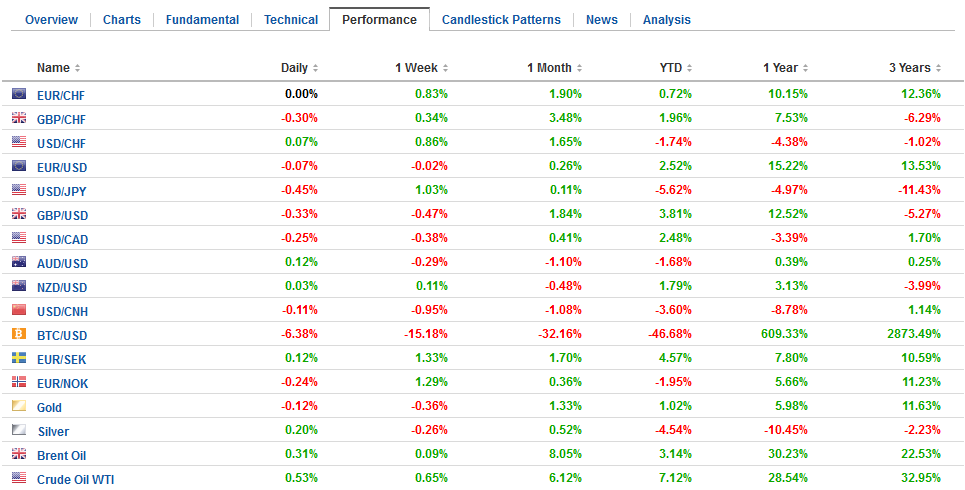

Swiss Franc The Euro has fallen by 0.11% to 1.1758 CHF. EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday’s gains, and bonds are mostly firmer. However, what really caught our eye was the magnitude of the foreign sell-off of Japanese assets. Foreign investors sold JPY2.174 trillion of Japanese bonds last week. This is the most since September 2016, and looks to be the third largest week’s divestment

Topics:

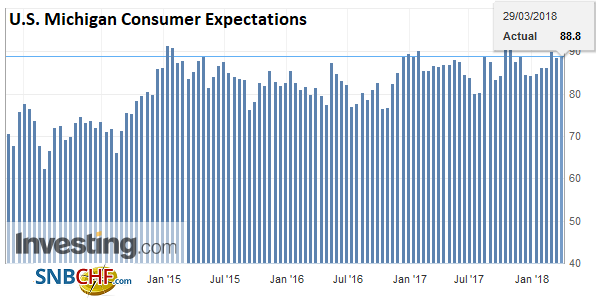

Marc Chandler considers the following as important: 4) FX Trends, CAD, China, EUR, EUR/CHF, Featured, GBP, Germany Consumer Price Index, Germany Unemployment Change, Germany Unemployment Rate, Japan Retail Sales, JPY, newslettersent, Saudi Arabia, U.K. Gross Domestic Product, U.S. Chicago PMI, U.S. Initial Jobless Claims, U.S. Michigan Consumer Expectations, U.S. Michigan Consumer Sentiment, U.S. Personal Income, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.11% to 1.1758 CHF. |

EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

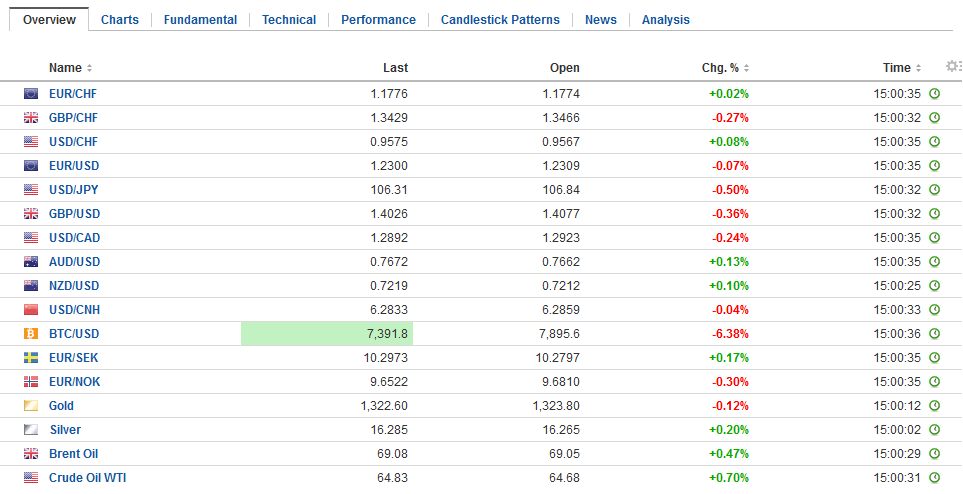

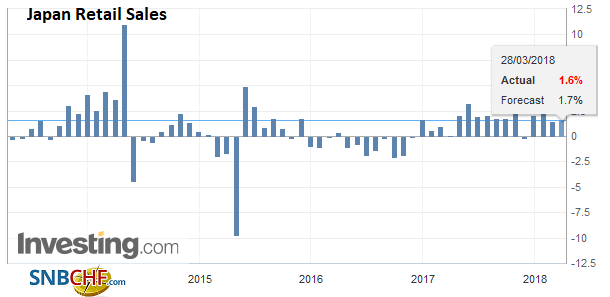

FX RatesThe choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday’s gains, and bonds are mostly firmer. However, what really caught our eye was the magnitude of the foreign sell-off of Japanese assets. Foreign investors sold JPY2.174 trillion of Japanese bonds last week. This is the most since September 2016, and looks to be the third largest week’s divestment since at least 2001. Foreign investors also bumped JPY2.161 trillion of Japanese stocks last week. This is by far the most since 2001. The closest sell-off was in March 2016, when foreign investors sold JPY1.58 trillion of Japanese shares. |

FX Daily Rates, March 29 |

| The dollar briefly ticked through JPY107 yesterday but is consolidating today, finding support bids near JPY106.40. There are some relevant option expires today, including $624 mln struck at JPY106.50, and another $734 mln at JPY107.00. If you fancy the downside, there is $505 mln struck at JPY106 that will be cut today.

After falling to $1.23 yesterday from $1.2475 on Tuesday, the euro’s losses were having been marginally extended and the low may not be in place for day yet. A band of support is seen between $1.2240 and $1.2280. Only a break of this area will be technically significant. There is a 529 mln euro option struck at $1.23 that expires today and is in play. |

FX Performance, March 29 |

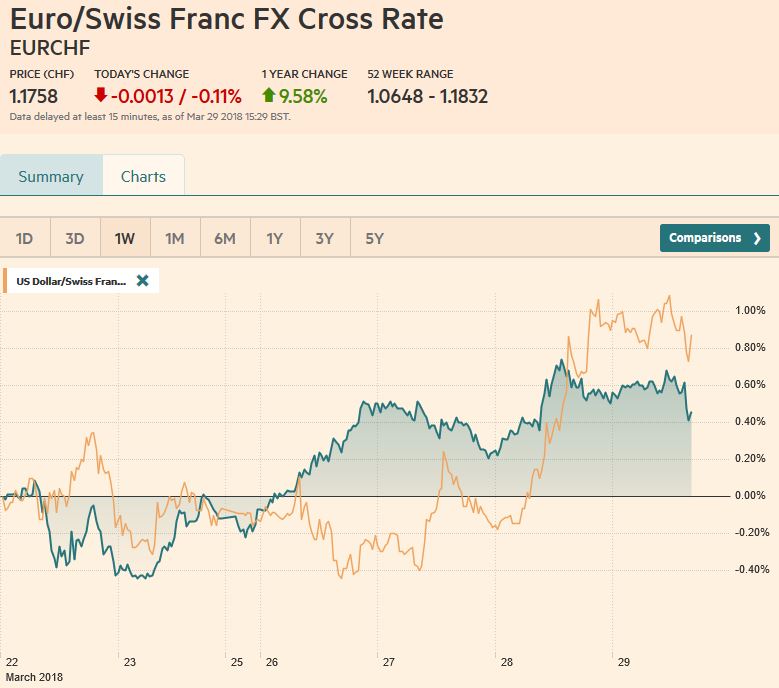

JapanWith the calendar effect and the approaching Easter holiday, trading enthusiasm is fading. There are several developments to note. In terms of economic data, Japan reported softer than expected February retail sales (0.4% vs. 0.6%). Japan reports employment figures, CPI, and industrial production figures tomorrow, ahead of the Tankan Survey to the new week. |

Japan Retail Sales YoY, Apr 2013 - Mar 2018(see more posts on Japan Retail Sales, ) Source: Investing.com - Click to enlarge |

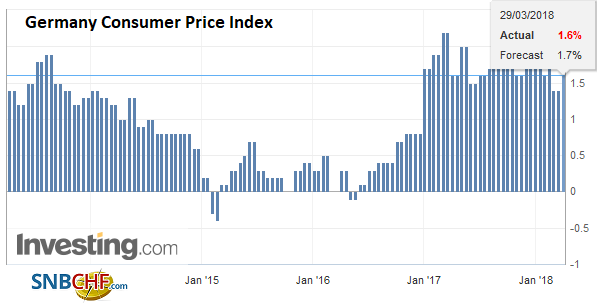

GermanyIn Europe, both Germany and the UK released data. In Germany, the states reported March inflation figures, and the federal government reported employment data. |

