Swiss Franc The Euro has fallen by 0.10% to 1.064 EUR/CHF and USD/CHF, July 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 rallied 1.6% yesterday to extend the streak to a fifth consecutive session, and the longest of the year and completed the negation of a bearish technical pattern. However, the main feature today is a wave of profit-taking on risk assets. Most equity markets moved lower in the Asia Pacific region. Chinese markets were a notable exception. The Shanghai edged about 0.35% higher, while the Shenzhen tacked on 1.7%. European shares are struggling, and the Dow Jones Stoxx 600 is giving back a bit more than half of yesterday’s 1.6% gain. US shares are trading heavily, setting up

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, Currency Movement, EUR/CHF, Featured, FX Daily, Germany Industrial Production, Japan Household Spending, newsletter, RBA, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

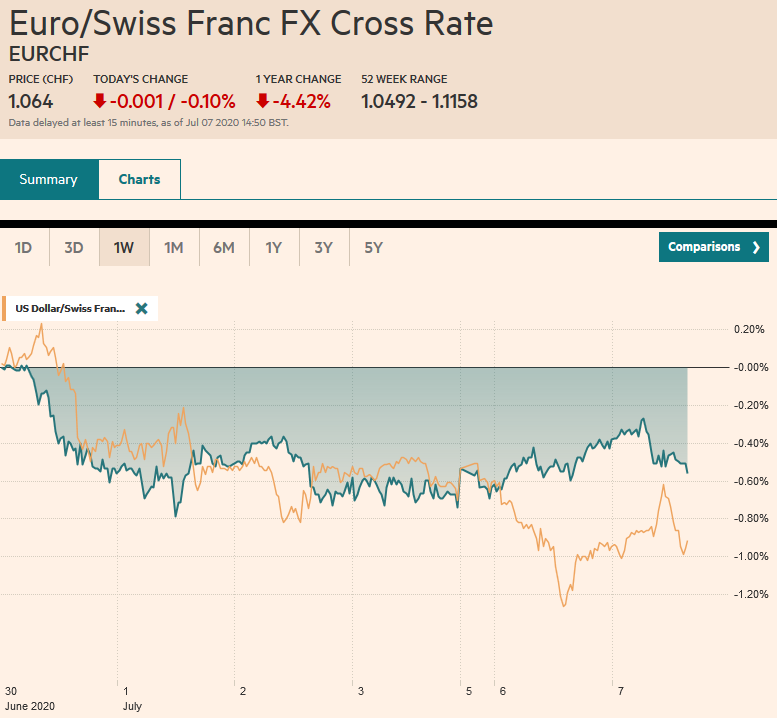

Swiss FrancThe Euro has fallen by 0.10% to 1.064 |

EUR/CHF and USD/CHF, July 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

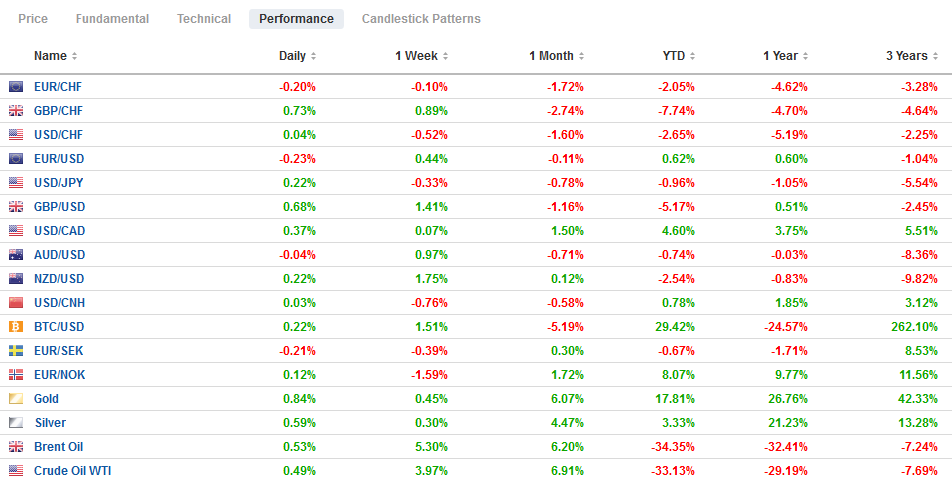

FX RatesOverview: The S&P 500 rallied 1.6% yesterday to extend the streak to a fifth consecutive session, and the longest of the year and completed the negation of a bearish technical pattern. However, the main feature today is a wave of profit-taking on risk assets. Most equity markets moved lower in the Asia Pacific region. Chinese markets were a notable exception. The Shanghai edged about 0.35% higher, while the Shenzhen tacked on 1.7%. European shares are struggling, and the Dow Jones Stoxx 600 is giving back a bit more than half of yesterday’s 1.6% gain. US shares are trading heavily, setting up for around a 1.0% early loss in the S&P 500. While Asia Pacific yields mostly eased, European 10-year benchmark yields are a little firmer. The US 10-year yield is practically flat at 67 bp. The dollar itself is firmer against all the major currencies, led by the Antipodeans and Norwegian krone. Emerging market currencies are also mostly weaker, with the JP Morgan Emerging Market Currency Index off around 0.4% late in the European morning. Gold is consolidating at lower levels. Initial support is seen ahead of $1770. Similarly, oil has slipped lower and WTI for August delivery is testing support near $40 a barrel level after briefly poking above $41 yesterday. |

FX Performance, July 7 |

Asia Pacific

