As we look ahead to 2019, what can we be certain of? Maybe your list is long, but mine has only one item: certainty is fraying. Confidence in financial policies intended to eliminate recessions is fraying, confidence in political processes that are supposed to actually solve problems rather than make them worse is fraying, confidence in the objectivity of the corporate media is fraying, and confidence in society’s ability to maintain any sort of level playing field is fraying. When certainty frays, capital gets skittish. Predicting increased volatility is an easy call in this context, as capital will not want to stick around to see how the movie ends if things start unraveling. The move out of stocks into government

Topics:

Charles Hugh Smith considers the following as important: 5) Global Macro, Featured, newsletter, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| With valuations at historic highs and real estate rolling over, confidence that gains are essentially permanent is also fading. Buying at the top and holding onto the asset as it loses value is a predictable way to destroy capital, and so capital’s willingness to exit is rising, as is its preference for deep, liquid markets such as U.S. Treasury bonds, markets where big chunks of capital can be safely parked until clarity and confidence return..

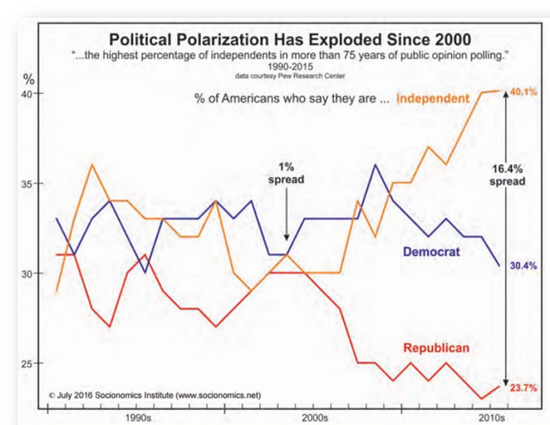

But clarity and confidence might become scarce for an extended period of time. Capital will remain skittish until there is some clarity and confidence, not just in official policies but in the political and financial contexts of those policies. This generates a self-reinforcing feedback loop: capital seeks safety and gains, and seeks to avoid catastrophic losses. As markets become more volatile, capital becomes increasingly skittish and risk-averse. This generates the very volatility that is making capital skittish. The net result is capital is impaired in eras of uncertainty. Uncertainty also leads to polarization, as people cling with irrational certainty to ideologies and policies that are failing. |

Political Polarization Has Exploded Since 2000 |

Tags: Featured,newsletter