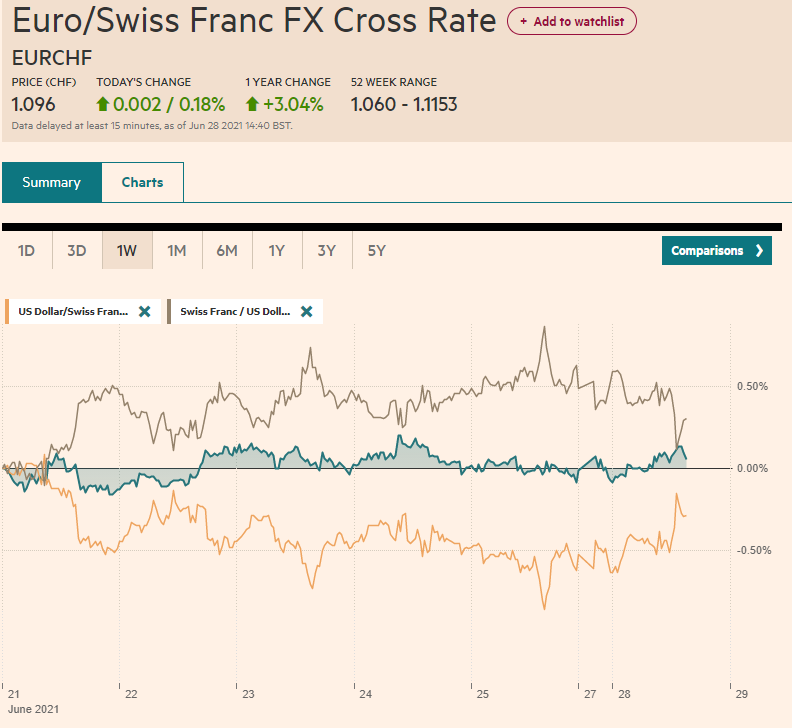

Swiss Franc The Euro has risen by 0.18% to 1.096 EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are off to a quiet start of what promises to be a busy week. Quarter and month-end adjustments, Japan’s Tankan survey, the eurozone’s preliminary June CPI, the US employment report, and an OPEC+ meeting are featured. The MSCI Asia Pacific Index was little changed amid a mixed regional performance. It had risen in the last four sessions. European shares are paring last week’s gains, which saw the Dow Jones Stoxx 600 gain 1.2%. Energy and consumer discretionary sectors are leading today’s losses. US futures are little changed. Last week, the S&P 500 and

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, EUR/CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.18% to 1.096 |

EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The global capital markets are off to a quiet start of what promises to be a busy week. Quarter and month-end adjustments, Japan’s Tankan survey, the eurozone’s preliminary June CPI, the US employment report, and an OPEC+ meeting are featured. The MSCI Asia Pacific Index was little changed amid a mixed regional performance. It had risen in the last four sessions. European shares are paring last week’s gains, which saw the Dow Jones Stoxx 600 gain 1.2%. Energy and consumer discretionary sectors are leading today’s losses. US futures are little changed. Last week, the S&P 500 and NASDAQ rose to new record highs. The US 10-year yield is holding a little above 1.50%, while European benchmark rates are slightly softer. The dollar is narrowly mixed. Neither sterling nor the Swedish krona have been unhinged by the political developments as they lead the movement against the dollar. Norway, New Zealand, and Canada are seeing their currencies nurse small losses. Emerging market currencies are also mostly heavier, and the JP Morgan Emerging Market Currency Index is posting the second day of small losses following a four-day advance. Gold was turned back from the $1785-$1786 area. It continues to map out a triangle pattern within the range set on June 18 (~$1761-$1797). Crude oil is little changed, with the August WTI contract hovering around $74 a barrel. Iron ore prices are firmer, though copper is off for the third session. The CRB rose 2.2% last week, its fourth weekly gain in the past five weeks. |

