On bankunderground, Michael Kumhof, Phurichai Rungcharoenkitkul, and Andrej Sokol question that foreign savings is an important driver of US current account deficits: Consider how US imports can be paid for in the real world: first, by transferring existing domestic or foreign bank balances to foreigners, which involves no new financing. Second, by borrowing from domestic banks and transferring the resulting bank balances to foreign households, which involves domestic but not foreign...

Read More »Redrawing the Map of Global Capital Flows

Redrawing the Map of Global Capital Flows: The Role of Cross-Border Financing and Tax Havens, by Antonio Coppola, Matteo Maggiori, Jesse Schreger, and Brent Neiman: We start with the dataset of global mutual fund and exchange traded fund (ETF) holdings provided by Morningstar and assembled in Matteo Maggiori, Brent Neiman and Jesse Schreger (2019a, henceforth MNS). For each position in the data, we link the security’s immediate issuer to its ultimate parent. The resulting data can then be...

Read More »Triple Coincidence in International Finance

On VoxEU, Stefan Avdjiev, Robert McCauley, and Hyun Song Shin discuss how a focus on net capital flows between countries can mislead policy analysts if they neglect heterogeneity between sectors in a country and/or non-congruence of economic and currency area that is, if they assume the “triple coincidence” between economic area, decision-making unit, and currency area. The triple coincidence misleads because it obscures gross flows, … in that it gives insufficient weight to international...

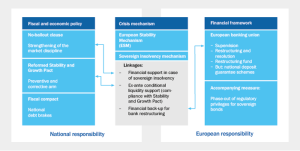

Read More »The German View of The Crisis

On VoxEU, representatives of the German Council of Economic Experts outline the German crisis narrative. In disagreement with the ‘consensus view’ outlined in Baldwin et al. (2015) the German economists including Lars Feld, Christoph Schmidt, Isabel Schnabel and Volker Wieland do not want to implicate the ‘intra-Eurozone capital flows that emerged in the decade before the crisis’ as the ‘real culprits’. … [Rather] it is the government failures and the failures in regulation and supervision...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org