The dollar fell sharply (~0.70-0.75%) against onshore and offshore yuan yesterday but stabilized today but only after dipping below CNH7.0. It remained below the 200-day moving average of both for the first time in three months. The inclusion of Chinese financial assets into global benchmarks has drawn almost $600 bln as of the end of Q1 20. These are still modest sums given the size of Chinese assets. Nevertheless, many fund managers appeared underweight China, and the recent surge has caught many wrongfooted. At the same time, investors, Chinese bonds have underperformed, as there seems to be a portfolio shift among domestic investors from bonds to stocks. Separately, China reported that the value of its reserve holding rose by about $10.6 bln to $3.112 trillion in June. It was the third consecutive monthly increase that puts the reserve holdings about $4.5 bln above the December 2019 levels.

China’s 10-year bond yield surged 12 bp yesterday to pop above the 3.0% level for the first time since January and edged a little higher today. The lack of new liquidity measures over the weekend and a deluge of anticipated supply offered fresh fodder for a move underway since the end of April. Since then, the yield has risen by a little more than 50 bp. For comparison, the US 10-year yield has edged up by about 5 bp. The rising yield is not desirable, and a policy response may be likely if elevated yields persist, such a cut in required reserves.

The Reserve Bank of Australia kept its cash rate target unchanged at 0.25%. That also remains its target for three-year money. Even as Melbourne, Australia’s second-largest city re-entered lockdown mode (six weeks), the RBA sees a less severe hit to the economy that it feared earlier. It continued to emphasize the uncertain economic outlook. If more support is needed, it will extend its bond-buying efforts.

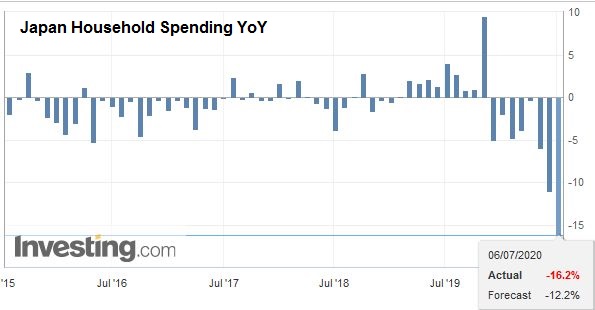

| In Japan, labor cash earnings were weaker than expected, falling 2.1% year-over-year in May, and it is the same decline when adjusted for inflation. Economists had been looking for a decline half as large. It is not surprising then that household spending was also weaker in May, falling a sharp 16.2% after an 11.1% decline in April. Economists had forecast a little less than a 12% drop. While there can be no doubt that the pandemic played a role, household spending in Japan has not risen since the sales tax hike was introduced at the beginning of Q3 19.

