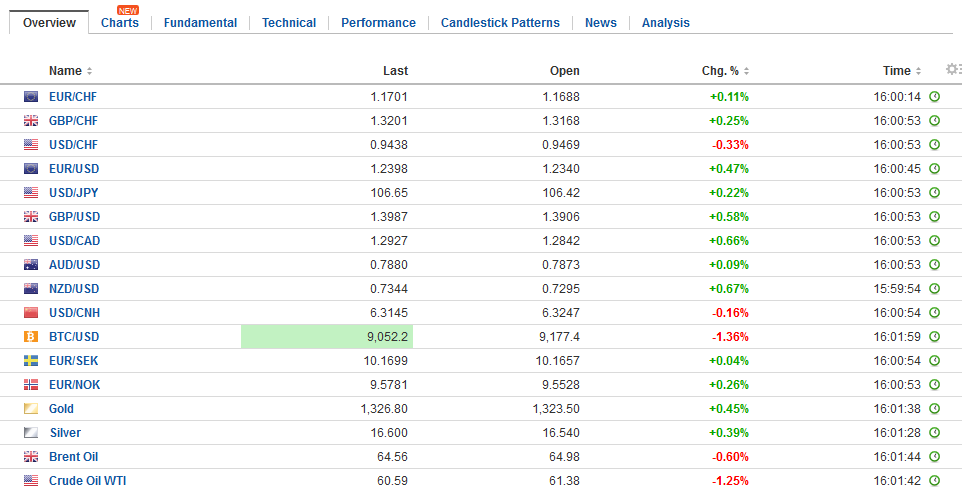

Swiss Franc The Euro stood still at 1.1684 CHF. EUR/CHF and USD/CHF, March 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Many see the eruption of the scandal that threatens senior government officials as yen positive because it weakens those that ostensibly want to depreciate the yen through monetary policy. The scandal involves falsifying documents to conceal a sweetheart deal. The government sold of state-owned land to a school-operator, reportedly with connections to Prime Minister Abe’s wife at an incredibly low price. At the end of last week, the head of the National Tax Agency chief resigned over comments he made before the Diet about the case. There is also

Topics:

Marc Chandler considers the following as important: EUR/CHF, Featured, FX Trends, GBP, Japan Producer Price Index, JPY, newsletter, Spain Consumer Price Index, U.S. Consumer Price index, U.S. Core Consumer Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro stood still at 1.1684 CHF. |

EUR/CHF and USD/CHF, March 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesMany see the eruption of the scandal that threatens senior government officials as yen positive because it weakens those that ostensibly want to depreciate the yen through monetary policy. The scandal involves falsifying documents to conceal a sweetheart deal. The government sold of state-owned land to a school-operator, reportedly with connections to Prime Minister Abe’s wife at an incredibly low price. At the end of last week, the head of the National Tax Agency chief resigned over comments he made before the Diet about the case. There is also an investigation into the possible suicide of a local finance ministry official that handled the land sale. There is pressure on Finance Minister Aso. Reports already suggest he will not attend the upcoming G20 meeting. The scandal is weighing on public support for the government. The goodwill won by Prime Minister Abe on his tough line on North Korea, and China and more may have been lost. It is important for Abe to get closure on this as soon as possible or he may face a stronger challenge for party leadership in September. |

