The SNB said its interventions were transparent and ‘motivated purely by monetary policy’ (Keystone) The US Treasury has called on the Swiss government to cut taxes and spend more public money, after it added the country to a watchlist of those it accuses of currency manipulation. The Swiss franc nudged up to a near three-year high against the euro on Tuesday as markets anticipated the move would limit the Swiss National Bank’s appetite for aggressive action to try...

Read More »Fünf Jahre Frankenschock – Wie der SNB-Negativzins die Schweizer Aktienkurse beeinflusst hat

Frontseite der Financial Times vom 16. Januar 2015 – dem Tag nach dem SNB-“Frankenschock”. Bild: cash Nicht eine, sondern zwei Massnahmen erschütterten am 15. Januar 2015 die Schweiz und die internationale Finanzwelt. Der unmittelbare Schock war die Aufhebung der Kursuntergrenze zum Euro, welche die Nationalbank seit 2011 bei 1,20 Franken verteidigt hatte. Was Märkte, Anleger und vor allem Sparer erst mit der Zeit so richtig zu spüren begannen, war die Einführung des...

Read More »The History and Structure of the Federal Reserve System

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] This chapter will provide a brief sketch of the historical context in which the Federal Reserve was founded, summarize some of the major changes to the Fed’s institutional structure and mandate over the years, and end with a snapshot of the Fed’s current governing structure. (Chapters 2 and 3 of this book cover more of the...

Read More »Instability Rising: Why 2020 Will Be Different

In 2020, increasing monetary and fiscal stimulus will be the equivalent of spraying gasoline on a fire to extinguish it. Economically, the 11 years since the Global Financial Crisis of 2008-09 have been one relatively coherent era of modest growth, rising wealth/income inequality and coordinated central bank stimulus every time a crisis threatened to disrupt the domestic or global economy. This era will draw to a close in 2020 and a new era of destabilization and...

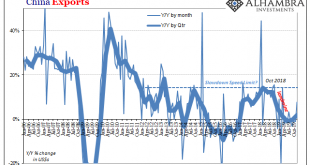

Read More »Clarida Picks Up Some Data

I should know better than to make declarative all-or-none statements like this. I said there isn’t any data which comports with the idea of a global turnaround, this shakeup in sentiment which since early September has gone right from one extreme to the other. Recession fears predominated in summer only to be (rather easily) replaced by near euphoria (again). Narrative yes, sentiment maybe, data nope. The vast majority of the economic accounts, anyway. There are a...

Read More »FX Daily, January 15: Phase 1 Trade Deal Shifts Terrain of US-China Rivalry

Swiss Franc The Euro has fallen by 0.18% to 1.0744 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that US tariffs on China will remain until through at least the November US election and continued US attempts to stymie China (e.g., more curbs on Huawei under consideration and stepped up efforts to force it to cut subsidies to business) have taken some momentum from the push...

Read More »EUR/CHF: Franc at 33-month high five years after SNB removed the cap

EUR/CHF is trading at 33-month lows near 1.0759. The US added Switzerland to its current manipulators’ list. The SNB removed the cap on the euro on Jan. 15, 2015. Five years after the Swiss National Bank (SNB) shocked the financial markets by abandoning the euro cap, the Swiss Franc is trading at 33-month highs against the single currency. The EUR/CHF pair dropped to 1.0759 on Tuesday, the lowest level since April 2017 and was last seen trading at 1.0766. Tuesday’s...

Read More »US places Switzerland on trade ‘watch list’

The US Treasury said it was also closely monitoring the interventions of the Swiss National Bank in the foreign exchange market (© Keystone / Ti-press / Alessandro Crinari) The US Treasury Department has put Switzerland back on a biannual list of countries that are under observation because of large trade surpluses with the United States. Switzerland was previously included on the Monitoring Listexternal link between October 2016 and October 2018, “having a material...

Read More »Signatures collected for vote on tax deduction for parents

Opponents of the tax breaks say it will not benefit the middle class and would be a gift for wealthy families instead. (© Keystone / Gaetan Bally) Opponents of a proposal to increase tax deductions for parents have succeeded in collecting enough signatures to force a referendum on the subject. On Tuesday the leftwing Social Democratic Party submitted the necessary signatures required to trigger a referendum. The party is opposed to a “tax bonus for rich parents” and...

Read More »The Many Ways Governments Create Monopolies

[From Power and Market, Chapter 3.] Instead of making the product prohibition absolute, the government may prohibit production and sale except by a certain firm or firms. These firms are then specially privileged by the government to engage in a line of production, and therefore this type of prohibition is a grant of special privilege. If the grant is to one person or firm, it is a monopoly grant; if to several persons or firms, it is a quasi-monopoly or oligopoly...

Read More » SNB & CHF

SNB & CHF