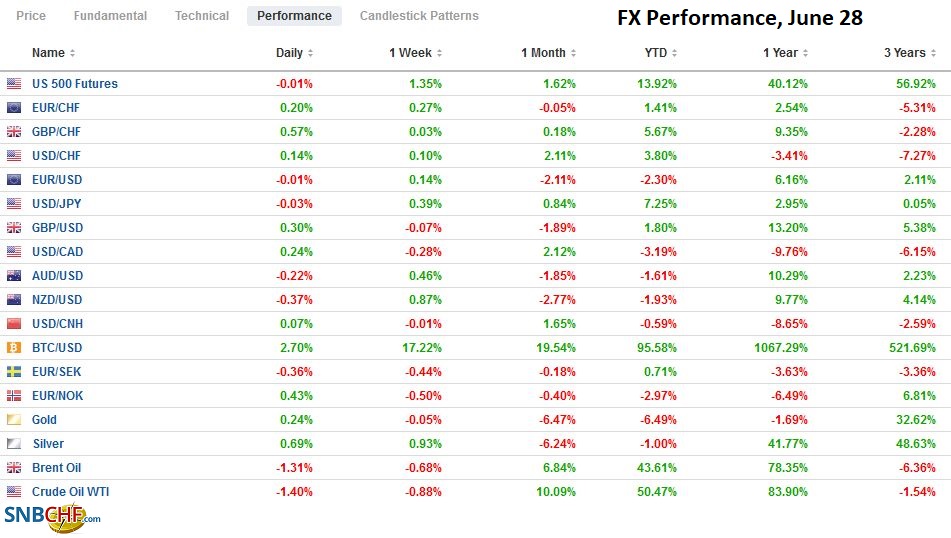

FX Performance, June 28 |

Asia Pacific

The gap between consumer and producer price increases in China suggested a squeeze on profits, which Beijing reported earlier today. Industrial profits slid to a still an impressive 36% in May from 57% in April. Separately, China ordered Tesla to fix all 285k cars it has sold in the country. Tesla is doing so with a free software update for its autopilot function. Meanwhile, reports suggest India has moved 50k troops to its border with China to around 200k, a 40% increase over the past year.

The US and Taiwan will hold their first trade talks in five years on Wednesday. Supply chain security (semiconductor chips) and digital trade (cybersecurity) are said to be the focus. Last week, Taiwan lifted its ban on US beef and pork, though a referendum is planned in August about US pork, which contains ractopamine, a controversial food additive. Instead of joining a regional trade block, the Biden administration seeks to strengthen bilateral ties in the region. The US national security personnel seem to be the driving force here more than the trade office.

The dollar has been confined to less than a quarter of a yen range today below JPY110.85. It reached the high for the year last week, a little above JPY111.10. There is a $1.5 bln option at JPY110.50 that expires today. Below there, support is seen in the JPY110.25-JPY110.40 area.

A 48-hour lockdown in Darwin and an extension of restrictions in Sydney until July 9 may have encouraged some profit-taking on the Australian dollar. It failed to close above $0.7600 ahead of the weekend despite the intraday push above. The 200-day moving average comes in a little below $0.7565 today.

After rising in the last three sessions, the Chinese yuan steadied today within the pre-weekend range (~CNY6.4510-CNY6.4675). The PBOC set the dollar’s reference rate at CNY6.4578, very close to the projection in the Bloomberg survey for CNY6.4577.

Europe

After losing a confidence vote last week, the first in Sweden, and unable to forge a new coalition, Sweden’s Prime Minister Lofven resigned today. The parliament speaker to find a new premier who can secure a majority or call for new elections. It had taken Lofven four months to form the fragile minority government in 2018. Lofven could head a caretaker government until the September 11 general election. Lofven’s Social Democratic party is the largest, with 100 of parliament’s 349 seats. Separately, note that the Riksbank meets July 1 and is widely expected to stand pat.

