Dan Oliver of Myrmikan Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the history of credit bubbles, the inevitability of central bank failings, and what history can tell us about the Fed’s current trajectory. Connect with Dan on Twitter: @Myrmikan and at Myrmikan.com Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources CMRE.org Myrmikan.com Gold Backwardation...

Read More »“Digital Money, Payments and Banks,” CEPR/IESE Report, 2020

Discussion of Antonio Fatás’ chapter in Elena Carletti, Stijn Claessens, Antonio Fatás, Xavier Vives, The Bank Business Model in the Post-Covid-19 World, CEPR/IESE report, London, June 2020. PDF. Antonio’s chapter offers a rich overview of the dramatic changes in the world of money and banking that we have seen in recent years. I focus on two themes: the nature of money and how it relates to these developments, and the government’s response to the structural changes we observe. I...

Read More »The Perversity of Negative Interest, Report 17 Nov

Today, we want to say two things about negative interest rates. The first is really simple. Anyone who believes in a theory of interest that says “the savers demand interest to compensate for inflation” needs to ask if this explains negative interest in Switzerland, Europe, and other countries. If not, then we need a new theory (Keith just presented his theory at the Austrian Economics conference at King Juan Carlos University in Madrid—it is radically different)....

Read More »“Monetary Policy for a Bubbly World”

In an VoxEU column, Vladimir Asriyan, Luca Fornaro, Alberto Martin, and Jaume Ventura lay out their perspective on bubbly money as a complementary store of value and the role of monetary policy in supporting optimal levels of investment.

Read More »“On the Equivalence of Private and Public Money,” JME, 2019

Journal of Monetary Economics, with Markus Brunnermeier. PDF. When does a swap between private and public money leave the equilibrium allocation and price system unchanged? To answer this question, the paper sets up a generic model of money and liquidity which identifies sources of seignorage rents and liquidity bubbles. We derive sufficient conditions for equivalence and apply them in the context of the “Chicago Plan”, cryptocurrencies, the Indian de-monetization experiment, and Central...

Read More »“On the Equivalence of Private and Public Money,” JME, 2019

Accepted for publication in the Journal of Monetary Economics, with Markus Brunnermeier. (NBER wp.) When does a swap between private and public money leave the equilibrium allocation and price system unchanged? To answer this question, the paper sets up a generic model of money and liquidity which identifies sources of seignorage rents and liquidity bubbles. We derive sufficient conditions for equivalence and apply them in the context of the “Chicago Plan”, cryptocurrencies, the Indian...

Read More »“On the Equivalence of Private and Public Money,” CEPR, 2019

CEPR Discussion Paper 13778, June 2019, with Markus Brunnermeier. PDF. (Local copy of NBER wp.) We develop a generic model of money and liquidity that identifies sources of liquidity bubbles and seignorage rents. We provide sufficient conditions under which a swap of monies leaves the equilibrium allocation and price system unchanged. We apply the equivalence result to the “Chicago Plan,” cryptocurrencies, the Indian de-monetization experiment, and Central Bank Digital Currency (CBDC). In...

Read More »“On the Equivalence of Private and Public Money,” NBER, 2019

NBER Working Paper 25877, May 2019, with Markus Brunnermeier. PDF. (Local copy.) We develop a generic model of money and liquidity that identifies sources of liquidity bubbles and seignorage rents. We provide sufficient conditions under which a swap of monies leaves the equilibrium allocation and price system unchanged. We apply the equivalence result to the “Chicago Plan,” cryptocurrencies, the Indian de-monetization experiment, and Central Bank Digital Currency (CBDC). In particular, we...

Read More »Are Stocks Overvalued, Report 24 Dec 2018

We could also have entitled this essay How to Measure Your Own Capital Destruction. But this headline would not have set expectations correctly. As always, when looking at the phenomenon of a credit-fueled boom, the destruction does not occur when prices crash. It occurs while they’re rising. But people don’t realize it, then, because rising prices are a lot of fun. They don’t realize their losses until the crash. So we...

Read More »Three Years Ago QE, Last Year It Was China, Now It’s Taxes

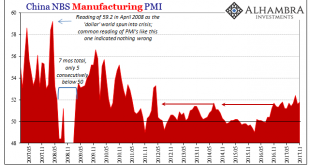

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month. China Manufacturing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org