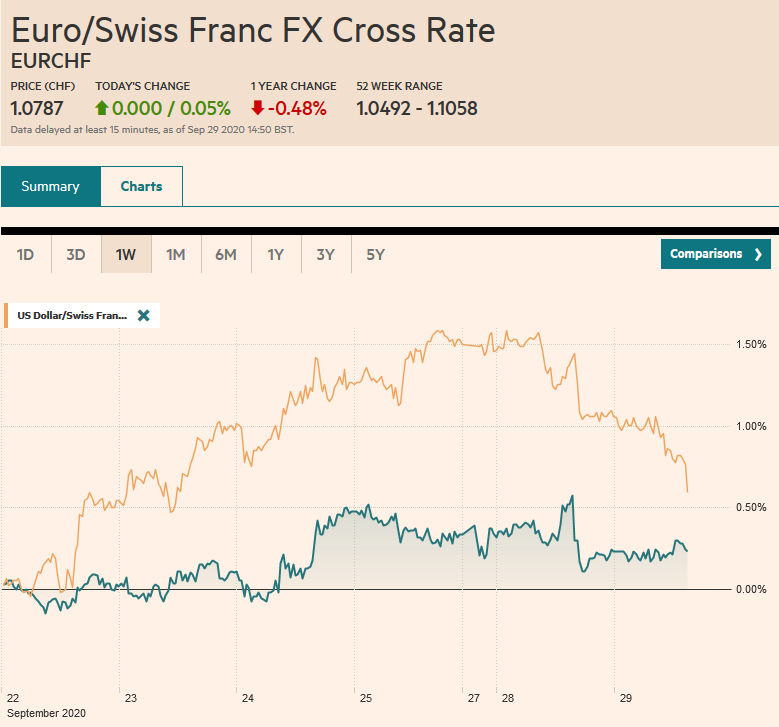

Swiss Franc The Euro has risen by 0.05% to 1.0787 EUR/CHF and USD/CHF, September 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A consolidative tone continues across the capital markets. Equities have lost their momentum. The MSCI Asia Pacific Index was mixed, while Europe’s Dow Jones Stoxx 600 is paring yesterday’s sharp 2.2% gain. US shares are little changed but mostly softer. Benchmark 10-year yields are 1-2 basis points lower in Europe, and the US 10-year is steady around 65 bp. The dollar is narrow ranges, mostly a bit softer, led by the Antipodeans and British pound, which has been resilient in recent days. The yen is nursing small losses. The liquid accessible emerging market currencies, like the

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, Currency Movement, ECB, EU, Featured, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.05% to 1.0787 |

EUR/CHF and USD/CHF, September 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A consolidative tone continues across the capital markets. Equities have lost their momentum. The MSCI Asia Pacific Index was mixed, while Europe’s Dow Jones Stoxx 600 is paring yesterday’s sharp 2.2% gain. US shares are little changed but mostly softer. Benchmark 10-year yields are 1-2 basis points lower in Europe, and the US 10-year is steady around 65 bp. The dollar is narrow ranges, mostly a bit softer, led by the Antipodeans and British pound, which has been resilient in recent days. The yen is nursing small losses. The liquid accessible emerging market currencies, like the Russian rouble, Turkish lira, South African rand, and Mexican peso are heavy, and the JP Morgan Emerging Market Currency Index is off for the third consecutive session and for the seventh session in the past eight. Gold is holding near a four-day high a little below $1890. November WTI is consolidating after reaching a five-day high near $40.80. It is the first session in seven that it has not traded below $40, but this may not stand today’s North American session. |

FX Performance, September 29 |

Asia Pacific

Tokyo’s September CPI shows deflation lingers. The headline rate eased from 0.3% year-over-year to 0.2%. However, the core rate, which excludes fresh food, improved to -0.2% from -0.3%. The measure that excludes energy alongside fresh food was flat after a 0.1% decline in August. Tomorrow Japan reports August industrial production and retail sales. The former is expected to slow from the 8.7% gain in July, while the latter is expected to have risen around 2% after a 3.3% decline previously. Separately, NTT has announced it will buy its wireless unit, making it a wholly-owned subsidiary (cost ~JPY4.25 trillion or ~$40 bln), at around a 40% premium. It is not clear the implication for Prime Minister Suga’s drive to lower mobile charges.

For a third session, the US dollar is in a roughly JPY105.20-JPY105.70 range. Expiring options are lower than spot and could reinforce the dollar’s floor. There are $1.7 bln in option at JPY105.30-JPY105.35 that will be cut and around $3 bln in expiring options in the JPY105.00-JPY105.10 area. However, the upside looks blocked in front of JPY106, leaving range-trading as the most likely scenario today. The Australian dollar has formed a shelf ahead of $0.7000 and is probing higher today. It has tested the $0.7120-level today, a four-day high. It is a little shy of the (38.2%) retracement of last week’s erosion. If the momentum stalls, as the intraday technicals suggest is possible, support is near $0.7080. The PBOC set the dollar’s reference rate at CNY6.8171, which is slightly higher than many banks expected. Note that while there are calls for further appreciation of the yuan, its 3.6% gain this quarter appears to be the most in a decade.

