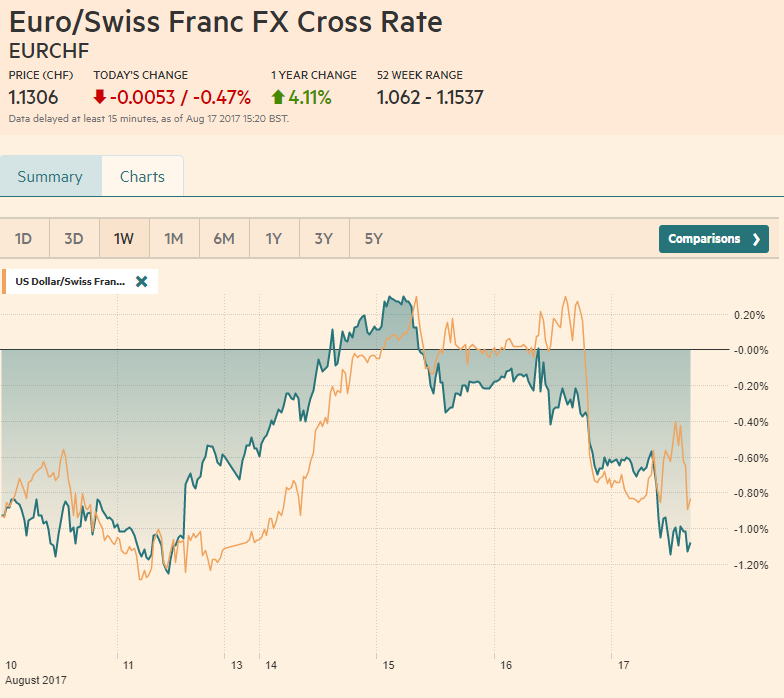

Swiss Franc The Euro has fallen by 0.47% to 1.1306 CHF. EUR/CHF and USD/CHF, August 17(see more posts on EUR/CHF, USD/CHF, ). FX Rates The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump’s business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move. The market responded to the minutes by selling the dollar and buying US notes and bonds. The narrative was the offered was that the market had seen in the minutes a reduced chance of another rate hike this year. US yields are slightly firmer, and the dollar has recovered back to JPY110, after being sold to JPY109.70 (tested the JPY111 area

Topics:

Marc Chandler considers the following as important: AUD, Australia Participation Rate, Australia Unemployment Rate, EUR, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Eurozone Trade Balance, Featured, FX Trends, GBP, Japan Exports, Japan Imports, Japan Trade Balance, JPY, newslettersent, U.K. Retail Sales, U.S. Capacity Utilization Rate, U.S. Initial Jobless Claims, U.S. Philadelphia Fed Manufacturing Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.47% to 1.1306 CHF. |

EUR/CHF and USD/CHF, August 17(see more posts on EUR/CHF, USD/CHF, ) . |

FX RatesThe US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump’s business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move. The market responded to the minutes by selling the dollar and buying US notes and bonds. The narrative was the offered was that the market had seen in the minutes a reduced chance of another rate hike this year. US yields are slightly firmer, and the dollar has recovered back to JPY110, after being sold to JPY109.70 (tested the JPY111 area yesterday). The dollar found bids ahead of Tuesday’s low (~JPY109.60). There are several optionsexpires that are in play today: JPY109.50 for $363 mln, JPY110-JPY110.05 for $1.8 bln), and JPY110.20-JPY110.30 for $1 bln. |

