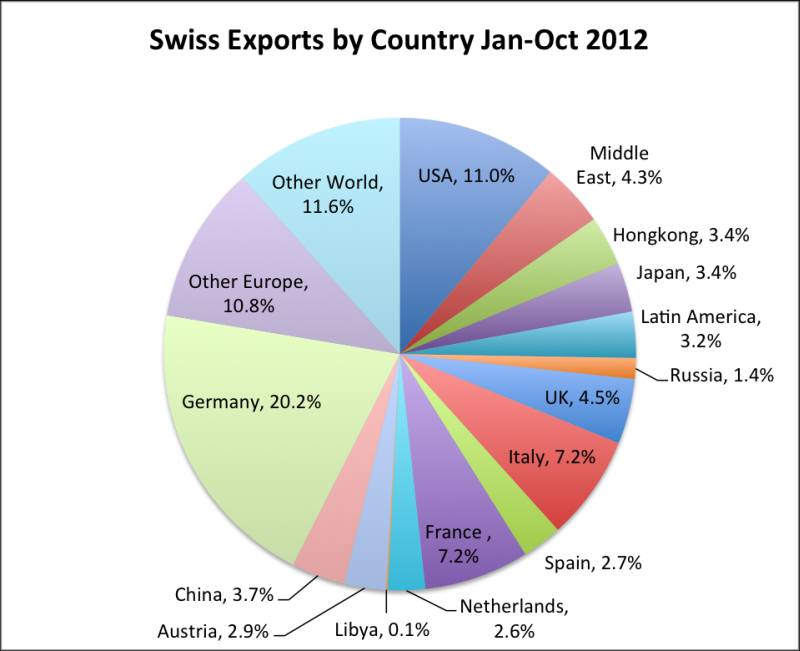

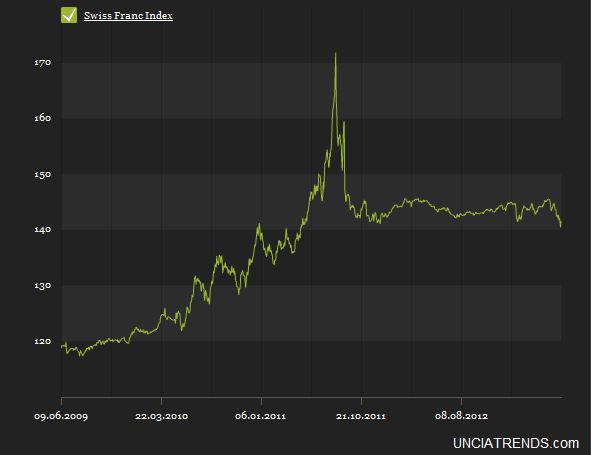

The Swiss Franc index is the trade-weighted currency performance 2016: Update On a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved. Swiss Franc Index 2009-2012 The CHF Trade-Weighted Index (click link on Unciatrends) shows how the Swissie has moved against a basket of other currencies weighted by their share in the Swiss trade. A similar figure, the export-weighted real exchange rate, can be found equally inside the SNB’s bi-weekly IMF data. Based on the 1999 base year (=100), the October 2012 value was 111.5, the November 2013 value 111.4. Trade-Weighting: Swiss Exports by Country The typical basket for the trade-weighted index is the export basket. The total of the euro share is around 45%. Details on the theory behind can be found here. Dollar and (near) dollar- pegged countries are around 30%. United States 11% Middle East 4.3% Hong Kong 3.4% China 3.7% A big part of Other World (11.

Topics:

George Dorgan considers the following as important: CHF FX, export-weighted, export-weighted CHF, SNB, George Dorgan's opinion, Swiss Franc currency Index, trade-weighted Swiss Franc

This could be interesting, too:

Investec writes Switzerland ranked world’s worst currency manipulator

George Dorgan writes Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Tyler Durden writes What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Tyler Durden writes Swiss 10 year bond yields still negative, but approaching zero.

The Swiss Franc index is the trade-weighted currency performance

2016: UpdateOn a three years interval, the Swiss Franc had a weak performance. The dollar index was far stronger. Contrary to popular believe, the CHF index gained only 1.73% in 2015. It lost 9.52% in 2014, when the dollar strongly improved. |

|

Swiss Franc Index 2009-2012The CHF Trade-Weighted Index (click link on Unciatrends) shows how the Swissie has moved against a basket of other currencies weighted by their share in the Swiss trade. A similar figure, the export-weighted real exchange rate, can be found equally inside the SNB’s bi-weekly IMF data. Based on the 1999 base year (=100), the October 2012 value was 111.5, the November 2013 value 111.4. |

|

Trade-Weighting: Swiss Exports by CountryThe typical basket for the trade-weighted index is the export basket. The total of the euro share is around 45%. Details on the theory behind can be found here. Dollar and (near) dollar- pegged countries are around 30%.

|