Germany Consumer Price Index (CPI) YoY, Apr 2013 - Mar 2018(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| There is risk that preliminary March that will be reported shortly will be a bit softer than the 1.6% rate the median expects. |

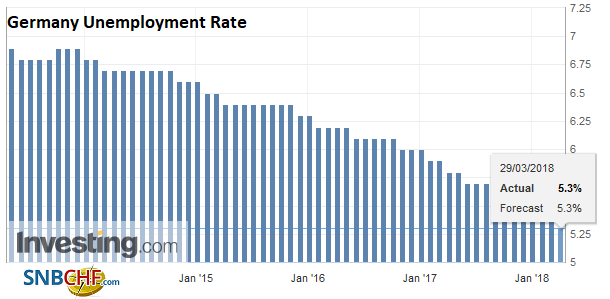

Germany Unemployment Rate, Apr 2013 - Mar 2018(see more posts on Germany Unemployment Rate, ) Source: Investing.com - Click to enlarge |

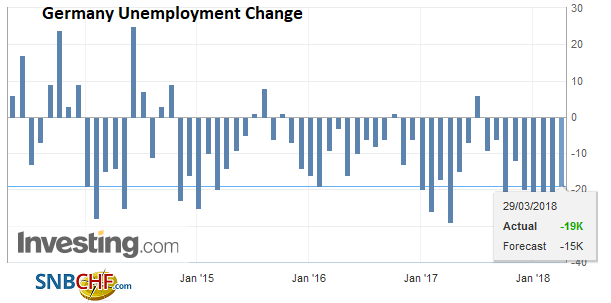

| Although details are scarce, the core rate may have firmed. Separately, Germany reported 19k decline in the unemployment queues and the unemployment rate fell to a new record low of 5.3%. |

Germany Unemployment Change, Apr 2013 - Mar 2018(see more posts on Germany Unemployment Change, ) Source: Investing.com - Click to enlarge |

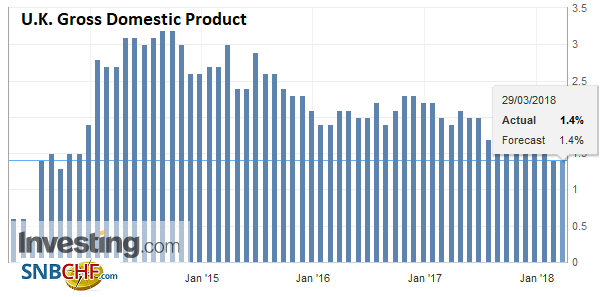

United KingdomThe UK’s data dump included Nationwide house price index (softer than expected 2.1% year-over-year), slightly stronger consumer credit and mortgage lending, a smaller Q4 current account shortfall (-GBP18.4 bln vs expectations of a GBP24.0 bln deficit), and left Q4 GDP unchanged at 0.4% (1.4% year-over-year). There are no policy implications and the market expects the BOE to hike rates in May. Sterling peaked on Monday near $1.4245. It is lower today for the third session, its longest losing streak this month. A number of technical levels can be found in the $1.3980-$1.4040 band. Sterling has entered this area, but the intraday momentum studies suggest that it may recover. There is a GBP843 mln option struck at $1.40 that expires today and GBP777 mln at $1.41. |

U.K. Gross Domestic Product (GDP) YoY, Apr 2013 - Mar 2018(see more posts on U.K. Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

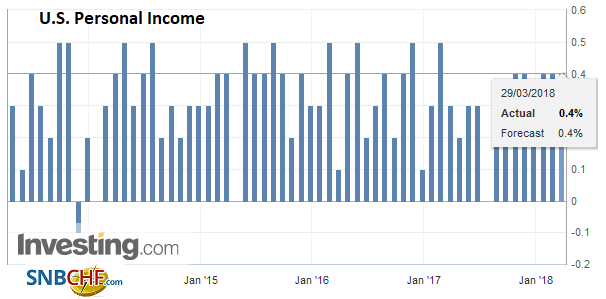

United StatesThe US reports February personal income and consumption figures, which will feed into Q1 GDP forecasts. Recall that yesterday’s upward revision to Q4 GDP was partly a function of stronger consumption. However, consumers have slowed here in Q1, and a CNBC poll found that 55% of working adults claim not having seen the impact of the tax cuts. The core PCE deflator is expected to tick up to 1.6% from 1.7%. The pricing of the Fed funds futures strip suggests the market is a bit less confident of two more hikes this year than it was a couple weeks ago, but today’s data is unlikely to have much impact on the FOMC decision in June. |

U.S. Personal Income, Apr 2013 - Mar 2018(see more posts on U.S. Personal Income, ) Source: Investing.com - Click to enlarge |