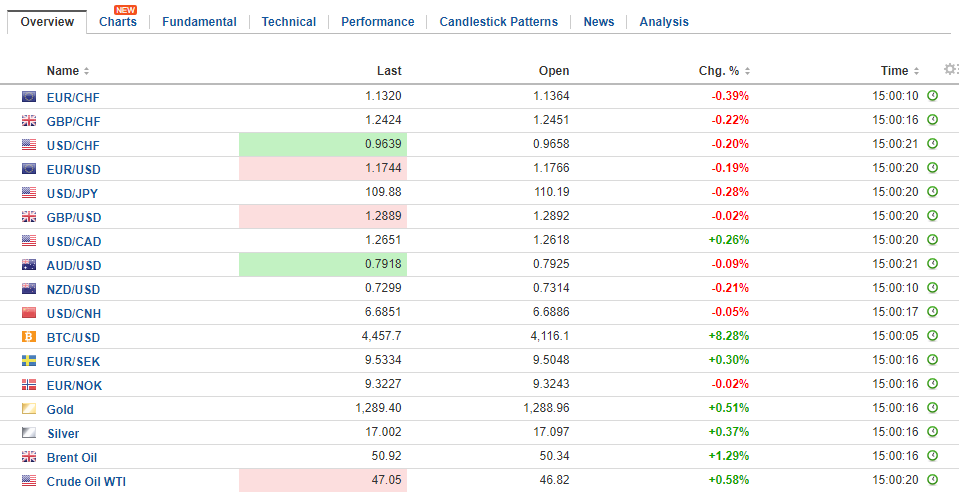

FX Daily Rates, August 17 - Click to enlarge |

| The dollar was turning better bid in late morning turnover in Europe. The euro returned to nearly $1.17 after being turned back from almost $1.18. The dollar returned to above JPY110 after slipping to nearly JPY109.60. The greenback is also firm against the freely accessible emerging market currencies. US yields are firmer while European and Asia-Pacific rates are lower. Asian equities rose 0.4%, the largest gain in the four-day rally. We note that Korea’s shares continue to recover. Foreign investors were net buyers today, but as set net sellers on the week. Europe could not match suit. The Dow Jones Stoxx 600 is off 0.2% to snap a three-day streak. Financials are the largest drag. Copper and zinc prices are leading the industrial metals complex higher.

The place to test that hypothesis, however, is not the long-end, but the short-end. The closest proxy is the December Fed funds contract. The implied yield rose a single basis point, and at 1.21%, it is slightly higher than it was at the end of last week (1.195%). |

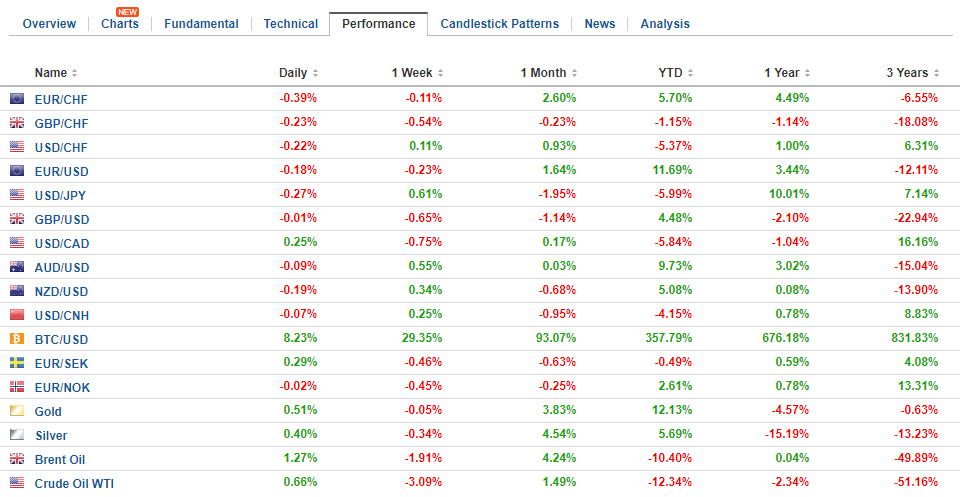

FX Performance, August 17 - Click to enlarge |

United StatesIn trading, a written confirmation is superior to a verbal confirmation. When interpreting the Federal Reserve, a similar principle applies. The minutes are an imperfect communication tool to guide expectations. Voter and non-voter views are indistinguishable. The passion and conviction are not easy to assess. The record of a meeting from a few weeks ago is less significant than more recent comments by a person part of the Fed’s leadership. |