The dollar found support near JPY107.25 and returned to yesterday’s highs near JPY107.75 in Europe. The intraday technicals readings are getting stretched. Last week’s peak was near JPY108.15, but this looks a bit too far today. We suspect early North American operators will be inclined to sell into these upticks. The Australian dollar has traded on both sides of yesterday’s range. The close will be important from a technical perspective. A close below $0.6925 could signal near-term losses toward $0.6850. |

Japan Household Spending YoY, May 2020(see more posts on Japan Household Spending, ) Source: investing.com - Click to enlarge |

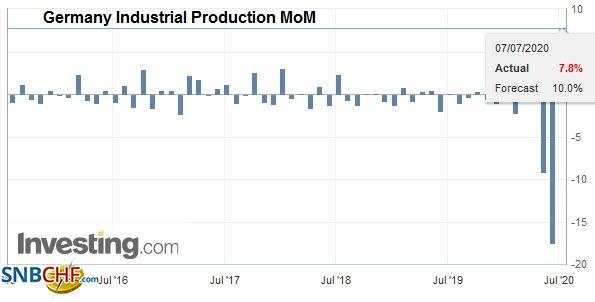

EuropeGermany followed its smaller than expected recovery in factory orders reported yesterday with a disappointing industrial output report. Industrial production rose by 7.8% in May. Economists had projected an 11.1% gain after a revised 17.5% decline in April, according to the median forecast in the Bloomberg survey. The takeaway is that the largest economy in Europe is recovering, though a little slower than the survey day would suggest. |

Germany Industrial Production MoM, May 2020(see more posts on Germany Industrial Production, ) Source: investing.com - Click to enlarge |

France’s May trade deficit yawned wider to 7.05 bln euros from 5.07 bln euros in April (initially 5.02 bln). It is the second-largest shortfall since 2012. However, the silver lining is that both exports and imports rose (16.8% and 20.7%, respectively) in the month. This lends credence to the French recovery story, which appears to be running ahead of many of its trading partners. Separately, note that in the cabinet reshuffle, Finance Minister Le Maire and Foreign Minister Le Drian retained their posts.

UK Chancellor of the Exchequer Sunak will present to Parliament tomorrow an economic update and new measures to support the economy and jobs. The government’s furlough program, under which it pays 80% of the wages, is now supporting 12.1 mln jobs (cost ~GBP35 bln). It is to begin winding down next month. Separately, the government’s three lending programs have lent about GBP45 bln to more than one million companies. Among his new proposals, Sunak will reportedly launch a GBP3 bln initiative to fund a conversion to more energy-efficient public buildings.

The euro peaked near $1.1345 yesterday and has been sold to about $1.1260 in the European morning. It is stretched, and a bounce is likely in the North American morning. There are 1.5 bln euros in options ($1.1265-$1.1275) that expire today. On the upside, another 1.7 bn euros in expiring options ($1.1335-$1.1345). Over the last couple of weeks, sterling has been capped in the $1.2530-$1.2550 area. Yesterday it peaked near $1.2520 and today has retreated to about $1.2465. Here too, we suspect support has been found in the European morning, and some recovery is likely in North America.

America

Another fairly subdued economic calendar is on tap for the Americas today. The US reports the JOLTS jobs-opening survey, and four Fed officials, including the Vice-Chair Quarles, speak today. Canada reports the IVEY survey, and a rise from May’s 39.1 reading is anticipated. Ottawa is expected to provide a budget update tomorrow. Note that the US Supreme Court allowed a lower court ruling that is blocking the Keystone XL pipeline to remain in place over the Trump Administration’s objections. Mexico reports vehicle production and exports. In Brazil, the results from President Bolsonaro’s Covid-19 tests are awaited await after apparently showing some symptoms.

With the foreclosure and eviction moratorium and the $600 a week extra unemployment insurance programs set to end later this month, pressure is building on Congress to take more action. The 7.5 mln employees returning to their jobs in May and June seemed to sap some enthusiasm for another large stimulus package. Still, new closures and the slowing of re-opening efforts in the face of the increase in the number of cases, with hospitalizations, also beginning to rise, Senate leader McConnell acknowledged that one more stimulus package will be put together in the coming weeks.

The US dollar found support near CAD1.3520 and has recovered to about CAD1.3590 today, which nearly fulfills a (38.2%) retracement objective of the recent losses from the push above CAD1.3700 on June 26. The next retracement is near CAD1.3620. However, we suspect the greenback’s bounce will run out of steam before getting there, and it could pullback toward the middle of the range. With a few exceptions, the US dollar has been confined to an MXN22.00-MXN23.00 range of over the last three weeks. We look for this range to be maintained near-term, and that suggests new peso buying will likely emerge shortly as the upper third of the range is entered.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movement,EUR/CHF,Featured,FX Daily,Germany Industrial Production,Japan Household Spending,newsletter,RBA,USD/CHF