It’s tough to pay for an Olympics when 95% of your supposed “wealth” has vanished. In the modern era (1896-present), the Olympics have only been cancelled in wartime: 1916 (World War I), 1940 and 1944 (World War II). But world war is not the only circumstance that could derail the Olympics; a global crisis in energy, finance or geopolitics could send the risks and costs of the Olympics beyond the reach of most...

Read More »Gold Trends: The Myth of Leverage

Mining Stocks, Gold Prices and Commodity Price Trends Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much...

Read More »FX Daily, August 23: Broadly Mixed Dollar in a Mostly Quiet Market

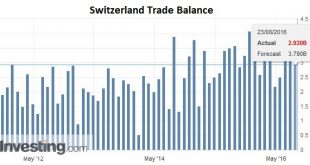

Swiss Franc Switzerland Trade Balance (See more posts for Switzerland Trade Balance) Click to enlarge. Source Investing.com FX Rates The US dollar is mostly little changed against the major, as befits a summer session. There are two exceptions. The first is the New Zealand dollar. Comments by the central bank’s governor played down the need for urgent monetary action and suggested that the bottom of cycle may be...

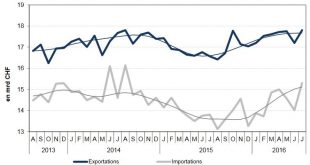

Read More »Swiss Exports + 7.9 percent YoY, Imports +11.8 percent. Trade Surplus +2.9 bn CHF.

Exports and Imports YoY Development In July 2016, Swiss exports declined due to two working days less. Adjusted for this difference, exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exports and Imports MoM Development Compared with June 2016, seasonally adjusted exports rose by 3.5% (in real terms: + 5.5%). Thus the positive trend that began in mid-2015 continues....

Read More »Swiss Sovereign Money Initiative: Reserves For Everyone

On a new website, Aleksander Berentsen rejects the Swiss Vollgeld initiative. As an alternative, he suggests the Swiss National Bank should offer transaction accounts for everybody, in line with proposals I have made earlier (see here (2016), here (2015), here (2015)). In the Handelszeitung (here and here), Simon Schmid reports....

Read More »Dollar Weakness and Fed Expectations

Summary: Dollar weakness does not line up with increased perceived risk of Fed hiking rates. Frequently the rate differentials lead spot movement. Some now turning divergence on its head, claiming too expensive to hedge dollar-investments so liquidation. TIC data, though, shows central banks not private investors, were the featured sellers in June, the most recent month that data exists. The US dollar has...

Read More »Silver is in a Different World

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Lighthouse Problem Measured in gold, the price of the dollar hardly budged this week. It fell less than one tenth of a milligram, from 23.29 to 23.20mg. However, in silver terms, it’s a different story. The dollar became more valuable, rising from 1.58 to 1.61 grams. Most people would say that gold went up $6 and...

Read More »Yarns, Mysteries, and the CPI

No CPI Change Several ill-defined economic data points were unveiled this week. Namely, the Labor Department’s July consumer price index report. According to the government data, on whole, consumer prices for the month didn’t change one iota. Reportedly, energy prices went down, food prices were unchanged, and all other items slightly increased. So when the official number crunchers tallied them all up, the...

Read More »Should we Be Concerned About the Fall in Money Velocity?

Alarmed Experts A fall in the US velocity of money M2 to 1.44 in June from 1.51 in June last year and 2.2 in May 1997 has alarmed many experts. Note that the June figure is the lowest since January 1959. Some commentators are of the view that this points to a severe liquidity crunch, which could culminate in a massive stock market collapse and an economic disaster in the months ahead. Money velocity is widely...

Read More »Does the UK Need Even More Stimulus?

AEP Speaks for Himself “We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the...

Read More » SNB & CHF

SNB & CHF