The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Switzerland and UK sign agreement on mobility of service suppliers

The UK market is being opened up to Switzerland in more than 30 service sectors Keystone An agreement that secures reciprocal, facilitated market access for service providers from Switzerland and Britain from January 1 has been signed by Economics Minister Guy Parmelin and Liz Truss, the British Secretary of State for International Trade. The Services Mobility Agreement (SMA), signed in London on Monday, regulates the mutual access and temporary stay of service...

Read More »Jeff Snider (Shadow Money, Derivatives, Free Banking, Bitcoin, "Money Printing")

The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. ✅ Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro For more content that'll help you build wealth and thrive in a world of out of control central...

Read More »FOMC Preview

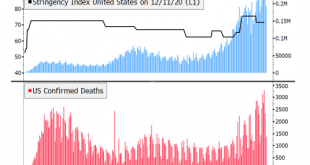

The two-day FOMC meeting starts tomorrow and wraps up Wednesday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in the coming months. RECENT DEVELOPMENTS The US outlook has worsened since the November FOMC meeting. Infection numbers are making new highs with no sign of abating. There is no national strategy to contain the...

Read More »Entrepreneurial Empowerment: You Are Only as Good as Your Employees

Abstract: As employees are increasingly recognized as an important source of ideas and inspiration, contemporary leadership research finds that the central task of leaders is to empower employees to realize their skills and talents to achieve an organizations’ visions and goals. Drawing on this leadership premise, this study develops the concept of entrepreneurial empowerment (EE). EE has structural and psychological dimensions that empower employees to utilize...

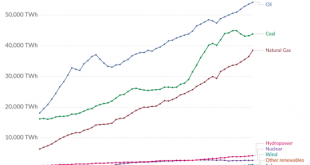

Read More »Professor Dr. Hans-Werner Sinn: „Das Klimaproblem und die deutsche Energiewende“

14. Dezember 2020 – Am 10. Oktober 2020 fand im Hotel „Bayerischer Hof“, München, die 8. Jahreskonferenz des Ludwig von Mises Institut Deutschland statt. Das Thema lautete: „Wie der Markt Umwelt und Ressourcen schützt“. Einen Konferenzbericht von Rainer Bieling finden Sie hier. Nachfolgend sehen Sie den Vortrag „Das Klimaproblem und die deutsche Energiewende“ von Professor Dr. Hans-Werner Sinn. Hans-Werner Sinn, geboren 1948, ist emeritierter Professor für...

Read More »One Little Problem with the “All-Electric” Auto Fleet: What Do We Do with all the “Waste” Gasoline?

Regardless of what happens with vaccines and Covid-19, debt and energy–inextricably bound as debt funds consumption– will destabilize the global economy in a self-reinforcing feedback. Back in the early days of the oil industry (1880s and 1890s), the product that the industry could sell at a profit was kerosene for lighting and heating. Since there was no automobile industry yet, gasoline was a waste product that was dumped into streams. Why couldn’t the refiners...

Read More »Swiss to make space squeaky clean

Did you know that Swiss are so good at tidying up on earth that they've now won a contract to clean up space? The Swiss start-up – ClearSpace - is using technology developed by engineers at the Swiss Federal Institute of Technology Lausanne (EPFL). Their four-armed robotic junk collector will be launched into space by the European Space Agency (ESA) in 2025. A lot of debris has accumulated over six decades of low-orbit activities and ESA hopes the mission will pave the way for a...

Read More »Cool Video: CNBC-Asia–Brexit, Sterling, the Euro, and Dollar

I had the privilege to join Sri Jegarajah at CNBC Asia at the start of today’s Asia Pacific session. We had a broad chat about the dollar, Brexit, and the euro. He gave me the opportunity to sketch out my views: The dollar’s entered a cyclical decline, and the “twin deficit” issue will likely frame the narrative. Many observers do not use that particular phrase now, but their arguments seem to rest on one if not both of the legs. Sterling gains appear to be more...

Read More »FX Daily, December 14: Brexit Deal Hopes Lift Sterling

Swiss Franc The Euro has risen by 0.06% to 1.0776 EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The fact that the UK and EU negotiators are still talking is seen as a constructive development and has spurred a sharp bounce in sterling. It traded below $1.3150 before the weekend and is pushing above $1.3400 in the European morning. It is part of the larger risk-on move lifting...

Read More » SNB & CHF

SNB & CHF