet (Premier of North Rhine-Westphalia), for prematurely re-opening. Merkel, who reversed herself over a lockdown for the Easter weekend, seems to be threatening to nationalize the fight against the virus.

The euro is trading quietly, and it could be the first session since last November 4 that it has not traded above $1.1800. For the third consecutive session, it found a modicum of support a little above $1.1760. The technical indicators are stretched, but sentiment is poor. It would probably take a move above the $1.1830 area to stabilize the tone. Sterling, on the other hand, found support in the $1.3670 area last week and recovered briefly above $1.38 ahead of the weekend. It built on those gains today, rising toward $1.3840. Last week’s highs (~$1.3865-$1.3875) offer nearby resistance. Support is pegged in the $1.3730-$1.3760 area.

America

The US employment report that will be released on Good Friday is the highlight of the economic reports. It is the first major report of the new month and sets the tone for the upcoming high-frequency data. The key political event will the unveiling of the Biden administration’s infrastructure initiative on Wednesday in Pittsburgh. It had featured prominently in the campaign. The proposed tax hikes will garner attention in addition to the price tag (estimated around $3 trillion). Biden has advocated returning the corporate tax rate to 28% (from 21%) and implementing a minimum corporate tax of 15% on large businesses. He also favors raising the personal income tax rate on incomes over $400k.

There are two main parts of the infrastructure initiative, and it could conceivably be submitted as two bills, which might increase the chances of bipartisan support for one. There is the material infrastructure: power grid, roads, bridges, wifi. It will include environmental-friendly initiatives that may overlap with parts of the Green New Deal. The other part of the infrastructure initiative will be about “human capital.” This will likely include health care and education components. It may also seek to make permanent the temporary earned income tax credits and the child tax credits adjustments in the $1.9 trillion stimulus bill.

The US sees the Dallas Fed manufacturing survey, and Waller, the new Governor on the Federal Reserve Board, speaks at a Peterson Institute gathering today. Canada has a light calendar until Wednesday’s January GDP (expected 0.5% after a 0.1% gain in December). Mexico’s economic diary does not feature market-moving reports this week.

The US dollar rose for the second consecutive week against the Canadian dollar and has begun the new week on firm footing, knocking against last week’s high (~CAD1.2630). Support is seen around CAD1.2560. The next upside target is the CAD1.2660 area. The Canadian dollar is the best performing major currency this month, with a modest 1.1% increase. The Norwegian krone is the only other major to gain on the greenback this month (~0.9%). Both are seen to be among the first of the high-income countries to remove some accommodation or taper. The greenback eased from near MXN21.00 last week to almost MXN20.50 ahead of the weekend. It has moved back toward the middle of that range now. The peso remains one of the strongest emerging market currencies this month, with around a 0.6% gain. Only the Indian rupee (~1.3%) and the South African rand (~0.9%) have risen more than it this month.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,China,Currency Movement,EU,Featured,infrastructure,newsletter,Recovery Fund,vaccine