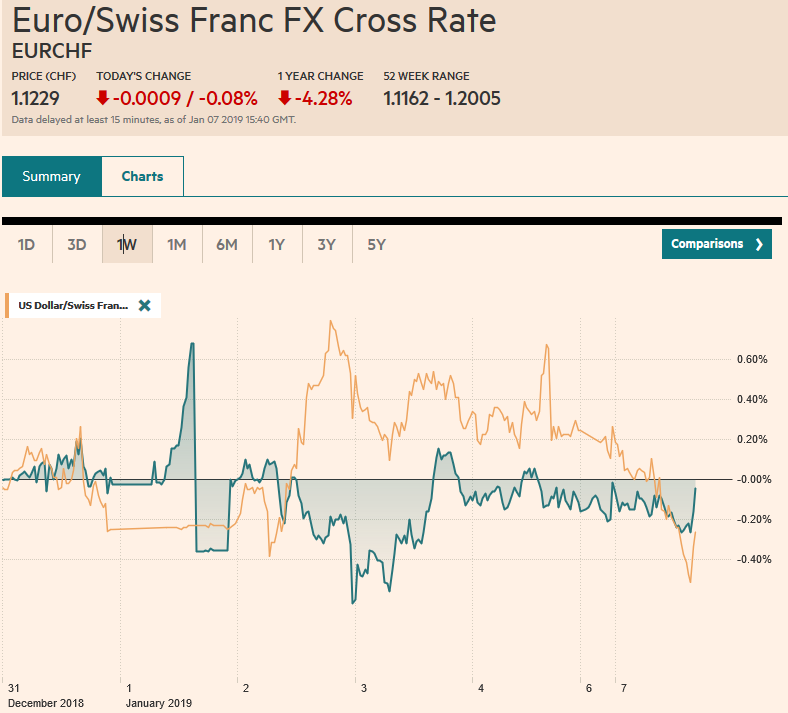

Swiss Franc The Euro has fallen by 0.08% at 1.1229 EUR/CHF and USD/CHF, January 07(see more posts on EUR/CHF, USD/CHF, ) - Click to enlarge FX Rates Overview: The combination of robust US jobs and wage growth, more comforting words from Powell and a strong rally US stocks before the weekend helped lift Asian markets today and underpinned risk-taking appetites. However, renewed protests in France (and Hungary) coupled with weak German factory orders have prevented European bourses from fully participating in the equity recovery. Yields rose in Asia-Pacific but are lower in Europe, and US rates are a little softer after both the two-year and 10-year yield rose 11 bp at the end of last week, despite what the

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, EUR/CHF and USD/CHF, Featured, GBP, JPY, MXN, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% at 1.1229 |

EUR/CHF and USD/CHF, January 07(see more posts on EUR/CHF, USD/CHF, ) |

FX RatesOverview: The combination of robust US jobs and wage growth, more comforting words from Powell and a strong rally US stocks before the weekend helped lift Asian markets today and underpinned risk-taking appetites. However, renewed protests in France (and Hungary) coupled with weak German factory orders have prevented European bourses from fully participating in the equity recovery. Yields rose in Asia-Pacific but are lower in Europe, and US rates are a little softer after both the two-year and 10-year yield rose 11 bp at the end of last week, despite what the consensus saw as a dovish shift by Powell. The greenback is heavier against the major currencies and most emerging market currencies. Oil prices are a little less than 2% higher as the streak extends into a sixth session. |

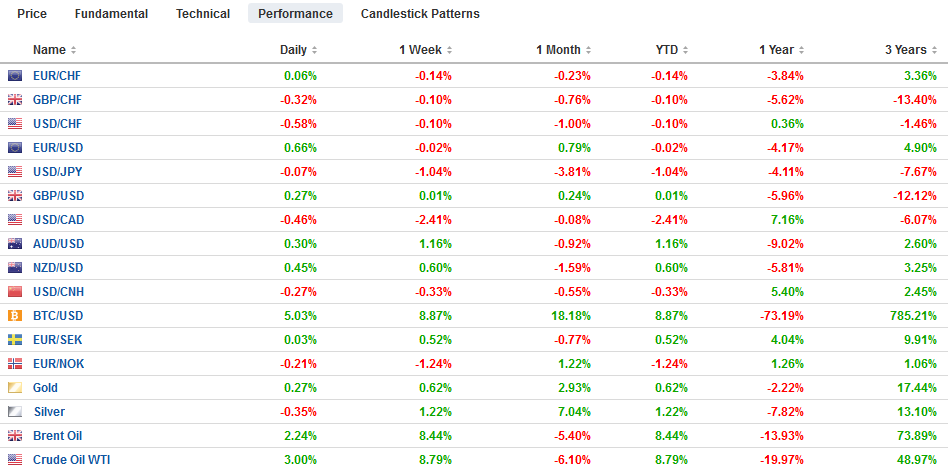

FX Performance, January 07 |

Asia Pacific

US-Chinese trade talks were held in Beijing today. Expectations of a breakthrough were low, but the unexpected appearance of Vice Premier Liu He lent the mid-level meeting more gravitas. The pieces appear to be falling into place for President Trump to meet Chinese Vice President Wang Qishan at the World Economic Forum in Davos. The freeze in tariff action expires in early March. On the face of it, there would seem to be scope for a deal. The US has agriculture and energy that China wants. China has begun allowing greater access to its financial markets and is reducing some tariffs and has rolled back the 25% retaliatory tariff on US autos. It has also increased punishments for intellectual property violations. Chinese officials have begun playing down the “Made in China 2025” rhetoric that seemed to antagonize US officials, even though it is not different in spirit than Make America Great Again, insofar, as both are ultimately import-substitution development strategies. The challenge is that the US wants to address non-tariff barriers and the divergence between declaratory and operational policy.