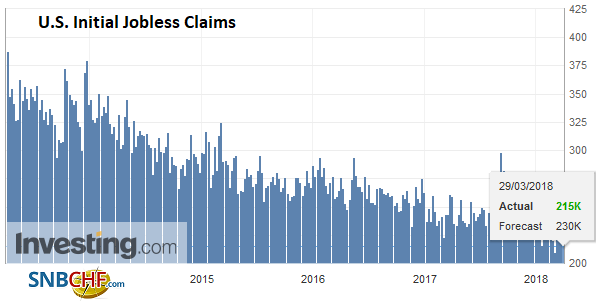

U.S. Initial Jobless Claims, Apr 2013 - Mar 2018(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

|

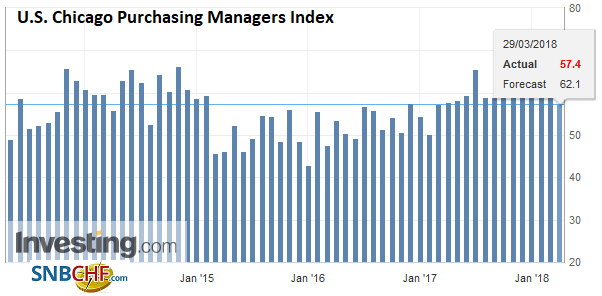

U.S. Chicago Purchasing Managers Index (PMI), Apr 2013 - Mar 2018(see more posts on U.S. Chicago PMI, ) Source: Investing.com - Click to enlarge |

|

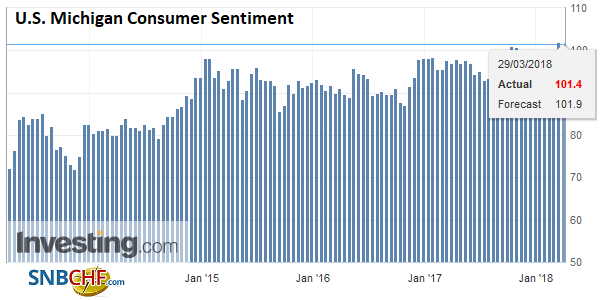

U.S. Michigan Consumer Sentiment, Apr 2013 - Mar 2018(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

|

U.S. Michigan Consumer Expectations, Arp 2013 - Mar 2018(see more posts on U.S. Michigan Consumer Expectations, ) Source: Investing.com - Click to enlarge |

There are also two flow stories to note. First, are a rash of mergers and acquisitions, which the Financial Times estimates to be more than $1.2 trillion here in Q1, and $50 bln yesterday alone. Today there are reports suggesting Softbank will take a stake in Swiss Re, and Nissan and Renault’s alliance and cross-shareholdings may turn into a full merger.

There is often not as much direct foreign exchange impact from the M&A deals as participants may suspect. Sometimes the transactions are for stock not cash. Sometimes the cash component is borrowed (thereby offsetting the new asset with a liability in the same currency). Sometimes, in the early stages option may be bought to manage the contingent risk.

Within our larger narrative of surplus capital, M&A activity is understood on several levels. Some M&A activity is industry rationalization–getting rid of excess capacity. Some M&A activity may also be ego-driven waste, where a premium is paid for good will, which is slowly eroded, and often the acquisition is unwound in part or in whole.

The second flow story is less obvious. Japan’s MOF reports portfolio flows on a weekly basis. Today’s report covers last week. The repatriation ahead of the fiscal was largely a February phenomenon. Japanese investors have been buying foreign bonds for the last three weeks. The average over the past three weeks has been JPY911 bln. It is the highest since last August.

Canada reports January GDP. A 0.1% increase will push the year-over-year rate to a still robust 2.9% from 3.3% in December. The year-over-year pace peaked last May near 4.5%, slowed in Q3 and stabilized in Q4. However, a sub-3% reading would be the first since last March. There are some chunky Canadian dollar options that expire today. There is a CAD1.2950 strike for $1.6 bln and $911 mln struck at CAD1.30.

There are two emerging market developments that stand out. First, China is considering boosting its bond connect program by allowing the use of repos. This is something that foreign asset managers have been encouraging. Second, Saudi Arabia has been included in the FTSE Russell emerging market index (effective March 2019). The MSCI is deliberating a similar decision that is expected to be made in in June. The Tadawul All Share Index is up a little more than 8% this year.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CAD,$EUR,$JPY,China,EUR/CHF,Featured,Germany Consumer Price Index,Germany Unemployment Change,Germany Unemployment Rate,Japan Retail Sales,newslettersent,Saudi-Arabia,U.K. Gross Domestic Product,U.S. Chicago PMI,U.S. Initial Jobless Claims,U.S. Michigan Consumer Expectations,U.S. Michigan Consumer Sentiment,U.S. Personal Income,USD/CHF