Two major Swiss banks imposed restrictions on staff travel to China after a UBS employee was detained in the country, underscoring the challenges of doing business in a country which is a mecca for banks eager to capture and manage (for a generous fee) the fastest growing fortunes in the world, yet are challenged by a regime that tramples over civil rights. According to Bloomberg, UBS asked some bankers not to travel to China after the incident, with fellow Swiss bank Julius Baer also imposing a travel ban while Credit Suisse said that so far there was no travel ban in place. The travel restrictions have only affected those bankers who help manage money for clients and haven’t been imposed on the securities unit. It

Topics:

Tyler Durden considers the following as important: 2) Swiss and European Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Two major Swiss banks imposed restrictions on staff travel to China after a UBS employee was detained in the country, underscoring the challenges of doing business in a country which is a mecca for banks eager to capture and manage (for a generous fee) the fastest growing fortunes in the world, yet are challenged by a regime that tramples over civil rights.

According to Bloomberg, UBS asked some bankers not to travel to China after the incident, with fellow Swiss bank Julius Baer also imposing a travel ban while Credit Suisse said that so far there was no travel ban in place. The travel restrictions have only affected those bankers who help manage money for clients and haven’t been imposed on the securities unit.

It was unclear under what circumstances the Singapore-based employee was detained and whether the person has been released.

As part of Beijing’s ongoing anti-corruption campaign, government clampdowns and unexplained absences have unsettled executives with operations in China, where even the president Interpol recently disappeared abruptly as a result of a bizarre detention. As reported previously, Meng Hongwei was reported missing this month after being taken into custody upon his arrival from France.

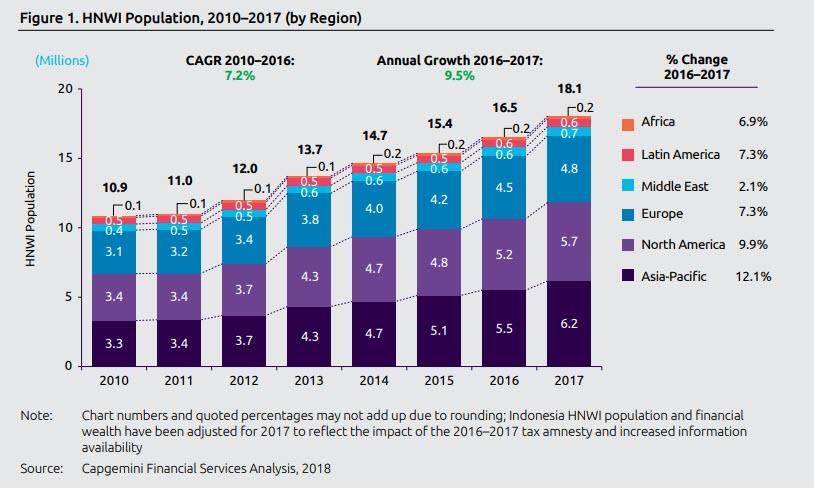

China has been a major new market for financial firms such as UBS as the share of world’s wealthy has soared in the region. UBS estimates a new billionaire is minted in China every two days and Credit Suisse this week said China’s total wealth has risen 1,300 percent this century to $51.9 trillion, more than double the rate of any other nation. The number of High Net Worth individuals in Asia-Pac recently surpassed that of North America, and at 6.2 million was the highest of any geographic region in the world. |

Asia HNW Population, 2010 - 2017 |

Taking advantage of foreign interest in its capital, China has thrown open its financial markets to foreign firms, a move that has given global companies unprecedented access to the world’s second-biggest economy, even as crackdowns on foreign professionals have been on the rise.

As for UBS, the world’s largest wealth manager has a long history in China and, according to Bloomberg, claims to have been the first Swiss-based bank to establish a presence in the Asia Pacific region in 1964. The Swiss lender is in talks to acquire a majority stake in its Chinese securities joint venture. UBS is also the largest wealth manager in Asia, with total assets under management of $383 billion at the end of last year.

It now remains to be seen if the detained UBS banker was actually guilty of a crime, and if not, whether the Zurich-based bank will forget all about the incident in hopes of further profit upside, or if it will demand fair treatment for its employees at the risk of angering local authorities and having its charter removed for making a big fuss. Considering that UBS has yet to officially confirm this incident ever took place – a UBS spokesman declined to comment on the ban and detention – and Bloomberg had to report about it using “anonymous sources”, it is pretty clear which way the bank is leaning.

Tags: Featured,newsletter