Separately, China reported reserve figures. December reserves rose by $11 bln, largely in line with expectations. They stand at $3.073 trillion compared with $3.140 in December 2017. The small increase in reserve holdings likely reflects valuation adjustments, with the actual accumulation of new reserves likely limited. US Treasury data shows that China reduced its Treasury holdings for the five months through October. The new TIC report is due out next week, but the closure of the government could impact the timing of the release.

Investors have only begun paying attention to Japan’s PMI. The composite was reported earlier today. It eased to 52.0 from 52.4 in November. It averaged 52.3 in Q4 after 51.5 in Q3, when the economy contracted by 0.6%. The Q4 average matches the Q2 average when the economy expanded by 0.7%. Nevertheless, the world’s third-largest economy may have expanded by 0.3% in Q4.

The dollar initially extended the pre-weekend recovery against the yen, rising to almost JPY108.80 before running out of steam. It tested JPY108.00 in the European morning. Below there, the JPY107.80 may be sufficient to hold back a deeper pullback. The Australian dollar extended the recovery seen at the end of last week. During the flash crash, it had fallen to nearly $0.6740. It rallied above $0.7100 before the weekend and poked through $0.7140 briefly today. The move does not appear exhausted, though an expiring option struck at $0.7160 (for A$641 mln) may slow the ascent today.

Europe

The main economic news consists of German factory orders and retail sales. The former disappointed while the latter exceeded expectations. The 1% decline in factory orders was much greater than the 0.1% decline of the Bloomberg median forecast. The main drag came from the eurozone where orders fell a whopping 11.6%, the most since December 2008. The year-over-year pace slumped to -4.3%, the most in six years. The silver lining, as it were, was that domestic orders and non-European orders improved. The rise in backlog orders is also seen as a sign of better output figures going forward. Separately, Germany reported a 1.4% rise in retail sales in November, which is more than three times greater than expected and the most in seven months. The 0.3% decline in October was revised away and replaced with a 0.1% gain.

The French government is sticking with its 1.7% 2019 GDP forecast. We suspect it will be lowered at some point, given the poor momentum from Q4 and the ongoing protests. However, revising down growth would also mean revising up the budget deficit, which would leave it at odds with the EC. The political situation looks untenable for long. One area to look for the pressure on France is the premium it pays over Germany. On 10-year yields, the premium is pushing through 50 bp, the most since April 2017.

There is little progress on Brexit. Prime Minister May continues to urge acceptance of the negotiated deal. There is increasing talk that Brexit will be delayed. A YouGov poll shows that if a second referendum were held, the Remain camp would win handily. A vote is still planned in the House of Commons next week. That a defeat seems so likely encourages speculation of another delay or dilution of the vote itself.

Last week, the euro transversed its two-cent range ($1.13-$1.15). It is firm today and appears poised to retest the upper end of its range. However, the intraday technicals warn of the likelihood of consolidation during the North American session. Initial support is seen near $1.1420. Sterling also extended its prev-weekend gains but is lagging behind the euro. Last week’s high for sterling was set just below $1.2775. It approached this area in the European morning but encountered resistance. Support is pegged near $1.27.

North America

The continued partial shutdown of the US federal government due to the budget dispute is now one of the longest on record. An effort to resolve it over the weekend apparently failed. The Democrats, who now have a majority in the House of Representatives passed a spending authorization bill nearly identical to the one the Republican-majority of the Senate approved previously, but now refuses to take up for a vote as it would undermine the President’s effort to get funding for a wall on the Mexican border, which past Democrat leaders had supported in some form. Estimates suggest the government shutdown may shave around 0.1% off annualized GDP a week and disruptive to tens of thousands of households. It continues to wreak havoc with the economic release schedule. Factory and durable goods orders due out today will not be released, nor will tomorrow’s November trade figures. That leaves private sector data like the ISM reports, and reports from the Bureau of Labor Statistics (BLS) which generates the JOLTs report on job openings and CPI, which is due at the end of the week. Reports suggest that Trump is considering declaring a national emergency that would ostensibly allow him to take funds from other areas to finance the wall.

Canada reports the IVEY survey today and trade tomorrow ahead of the Bank of Canada meeting on Wednesday. Expectations of additional rate hikes have been scaled back. The risk is that the central bank confirms that it is no longer keen to remove accommodation. Activity in the housing market has cooled, and prices often lag.The Canadian dollar extended last week’s 2% rally against the US dollar. The US dollar briefly slipped below the uptrend line drawn off last September and December lows. It came in a little above CAD1.3350 today. Additional support is seen near CAD1.3330. The greenback fell to nearly MXN19.37, its lowest level since late October before the weekend. It appears overextended and initial resistance is seen around MXN19.50.

Tags: #GBP,$AUD,$CAD,$EUR,$JPY,EUR/CHF and USD/CHF,Featured,MXN,newsletter