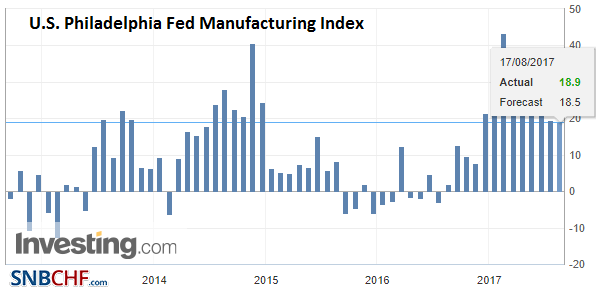

U.S. Philadelphia Fed Manufacturing Index, August 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

| Simply put, in addition to the limited movement in the Fed funds futures contracts, Dudley trumps the minutes. Dudley expressed what we assume is the leadership’s view: balance sheet announcement next month, and a relatively low bar to a rate hike in December. Moreover, as we have been pointing out, Fed officials have buffered their argument about rates by spending more time talking about financial conditions. This is important: “vulnerabilities associated with asset valuation pressures edged up from notable to elevated.” |

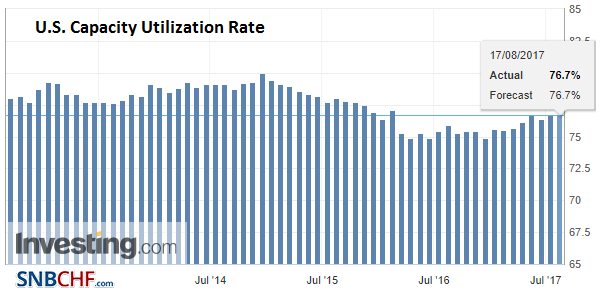

U.S. Capacity Utilization Rate, Jul 2017(see more posts on U.S. Capacity Utilization Rate, ) Source: Investing.com - Click to enlarge |

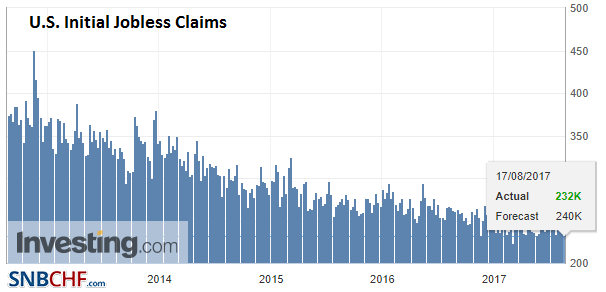

| The US reports weekly jobless claims, which cover the period in which the national survey is conducted. The Philadelphia Fed survey for August is unlikely to repeat the surge of the Empire State survey earlier in the week, but the bar is low for an upside surprise. Industrial output for July is also on tap. Note that perhaps one of the considerations holding back investment is that fact the capacity utilization rates are low (76.6% in June). The cyclical peak was three years ago and below 80%. |

U.S. Initial Jobless Claims, 17 August 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

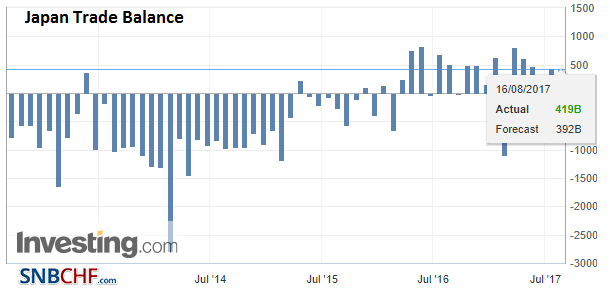

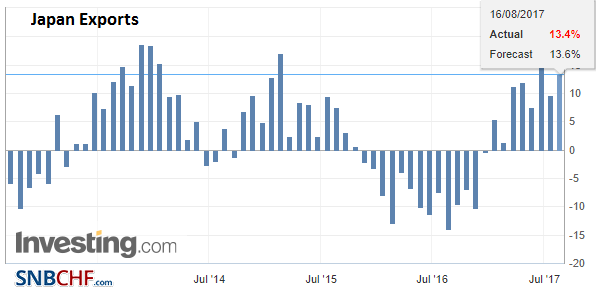

JapanJapan reported a larger than expected July trade surplus. |

Japan Trade Balance, Jul 2017(see more posts on Japan Trade Balance, ) Source: Investing.com - Click to enlarge |

