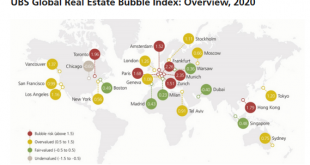

Zurich, 30 September 2020 – The UBS Global Real Estate Bubble Index, a yearly study by UBS Global Wealth Management’s Chief Investment Office, indicates bubble risk or a significant overvaluation of housing markets in half of all evaluated cities. Prices increased on average, with Europe showing most cities at risk The Eurozone stands out as the region with the most overheated housing markets. Munich and Frankfurt top the ranking. Paris and Amsterdam...

Read More »Zurich invention may be used in Fukushima nuclear clean-up

Millions of litres of radioactively contaminated water are stored in water tanks at the tsunami-crippled nuclear power plant in Okuma, Fukushima, in Japan. Keystone / Kimimasa Mayama Researchers in Zurich have developed a filter membrane made of whey proteins and activated carbon that can clean contaminated radioactive water. They hope to deploy their invention at the site of the Fukushima nuclear disaster in Japan. Four years ago, scientists at the federal...

Read More »We don’t have to kill the king, if we just can ignore the king

“The right of self-determination in regard to the question of membership in a state thus means: whenever the inhabitants of a particular territory, whether it be a single village, a whole district, or a series of adjacent districts, make it known, by a freely conducted plebiscite, that they no longer wish to remain united to the state to which they belong at the time, but wish either to form an independent state or to attach themselves to some other state, their...

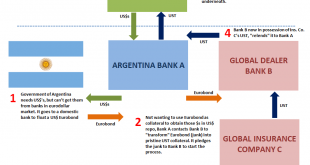

Read More »What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying. Zambia did what everyone does, the country floated its first Eurobond ($750 million). At that point, copper was only down modestly from its 2011 peak. By 2014,...

Read More »How are Swiss cities being planned?

Swiss cities and the growing areas around them are increasingly being developed. An expert on urban transformation walks us through the three phases of Swiss spatial planning, with examples in Zurich. Spatial planning has undergone major changes in the course of history. At first, before the 1960s, hardly any distinction was made between building and non-building areas. From then onwards, Switzerland was surveyed and areas were assigned a use, that is, building land, agricultural land or...

Read More »FX Daily, September 30: Nervous Calm

Swiss Franc The Euro has risen by 0.05% to 1.0798 EUR/CHF and USD/CHF, September 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Quarter and month-end considerations could be overwhelming other factors today. Turnaround Tuesday saw early gains in US equities fade. Asia Pacific shares were mixed, with the Nikkei (-1.5%) and Australia (-2.3%) bear the brunt of the selling, while China, Hong Kong, Taiwan, and...

Read More »How much blockchain does the financial world need?

Switzerland’s central bank is exploring the potential of blockchain but is in no rush to produce digital cash. © Keystone / Gaetan Bally Central Bank Digital Currency (CBDC) is the buzz-phrase of the moment. But the Swiss National Bank (SNB) says producing digital Swiss francs for the general public would create many problems with unclear benefits. The Swiss government has backed up the central bank word for word. And it turns out that an SNB issued digital Swiss...

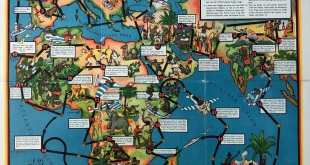

Read More »The colonial vision of Swiss multinationals

A childhood pastime – playing the Maggi aviator board game. swissinfo.ch Switzerland is the home of many major multinational companies, many of which date back to the late 19th century, the high tide of colonialism. But is there a link between the rise of great Swiss corporate names and European colonial expansion? The issue turns out to be a complex one. I found a board game a few weeks ago in the apartment that belonged to my grandmother. I vaguely remembered it...

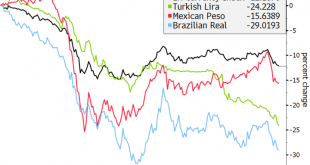

Read More »Dollar Softens as Risk-Off Sentiment Ebbs

The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns The pound continues to outperform as comments from the latest Brexit talks remain skewed to the positive side; latest eurozone CPI and retail sales readings have started coming out...

Read More »Silver Rises, JP Morgan Manipulates!

While the silver price was dropping recently, we published analyses here and here. At that time, we saw a basis that fell with price, but which recovered during “off” days. In short, there was not much of a decrease in abundance of the metal to the markets commensurate with the price drops. On Monday, the price went up from about $22.95 to about $23.70, a gain of 3.3%. Let’s look at the intraday price and basis action. There are several trends. The day begins with...

Read More » SNB & CHF

SNB & CHF