Europe

Several of the major business press have run articles over the past 48 hours or so playing up the difference of opinion on the ECB. That likely means one thing: the hawks are again pressing their case hard. Two issues have surfaced. The first is that some hawks want to slow down the PEPP buying as amid relatively stable and have the flexibility to increase in the future. The other issue is that the staff’s forecasts are too pessimistic. These two issues share a common element, and that is a pushback against efforts from the moderates and doves support. The new surge of virus cases in cases and the introduction of measures to contain the spread will serve as a coolant just as the PMIs show that the pace of recovery is stalling. ECB President Lagarde is seen as more of a consensus-builder than Draghi, but it seems clearer than the problem for the hawks is about substance, not really procedures and management styles. The ECB is in a similar position as the Federal Reserve. The pandemic has knocked their respective economies further off-course, but both are reluctant to take new action. That said, the ECB is expected its bond-buying in December, while the Fed’s current commitment is open-ended.

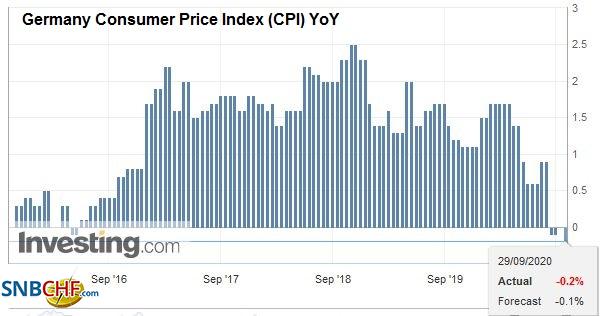

| Lagarde reiterated before the European Parliament that eurozone deflation may persist a few more months, though next year’s forecast is for recovery to 1%. If on cue, Spain reported a soft September number. The EU-harmonized measure was flat on the month. The median forecast in the Bloomberg survey was for a 0.5% gain. The year-over-year rate was unchanged at -0.6%. German states have reported ahead of the national figure that is due shortly. Most of the states saw softer price pressures, and the risks are to the downside of the median (Bloomberg) forecast for a 0.1% decline on the month and year-over-year. In August, the harmonized measure fell 0.2% on the month and was -0.1% on a year-over-year basis. The temporary cut in the VAT is a significant distortion. The aggregate figure for the eurozone will be published on October 1. |

Germany Consumer Price Index (CPI) YoY, September 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

The EC is trying to stay optimistic that a trade deal with the UK can still be negotiated, while at the same time, pushing the UK to be “more serious.” Some link sterling’s relative resilience in recent days to market, recognizing that a break-through this week is possible. After this week’s negotiations, a decision will be made whether the talks have sufficiently progressed to begin the crafting of a document, which is where some of the most thorny issues could be ultimately addressed.

Germany, which holds the rotating EU presidency, has proposed a compromise to allow for the approval of the new budget and the 750 bln-euro Recovery Fund. In essence, it links access to funds to “respect” for the rule-of-law, but shifts the burden, making it more difficult to trigger the sanctions. Previously, it would take a qualified majority to block the effort, while under the proposal, it would take a qualified majority to invoke the measure. It may not be sufficient for Hungary and Poland, which are the two countries that are currently subject to proceedings on rule-of-law issues.

The euro is trading at a four-day high just below $1.17 in the European morning. It could push a little higher ~($1.1710 ), but the intraday technical readings are stretched. That said, a move above the $1.1740 area would suggest a corrective low is in place. The weak technical reading at the end of last week warned of the risk of another leg lower to complete what we see as a correction from the $1.20-high seen at the start of the month. Sterling reached $1.2930 yesterday, a five-day high but met a wall of sellers that knock it back a full cent. It is consolidating firmly but below $1.29 today. Support is seen in the $1.2800-$1.2830 area today.

America

The House of Representatives is putting forward a $2.2 trillion package as a negotiating chit with the White House and the Senate. It is more than the $1.5 trillion that the Trump administration previously endorsed and well above the “skinny” $650 bln proposal from the Senate. It includes funds for state and local governments, $1200 UBI and $500 per dependent, $600 a week federal unemployment compensation through January, and funds for sectors that previously did not receive much assistance (airlines, restaurants, and small businesses). Funds earmarked for schools were doubled.

The US high-frequency data will not distract much from the highlight of the week–the September employment report on Friday. The August trade balance is due and wholesale and retail inventory figures. The trade balance is deteriorating, and the inventories are expected to have helped lift Q3 GDP. Case-Shiller house prices and the Conference Board’s Consumer Confidence will draw attention but are typically not market-movers. Canada reports raw material prices, which hardly impact trading, but tomorrow’s July GDP (median forecast in the Bloomberg survey is for a 2.9% expansion after 6.5% growth in June) may attract more attention. Mexico reports weekly reserve figures after yesterday reporting a record monthly trade surplus (~$6.1 bln). Exports were off 7.7% year-over-year after an 8.9% decline in July. Imports fell 22.2% from a year ago, following a 26.1% decline in July.

For the third session, the US dollar remains in a CAD1.3325-CAD1.3420 trading range. This wedge/pennant pattern is often seen as a continuation pattern, which in this case would point to a stronger greenback. However, the daily momentum indicators are more suggestive of a top, though they have not turned down yet. The greenback also remains rangebound against the Mexican peso. The range, roughly MXN21.95 to MXN22.70, was set on September 24 and has held since. The daily technical indicators suggest continued range-trading is the most likely scenario.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,Currency Movement,ECB,EU,Featured,newsletter