| Exports strengthened, growing 13.4% from a year ago up from 9.7% in June. Japan’s exports are a key catalyst for its industrial sector and capex. |

|

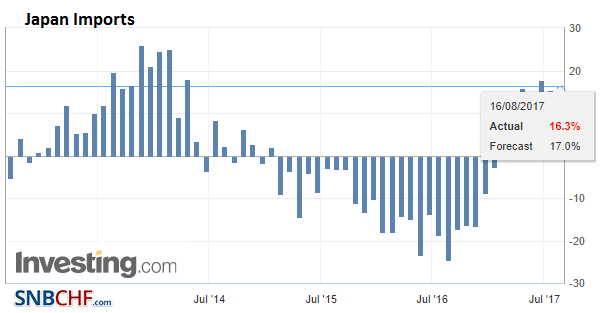

| Imports were also stronger. They rose 16.3% after a 15.5% pace in June. The imports are partly a reflection of domestic demand. |

Japan Imports YoY, Jul 2017(see more posts on Japan Imports, ) Source: Investing.com - Click to enlarge |

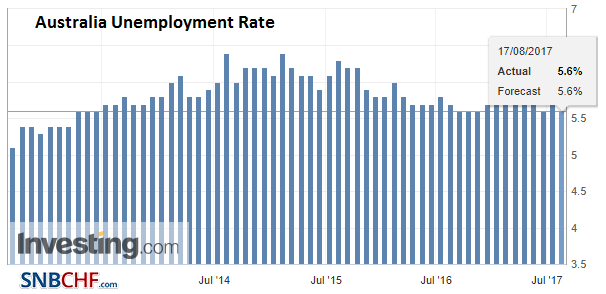

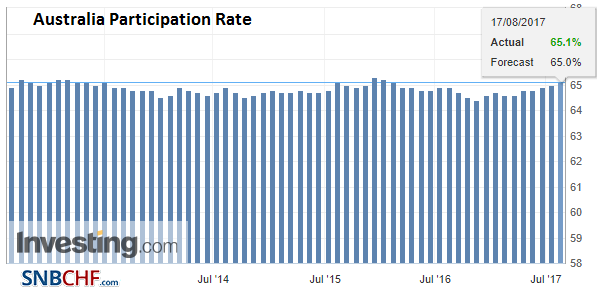

AustraliaThe yen is rivaling the Australian dollar as the strongest of the majors. Australia’s July employment data was reasonable and will not change views of monetary policy. Australia created 27.9k jobs, which was a bit more than expected, but there were all part-time positions. There were 20.3k fewer full-time positions. On the other hand, the June series was revised up to show a dramatic 69.3k full-time position. The unemployment rate ticked down to 5.6% from a revised 5.7% even though the participation rate also rose (65.1% from 65.0%). |

Australia Unemployment Rate, Jul 2017(see more posts on Australia Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| The Australian dollar has built on yesterday’s strong gains, some suggesting in part because of the continued rally in industrial metals, including copper to two-year highs. It is testing a retracement objective near $0.7965. There is an A$1.1 bln option expiring today struck at $0.7975. |

Australia Participation Rate, Jul 2017(see more posts on Australia Participation Rate, ) Source: Investing.com - Click to enlarge |

