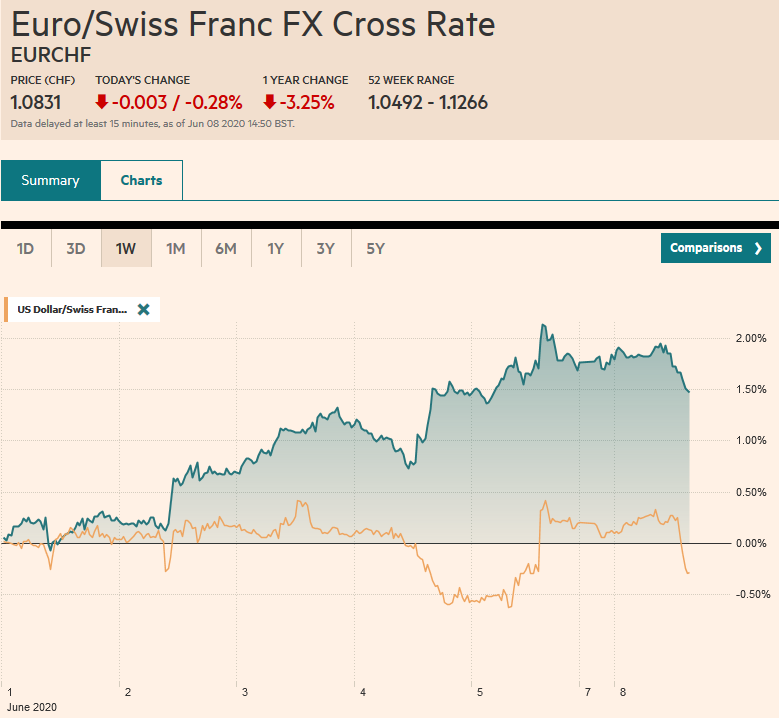

Swiss Franc The Euro has fallen by 0.28% to 1.0831 EUR/CHF and USD/CHF, June 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The MSCI Asia Pacific Index rose for a sixth consecutive session. Japan, Taiwan, Singapore, and Indonesian markets advanced more than 1%. European bourses are mixed, with the peripheral shares doing better than the core, leaving the Dow Jones Stoxx 600 about 0.5% lower near midday after surging 2.5% ahead the weekend. US shares are firm, as is the 10-year yields, hovering near 92 bp. Core 10-year benchmark yields are a softer in Europe, while peripheral yields are edging higher to start the week. The Scandis and Antipodean currencies continue to lead the move against the dollar, while

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Brexit, China, Currency Movement, Featured, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.28% to 1.0831 |

EUR/CHF and USD/CHF, June 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

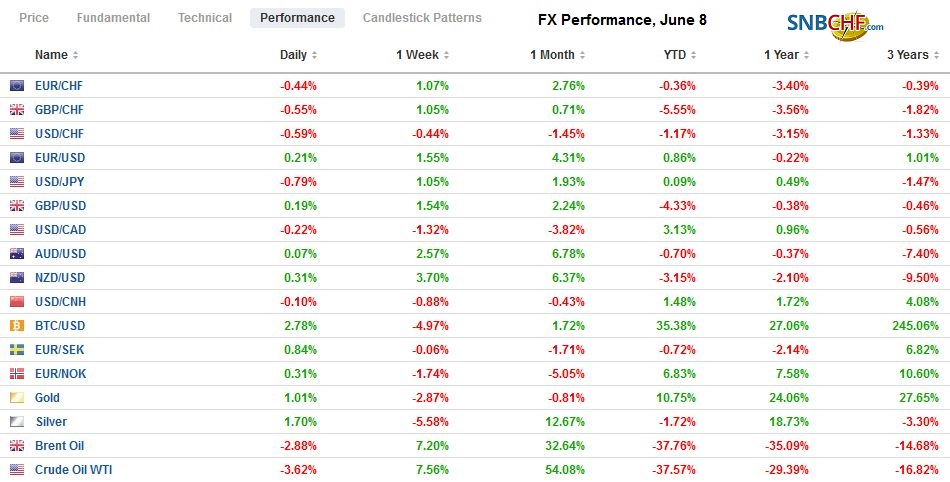

FX RatesOverview: The MSCI Asia Pacific Index rose for a sixth consecutive session. Japan, Taiwan, Singapore, and Indonesian markets advanced more than 1%. European bourses are mixed, with the peripheral shares doing better than the core, leaving the Dow Jones Stoxx 600 about 0.5% lower near midday after surging 2.5% ahead the weekend. US shares are firm, as is the 10-year yields, hovering near 92 bp. Core 10-year benchmark yields are a softer in Europe, while peripheral yields are edging higher to start the week. The Scandis and Antipodean currencies continue to lead the move against the dollar, while the other major currencies are less than 0.2% higher. Emerging market currencies continue their run higher, led by Russia, South Africa, and Mexico. The JP Morgan Emerging Market Currency Index is extending its recovery for the eighth consecutive session. Gold has steadied below $1700 after falling 2.6% last week. Oil reacted favorably to the OPEC+ agreement to extend the maximum output cuts until the end of next month. July WTI is higher for the fifth straight session and briefly traded above $40 a barrel. |

