I truly enjoyed the conversation with Hrvoje Morić. I hope you will enjoy it 2. Happy Weekend! In liberty, Claudio Claudio Grass, Hünenberg See, Switzerland This work is licensed under a Creative Commons Attribution 4.0 International License. Therefore please feel free to share and you can subscribe for my articles by clicking here

Read More »Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder

Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder - 'Commodities King' Gartman sees $1,400 gold surge in months- "Gold is the one currency that will do the best of all..."- Pullback below $1300 "is relatively inconsequential"- Use gold price weakness to be a buyer "no question"- Bullish on gold due to central banks and easy monetary policy and gold will be even higher in euro terms- Gold will be the best of all, as a result of QE and expansionary policies-...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »The World’s Central Banks Are Making A Big Mistake

Authored by John Mauldin via MauldinEconomics.com, While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national...

Read More »World’s Central Bankers Gathering At BIS’ Basel Tower Ahead Of Brexit Results

What happens on the 18th floor of the main tower at Centralbahnplatz 2 in Basel, stays on the 18th floor of the main tower at Centralbahnplatz 2. That’s because this is where every other month the world’s central bankers meet in complete secrecy – no minutes are ever kept – to discuss the global economy completely unfettered of any concerns of accountability, and decide on what monetary policies they will implement to...

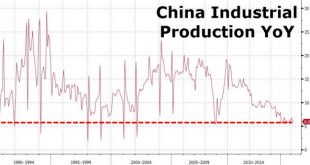

Read More »China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better. Economic Data from China Then Chinese data largely disappointed. A “meet” in Industrial Production – hovering at multi-year lows… *CHINA MAY INDUSTRIAL OUTPUT RISES 6.0% FROM YEAR EARLIER...

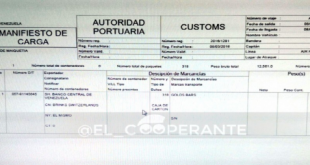

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another...

Read More »The Global Run On Physical Cash Has Begun: Why It Pays To Panic First

Back in August 2012, when negative interest rates were still merely viewed as sheer monetary lunacy instead of pervasive global monetary reality that has pushed over $6 trillion in global bonds into negative yield territory, the NY Fed mused hypothetically about negative rates and wrote "Be Careful What You Wish For" saying that "if rates go negative, the U.S. Treasury Department’s Bureau of Engraving and Printing will likely be called upon to print a lot more currency as individuals and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org