© Leigh Prather | Dreamstime.com Mistrust of vaccines against Covid-19 continues to rise in Switzerland, according to a recently published survey. A survey run in Switzerland at the end of October 2020, found that only 49% were prepared to take a Covid-19 vaccine, a percentage significantly lower than the 62% recorded in a similar survey in April 2020. Of the other 51%, 25% said they would not take a vaccine for Covid-19 and 26% said they did not know whether they...

Read More »Can 20 Years of Deflation Be Compressed into Two Years? We’re About to Find Out

Extremes become more extreme right up until they reverse, a reversal no one believes possible here in the waning days of 2020. The absolutely last thing anyone expects is a collapse of all the asset bubbles, i.e. a deflation of assets that reverses the full 20 years of bubble-utopia since 2000. The consensus is universal: assets will continue to loft ever higher, forever and ever, because the Fed has our back, i.e. central banks will create trillions out of thin...

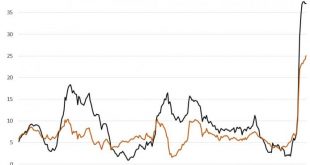

Read More »The US Money Supply Was up 37 Percent in November

In November, money supply growth rate was essentially unchanged from October and remains near September’s all-time high. The stabilization we find in money-supply growth in recent months comes after eight months of record-breaking growth in the US which came in the wake of unprecedented quantitative easing, central bank asset purchases, and various stimulus packages. Historically, the growth rate has never been higher than what we’ve seen this year, with the 1970s...

Read More »Skiing in Switzerland: is it good for your health?

Swiss ski resorts are open for Christmas despite pressure from neighbouring countries on Switzerland to close its pistes until the latest coronavirus wave passes. Germany, Italy and France pushed for Swiss resorts to close until January but Switzerland is reluctant to further damage a sector worth billions to their economies. From December 22, all ski resorts will have to prove they have met strict safety standards to obtain cantonal permits to remain open. swissinfo.ch is the...

Read More »Switzerland among best placed to recover from Covid crisis

Switzerland ranks well on flexible working and good digital connections that allow people to work from home. Keystone / Jean-christophe Bott Switzerland is among the countries best equipped to withstand the effects of the global pandemic, although no nation has emerged unscathed, according to the World Economic Forum (WEF). The Alpine country does well on several of the indicators used in a WEF report released Wednesday in Geneva. Replacing its usual annual Global...

Read More »FX Daily, December 16: Greenback Slides Ahead of FOMC as Optimism Underpins Risk Appetites

Swiss Franc The Euro has risen by 0.26% to 1.0789 EUR/CHF and USD/CHF, December 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a four-day downdraft helped by optimism over the progress toward fiscal stimulus and some hope that a new trade deal can still be negotiated between the UK and EU. Europe reported better than expected PMIs. Equities are broadly higher, as are interest rates,...

Read More »“Dirk Niepelt im swissinfo.ch-Gespräch (Interview with Dirk Niepelt),” swissinfo, 2020

Dirk Niepelt ist der Direktor des Studienzentrums Gerzensee und Professor für Makroökonomie an der Universität Bern. Hier im Gespräch mit Geldcast-Host Fabio Canetg. swissinfo.ch Swissinfo, December 14, 2020. HTML, podcast. We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed. Dirk Niepelt ist weltweit einer der führenden Forscher auf dem Gebiet der...

Read More »This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality. Oddly the same for 2017’s update heading into 2018 and 2019. If currency wars are the...

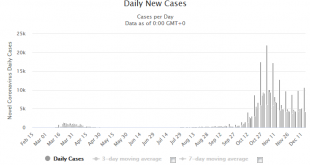

Read More »Covid, December 16: declaring extraordinary situation pointless right now, says Swiss minister

Speaking to broadcaster RTS, Swiss health minister Alain Berset said the pandemic was under control and that it currently made no sense to declare an extraordinary situation, a provision in Swiss law on managing infectious diseases that allows the Federal Council to take charge of the situation over and above cantonal governments. Declaring an extraordinary situation would be pointless right now, said Berset. We currently have all the tools we need to act and we must...

Read More »FX Daily, December 15: The Bulls are Emboldened

Swiss Franc The Euro has risen by 0.12% to 1.0775 EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P fell for the fourth consecutive session yesterday, the longest losing streak of the quarter, and this seemed to encourage profit-taking in the Asia Pacific region today. The MSCI Asia Pacific Index slipped for the second consecutive session, and even confirmation of the...

Read More » SNB & CHF

SNB & CHF