FX Performance, June 8 |

Asia PacificChina reported May trade and reserve figures over the weekend. The reserves rose by about $10 bln, which is a little more than twice what economists had anticipated. Still, on a $3.09 trillion-base, it is little more than a rounding error and has no significance. On the other hand, the trade surplus jumped by more than a third, those economists had anticipated a small decline. The rise in the trade surplus to a record of almost $63 bln is not a function of China’s economic prowess. Exports fell 3.3% year-over-year after a 3.5% increase in April. A Reuters poll found a median forecast of a 7% increase. Imports plunged 16.7%, worse than the 14.2% decline in April and the sharpest decline since January 2016. The Reuters poll looked for a 9.7% decline. It appears that weaker prices contributed to the decline in imports. For example, Bloomberg cites a 5.2% rise in oil import volumes so far this year, while the average purchase price has declined by over a fifth. This, in turn, speaks to a positive terms of trade shock. China may indeed be pursuing an import substitution strategy, but it is not the key driver of the dramatic widening of the trade surplus in May. It will not feel like an import substitution strategy for Brazil. China appears to be the destination of a growing share of Brazilian exports, taking 54% of its outbound shipments in May. In the first five months of the year, Brazilian exports to China have risen by 128% year-over-year, according to data released last week. Much of what Brazil ships to China (agriculture and energy) compete directly with US exports to China. |

China Trade Balance (USD), May 2020(see more posts on China Trade Balance, ) Source: investing.com - Click to enlarge |

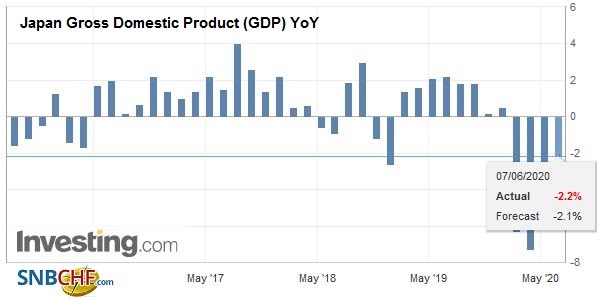

| Japan reported Q1 GDP contracted by 2.2% at an annualized pace rather than by 3.4% as initially estimated. The upward revision to capex (1.9% vs. -0.5%) more than offset the small downward revisions to private and public consumption and inventories. |

Japan Gross Domestic Product (GDP) YoY, Q1 2020(see more posts on Japan Gross Domestic Product, ) Source: investing.com - Click to enlarge |

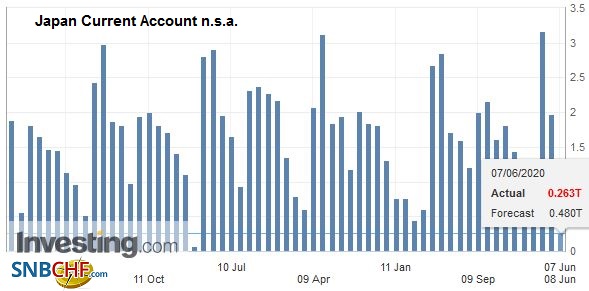

| The world’s third-largest economy may contract by around 25% this quarter. Separately, Japan reported a JPY252 bln seasonally adjusted current account surplus in April despite a JPY966 bln trade deficit. |

Japan Current Account n.s.a. April 2020(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The dollar is trading in the upper end of the pre-weekend range (~JPY109.05-JPY109.85) and has been confined to about a 15 tick range on both sides of JPY109.55. It had risen for the previous four sessions. The market lacks near-term conviction. The Australian dollar is firm, but it is also trading within the pre-weekend range. It had risen to nearly $0.7015 before the weekend and rose above $0.7000 in both Asia and the European morning. It did not see much follow-through buying. Support is seen in the $0.6950-$0.6960 area. The New Zealand dollar did edge to a new high, encouraged by reports that the pathogen has been eradicated from the country. While the Hong Kong dollar’s forward points continue to ease, flows, especially from the mainland, are keeping the HK dollar itself pinned at the strongest end of the band, forcing the HKMA’s hand. The PBOC dollar’s reference rate was firm at CNY7.0882 compared to the bank models, but the greenback slipped lower for the third consecutive session.

Europe

The US surprised Germany by indicating plans to withdraw a little more than a quarter of its troops (or around 9500). No official reason or notification has been delivered. US-German ties have been strained over various issues, including NATO, the Nord Stream II pipeline, and various trade issues. Before the weekend, Trump renewed his threat of auto tariffs if Europe did not reduce its tariffs on American lobsters. Some might argue that this is part of the US “isolationism,” but the troops might not be brought home but simply re-deployed in Europe.