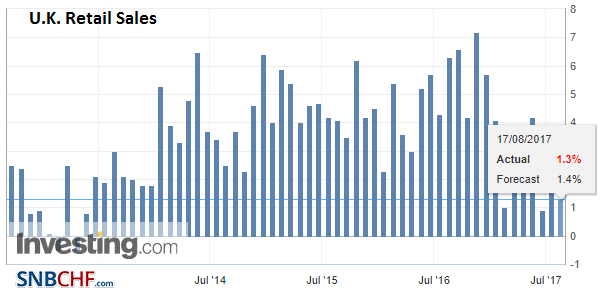

United KingdomSterling was sold into a brief bounce after the headline retail sales report edged out expectations. Retail sales rose 0.3% instead of 0.2%. However, the June gain was cut in half to 0.3% from 0.6%. Admittedly some of this is the result of petrol, though a concerning picture is still evident. Excluding auto fuel, retail sales slowed to 1.5% in July from a revised 2.8% in June. Including fuel, retail sales rose 1.3% from a year ago, down from 2.8%. Sterling is trading within yesterday’s ranges. |

U.K. Retail Sales YoY, Jul 2017(see more posts on U.K. Retail Sales, ) Source: Investing.com - Click to enlarge |

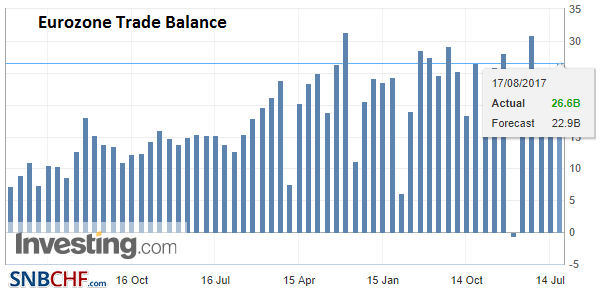

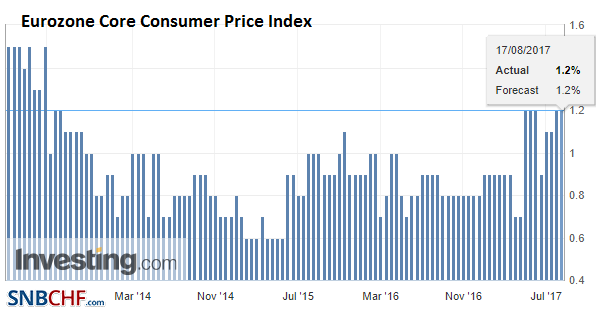

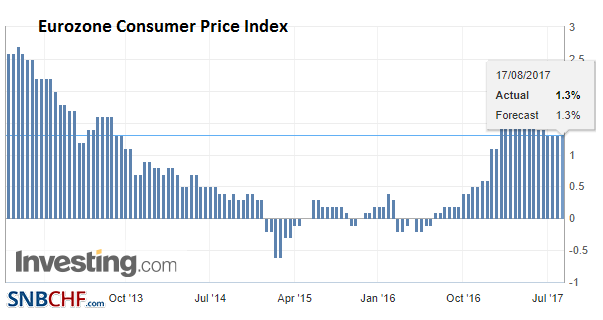

EurozoneThe euro is surrendering yesterday’s gains, of which we were suspicious. There does not appear to be a macro driver. The eurozone confirmed July inflation readings, and the June trade balance was a little largest than expected, but mostly offset by a downward revision in May. |

Eurozone Trade Balance, Jun 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

| There is no materialimpact on GDP expectations. Nevertheless, the euro is heavier on the crosses as well. The euro is holding a down trend since peaking on August 2 a little above $1.19. The trend line comes in today near $1.1815. |

Eurozone Core Consumer Price Index (CPI) YoY, Jul 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| The high in Asia and Europe is $1.1790. Support is pegged in the $1.680-$1.1720 area. There are nearly twobln euros of options struck between $1.17 and $1.1715 that are on the block today. There is another option for nearly 550 mln euros struck at $1.1760. |

Eurozone Consumer Price Index (CPI) YoY, August 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Australia Participation Rate,Australia Unemployment Rate,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Trade Balance,Featured,Japan Exports,Japan Imports,Japan Trade Balance,newslettersent,U.K. Retail Sales,U.S. Capacity Utilization Rate,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index

.

.