Stell dir vor, Ludwig von Mises wäre nicht Jahrgang 1881, sondern Jahrgang 1981. Er wäre dann nicht vor 140 Jahren am 29. September 1881, sondern erst vor 40 Jahren am 29. September 1981 geboren worden – zehn Jahre vor dem Ende der Sowjetunion. Seine Geburtsstadt hieße dann nicht Lemberg, sondern Lwiw, und sein Geburtsland hieße dann nicht Österreichisch-Ungarische Monarchie, sondern Ukrainische Sozialistische Sowjetrepublik. Und nun stell dir vor, die Familie von...

Read More »Trading with the Enemy: An American Tradition

During the French and Indian War (1754–1763), Americans continued the great tradition of trading with the enemy, and even more readily than before. As in King George’s War, Newport took the lead; other vital centers were New York and Philadelphia. The individualistic Rhode Islanders angrily turned Governor Stephen Hopkins out of office for embroiling Rhode Island in a “foreign” war between England and France. Rhode Island blithely disregarded the embargo against...

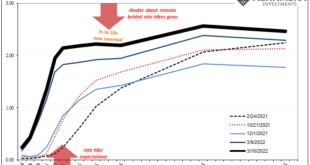

Read More »Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4...

Read More »Switzerland’s S permit for refugees from Ukraine

People fleeing the war in Ukraine will be granted an S permit upon arrival in Switzerland. It's the first time this permit will be issued since its introduction in 1999. The protection status "S" was created following the Balkan conflicts in the 1990s but it was never used until now. It allows refugees to live and work in Switzerland for a year with an option to extend if necessary. Over 6,000 Ukrainians have registered with Swiss authorities since the outbreak of the war on...

Read More »Patents, Legal Monopolies, and the High Prices for Drugs

Currently, 63 percent of American adults are on prescription drugs, according to a 2021 survey. Of this 63 percent of Americans, 26 percent say they have difficulty affording their prescriptions. Despite the prices of prescription drugs falling in recent years, an increasing number of Americans are concerned about high drug costs and demanding action be taken, 88 percent saying they want it to be easier for generic drugs to enter the market. The same percentage...

Read More »Swiss companies’ balancing act with Russia

Big consumer brands are leaving Russia in droves but for many Swiss companies untangling ties isn’t that easy. Last week Swiss chocolate maker Lindt & Sprüngli joined a chorus of brands like McDonald’s closing shops and suspending deliveries to Russia after its invasion of Ukraine. The decision by Lindt & Sprüngli took some by surprise. The company’s CEO, Dieter Weisskopf, had said during its annual results call a day before, that it was planning to keep...

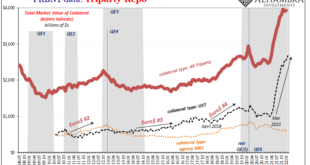

Read More »There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 2]

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking. This despite the fact, yes, fact, securities lending was the epicenter of the 2008...

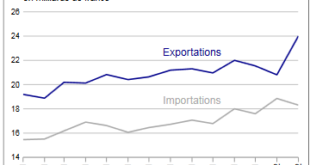

Read More »Swiss Trade Balance February 2022: chemicals-pharma propels exports to a record level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »The Fed Has No Idea What’s Coming Next!

We will let you know what we are doing once we know what we are doing was the message from the Federal Reserve statement and Chair Powell’s press conference that followed. The Fed, as widely expected did raise their short-term rate, known as the fed funds rate, by .25% to a range of 0.25% to 0.50%. This was the first increase since 2018. Along with the statement FOMC (Federal Open Market Committee) participants also released their Summary of Economic Projections....

Read More »Indien kündigt digitale Rupie für 2022/2023 an

Indien ist schon des Öfteren in die Schlagzeilen geraten, wenn es um Cryptocoins geht. Doch trotz zahlreicher Verbotsankündigungen und Restriktionen blieb der Markt bis jetzt offiziell unreguliert. Dies soll sich nun ändern, während die Regierung gleichzeitig eine digitale Version der nationalen Fiat-Währung angekündigt hat. Crypto News: Indien kündigt digitale Rupie für 2022/2023 anNeben Russland und China wird Indien damit zu den größeren Ländern gehören, die...

Read More » SNB & CHF

SNB & CHF