Politics dominated the weekend in Europe. The latest scandal in the UK saw the health minister (Hancock) resign and was replaced with Javid, who is hoped to help stabilize the government. Meanwhile, the spreading contagion may threaten the postponed re-opening now penciled in for July 19. In yesterday’s run-off elections in France, Macron’s party garnered less than 7% of the votes, while Le Pen got 20%.

The euro has been confined to a quarter of a cent range above $1.1920. A 1.1 bln euro option at $1.1950 will be cut today. The single currency is really in a slightly broader range of about $1.1910 to $1.1975. The 200-day moving average and a technical retracement target are found around $1.20. The highlight of the week is the preliminary estimate for June CPI. According to the median projection in Bloomberg’s survey, the year-over-year may tick down to 1.9% from 2.0%.

Sterling held the pre-weekend low near $1.3870, briefly traded above the pre-weekend high (~$1.3935) to reach $1.3940 in early European turnover. This likely marks the day’s range. June house prices (from Nationwide) and May consumer credit due tomorrow are the main economic data points this week outside of another look at Q1 GDP and the final manufacturing PMI.

America

This week’s US economic reports begin slowly, with only the Dallas Fed’s manufacturing survey on tap for today. House prices are featured tomorrow ahead of the ADP private-sector jobs estimate and pending home sales in the middle of the week. The highlight is Friday’s non-farm payroll report, and estimates are for around a 700k increase after 559kin May. Fed presidents Williams (BIS panel) and Barkin (inflation risks) speak, while Vice Chair Quarles discusses central bank digital currency.

Canada will not report its June employment data until June 9. This week’s highlight is the April monthly GDP on Wednesday and the merchandise trade balance on Friday. StatsCan has estimated that April GDP likely contracted by around 0.8% in April after a 1.1% expansion in March. It will be the first monthly contraction since April 2020. New social restrictions are the main culprit. The economy may not have improved much in May, but preliminary June data appears better. After two disappointing reports, the employment data is seen as the key to whether the Bank of Canada continues the tapering of its bond purchases at the July 14 meeting.

Mexico surprised the world last week by delivering a 25 bp rate hike. The market sees the move as the start of an aggressive tightening cycle. Roughly 100 bp of tightening appears to be priced in for the remainder of the year and another 100 bp in H1 22. Today, Mexico reports the May trade balance. The compression of domestic demand, the strong recovery in the US, and favorable terms of trade saw Mexico’s trade surplus average $2.8 bln in 2020 compared with $446 mln in 2019 and a $1.13 bln deficit in 2018. The trade balance was in deficit in Q1 but rebounded in April ($1.5 bln) and is seen near $1.3 bln in April. Separately, at the end of last week, Brazil’s central bank raised its growth projection to 4.6% from 3.6% in March. The drought is boosting hydroelectric prices, and June CPI (IBGE) rose above 8%. Brazil’s central bank does not meet until August 4, and it is seen lifting the Selic rate for the fourth time by 75 bp.

The Canadian dollar is trading softer but within the pre-weekend range (~CAD1.2270-CAD1.2330). Recall that the greenback peaked slightly shy of CAD1.2490 last Monday and found support near CAD1.2255 in the middle of last week. Resistance is found in the CAD1.2330-CAD1.2350 area. The unexpected Banxico rate hike sent the US dollar to roughly MXN19.7165. Follow-through selling ahead of the weekend saw a marginal new low close to MXN19.7060. The dollar is better bid today near MXN19.88. The pre-weekend high was almost MXN19.9060. Above there, resistance is seen around MXN20.00. The peso was the strongest currency in the world last week, surging 4.2%. Some consolidation looks warranted. The Brazilian real was the second strongest, with a little more than a 3.1% gain. After breaking below BRL5.0, the dollar found support near BRL4.90. Some backing and filling look likely. The Chilean peso was the third-based among emerging market currencies, gaining almost 2% against the dollar. It is seen lifting rates at the July 14 central bank meeting.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: EUR/CHF,Featured,newsletter,USD/CHF