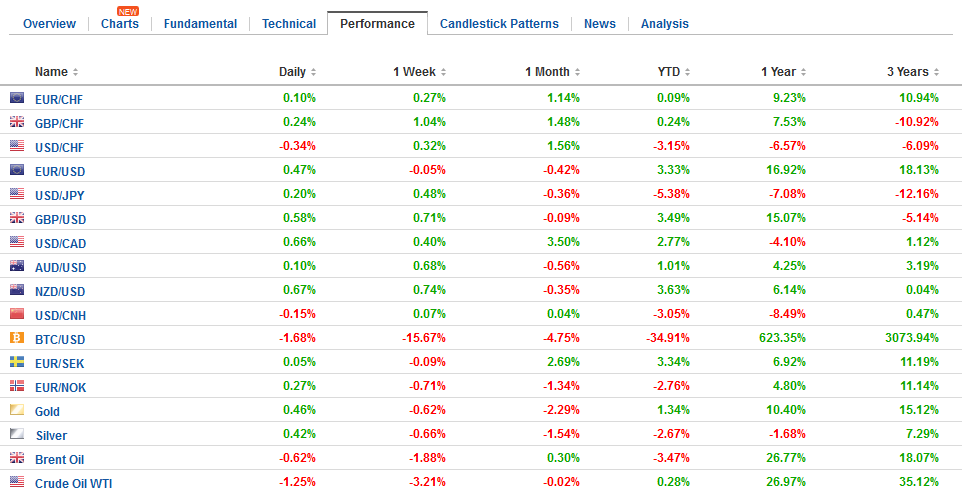

FX Daily Rates, March 13 |

| Initial support for the dollar may be near JPY106.20, though the month’s low was closer to JPY105.25. The JPY105 area is important psychological and chart support and the strongest support ahead of JPY100. In the second half of February, the dollar was turned back from JPY108. The cap has come down now to JPY107.00.

Sterling traded higher yesterday after recovering from a dip below $1.38 after the US employment data before the weekend. The $1.39230-$1.3960 offers nearby resistance. Our reading of the technical indicators favor the upside, but risk-reward for the short-term suggests buying closer to the lower end of the range, which is still around $1.3800. |

FX Performance, March 13 |

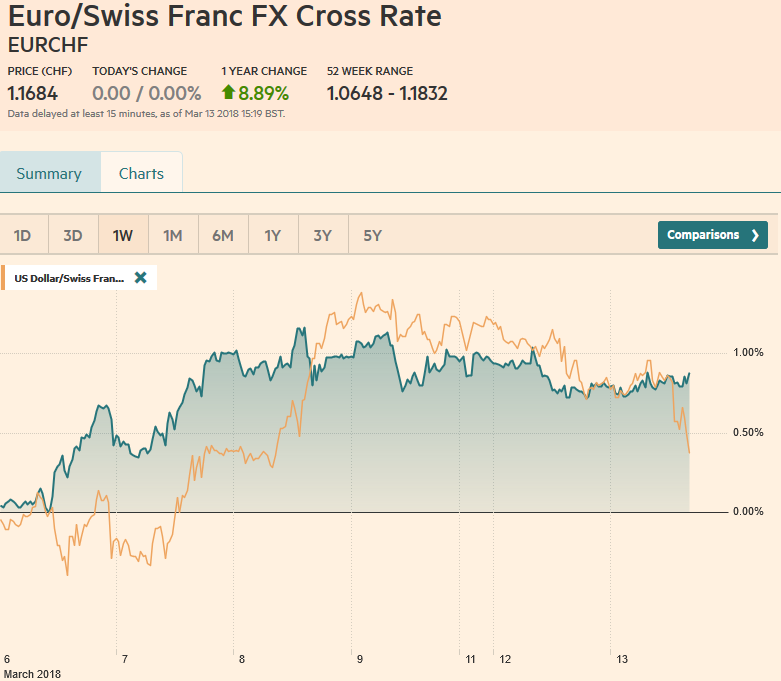

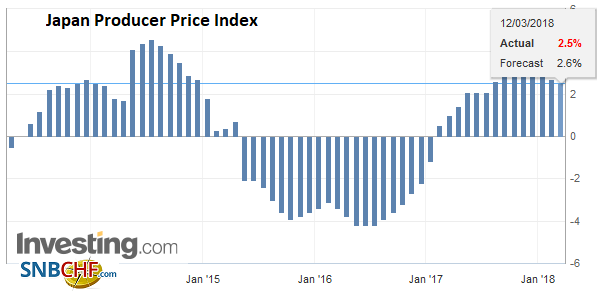

JapanThe yen’s 6% gain against the dollar this year makes it the strongest of the major currencies in here in the first quarter. Investors have been given another reason not to resist the seasonal pressures that often see Japanese investors repatriate capital ahead of the end of the fiscal year later this month. |

