When you choose to invest in gold it can be confusing to know the best way to add it to your portfolio. Should you buy gold bullion? Should you buy a gold ETF? Or maybe gold mining shares?It’s a minefield! Here at GoldCore, we see it very simply: if you want to get all of the benefits of holding gold then you should own physical gold. Because if you can’t hold it then you don’t own it. Never before has this philosophy been more pertinent than in the last few...

Read More »European Energy Crisis: 4 Things You MUST Know!

European Energy Crisis: 4 Reasons You MUST Know! European households are facing rising prices on many goods and services, but one particular standout is electricity and gas bills. According to Bank of America, European household gas bills are expected to rise to €1,850 in 2022 from €1,200 in 2020 (an ~55% increase). Natural gas prices have pulled back from the December peak. However, it remained high and it could get worse over the remainder of the winter months....

Read More »The Great Reset vs. The Great Reset

In baseball, there is a situation where a base runner is sprinting to home plate and can’t see what is happening behind him. Totally focused on scoring, he doesn’t know if the outfielder is throwing a ball that will reach home plate first. That’s where we get the phrase “out of left field.” (If the ball were coming from right field, the runner could actually see it.) COVID-19 was the ultimate ball out of left field. Yes, we knew viruses spread and pandemics were...

Read More »There is No Denying that Cash is Trash!

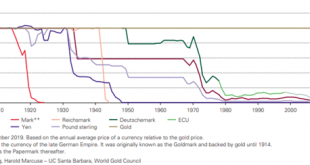

By Stephen Flood Governments are likely to continue printing money to pay their debts with devalued money. That’s the easiest and least controversial way to reduce the debt burdens and without raising taxes. Ray Dalio – Bridgewater Associates This is the only chart that matters in the world today. Consider the following: Gold can only be produced at a rate of 1.6% per annum. This is a relative constant. Gold has returned 8% per year in Euros and 9% in USD terms...

Read More »Biden Transition and Vaccine Hopes Weigh on Gold for Now

Today we are taking our monthly look at the charts for gold and silver. We have now received news of 3 Covid19 vaccines that are seeking approval following successful trials and markets have sat up and listened. Investors have moved in to “Risk On” mode as a result of the vaccine developments and also on signs that the transition to the Biden administration is now progressing better than previously. While stock markets, oil markets and cryptos have benefitted from...

Read More »What is “The Great Reset” and How to Prepare

“The Great Reset” is a term that we are hearing more frequently in the financial news today, but what exactly is “The Great Reset”? In Episode 16 of The Goldnomics Podcast, Stephen Flood, Mark O’Byrne and Dave Russell discuss “The Great Reset” and how it could impact investors, what they can do now to prepare themselves and their finances and the role that gold plays in protecting your wealth. [embedded content] [embedded content]...

Read More »Prepare For ‘No-Deal Brexit’ – Own Physical Gold To Protect Your Wealth

The Brexit deadline of December 31st, the date beyond which the transition or implementation period cannot be extended, now looms large and the dreaded “No-Deal” Brexit outcome looks increasingly possible by the day. There is plenty of brinkmanship, rhetoric and passionately held views on the Brexit issue and recent days have seen this again. It is and will continue to be a highly partisan and divisive issue. It is important to tune out the political noise and...

Read More »Why High Net Worth Investors are Opting for Physical Gold Vs ETFs, Digital Gold & Crypto-Currencies

As we continue to await the official result of the US Election, in the short-term financial markets remain volatile. However, today Mark O’Byrne is talking with David Bell of PCD Club about why the current uncertainty in global financial markets has High Net Worth Investors seeking out physical gold coins and bars in preference to ETF’s, Digital Gold and Crypto-Currencies. [embedded content] You Might Also Like...

Read More »Is the US Election the “Cork in the Bottle” for Gold and Silver?

Today we are taking our weekly look at the charts for gold and silver. Republicans and Democrats continue to play the “will they, won’t they?” game over another stimulus package in a Covid19 ravaged US economy. An agreement on a package will ultimately be seen as positive for the markets but, with the US Election just weeks away this may prove to prolong negotiations or postpone decisions until the results of the election are clear and accepted by all. Will Gold Now...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org