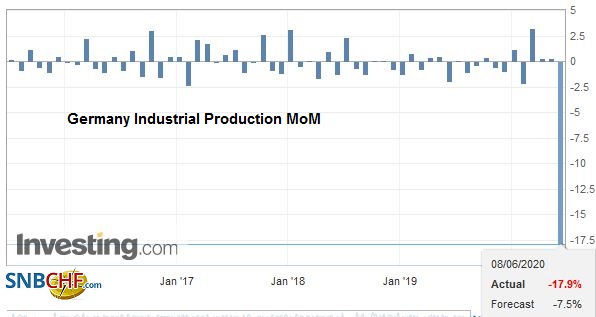

| Before the weekend, Germany reported a nearly 26% drop in April factory orders. The median forecast in the Bloomberg survey was for a 20% decline. Today, it reported a 17.9% fall in April industrial output. It was worse than expected. Aggregate eurozone figures will be reported at the end of the week, and a contraction of around 20% month-over-month is expected after March’s decline of a little more than 11%. |

Germany Industrial Production MoM, April 2020(see more posts on Germany Industrial Production, ) Source: investing.com - Click to enlarge |

The latest round of UK-EU trade talks did not see much progress, and the next important step is a bilateral meeting between Prime Minister Johnson and EU President von der Leyen. Meanwhile, negotiations with Japan over a trade agreement continue today. Separately, Johnson is expected to brief his cabinet on the next stage of lifting social restrictions. The Prime Minister wants to expedite infrastructure and hospital spending. The latest polls show falling support for Johnson and the Tories.

The euro reversed ahead of the weekend, retreating from the $1.1385 area to about $1.1280. It has been confined through the European morning in a 20-tick range centered at $1.1300. There is an option for about 615 mln euros struck at $1.1365 that expires today, but the intraday technicals suggest it is unlikely to be in play. A break, and especially a close below $1.1265 today, could signal a near-term test on the $1.1200-area. Sterling encountered selling in front of the pre-weekend high near $1.2730 and has drifted lower in the European morning. A break of $1.2650 signals a move toward $1.2600 initially, and maybe $1.2550 near-term. The euro is finding support near GBP0.8865-GBP0.8880.

America

The FOMC meeting conclusion and press conference on Wednesday is the main event this week. The week, though, begins slowly without US and Mexican data today. Canada reports May housing starts. Mexico will release its May estimate of CPI tomorrow, and a small uptick is expected. The US reports its May CPI a Wednesday morning. In addition to its weekly sales, the US will auction 3-year notes today and 10-year notes tomorrow. Some $35-$40 bln of investment-grade corporate bonds are expected to be brought to market this week.

The market continues to digest the stronger than expected employment data reported by both the US and Canada ahead of the weekend. There are temporary and likely permanent job losses in recent months. Economists and policymakers cannot be sure of the precise mix. As cities and states relaxed the stay-in-place orders, it makes sense that food services and restaurants saw a jump in employment, and accounted for around half of the US job growth. Health care gained ~310k jobs and construction,~465k jobs. In Canada, Quebec appears to account for the bulk of the job increase. The US unemployment rate was dragged down by misclassification of furloughed workers and the fact that the labor force shrank. Nevertheless, the first signs of stabilization are in place, and the long slog back has begun.

Mexico reluctantly agreed to 100k barrel a day cut in output after much arm twisting and a broad claim that the US would make up the difference between that and the 400k barrels that OPEC+ wanted it to cut in the April agreement. It does not seem so surprising that it has balked at joining the extension announced last week and confirmed over the weekend. Saudi Arabia feels so confident in its strategy that it hiked next month’s prices to Asia by $5.60-$7.30 a barrel. This is well above the $4 increase the median of a small Bloomberg poll anticipated. However, two other developments should be noted. First, the largest oil field in Libya is coming back on-line and provided the cease-fire holds, can ramp up production to around 300k barrels a day the end of Q4. Second, as we have noted, US shale output can rebound quicker than traditional crude wells. Shut-in production (wells drilled and capped) can be seen as in-ground storage that is relatively quick and cheap to extract now. If not this week, then soon, market participants should be prepared for US inventories and the drill count to rise.

The US dollar remains pinned near the pre-weekend lows just below CAD1.3400, where a $950 mln option is set to expire today. The US dollar’s momentum indicators are stretched, and a move above CAD1.3445-CAD1.3465 may be the first sign of consolidation or correction. That said, chart-support is not seen until nearer CAD1.3560. The greenback did extend its losses against the Mexican peso, falling to about MXN21.4770. However, the inability to maintain the downside momentum may suggest the corrective/consolidation phase is at hand. Initial resistance is seen in the MXN21.60-MXN21.70 area. A close above there could signal near-term greenback gains toward MXN22.00

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Brexit,China,Currency Movement,Featured,newsletter,OIL