Japan Producer Price Index (PPI) YoY, Apr 2013 - Mar 2018(see more posts on Japan Producer Price Index, ) Source: Investing.com - Click to enlarge |

United StatesA third non-economic development was the US government’s preemptive decision to block Broadcom’s $117 bln acquisition of Qualcomm. National security concerns were cited. The US President acted on the recommendation by the Committee on Foreign Investment in the US, which reviews foreign acquisitions of US companies. Still, the prohibition was seen as aggressive because there was no agreement between the two companies. It is the first non-Chinese company that was blocked by the US in a year. |

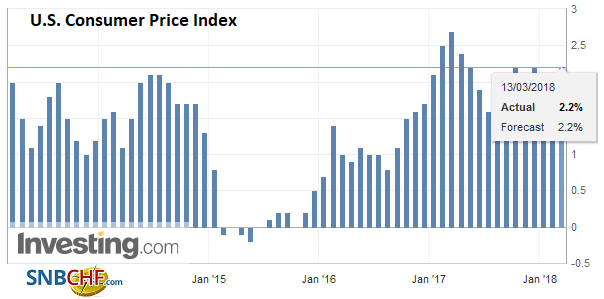

U.S. Consumer Price Index (CPI) YoY, Mar 2013 - 2018(see more posts on U.S. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Last year, Broadcom indicated it was considering moving its headquarters to the US. Reports suggest that, unlike the steel and aluminum tariffs, the Pentagon actually pressed for this sanction, while the Treasury Department was reportedly initially more reluctant. |

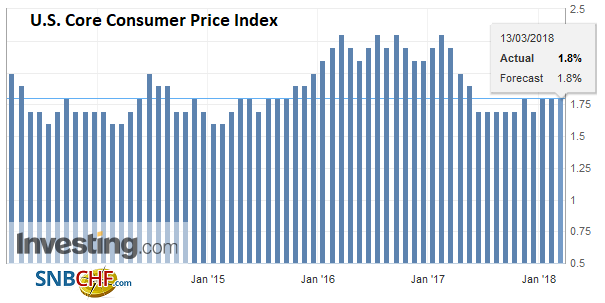

U.S. Core Consumer Price Index (CPI) YoY, Mar 2013 - 2018(see more posts on U.S. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

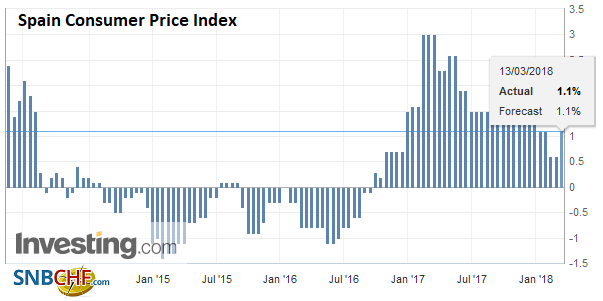

Spain |

Spain Consumer Price Index (CPI) YoY, Apr 2013 - Mar 2018(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Prime Minister May gave Russia until the end of business on Tuesday to address the allegations that it used nerve gas in the UK earlier this month. When she was Home Secretary, May did not press Russia in the 2006 poisoning by plutonium of a Russian informant for British intelligence. This comes on the heels of the UK’s objections to Russian interference in their election. A Labour MP claims that there are as many as 14 deaths that UK officials do not regard as suspicious though reportedly US intelligence suggests potential Russian involvement.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$JPY,EUR/CHF,Featured,Japan Producer Price Index,newsletter,Spain Consumer Price Index,U.S. Consumer Price Index,U.S. Core Consumer Price Index,USD/CHF