La léthargie estivale des marchés a tendance à insuffler un sentiment de fausse sécurité. Les actions et l’immobilier approchent de leurs plus hauts historiques, les taux d’intérêt sont à un plus bas de 72 ans, et la plupart des investisseurs se sentent plus riches que jamais. Les banques centrales envoient les signaux d’économies fortes en annonçant des hausses de taux et une réduction de leurs bilans. Source image:...

Read More »U.S. Consumer Price Index, Oil Prices: Why It Will Continue, Again Continued

Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing...

Read More »Switzerland UBS Consumption Indicator June: Subdued Growth

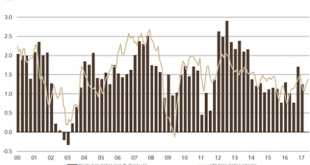

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. UBS consumption indicator printed 1.38 in June, pointing to subdued growth in Swiss private consumption in recent months. Relatively weak growth in employment was much to blame for the lackluster number, however...

Read More »Forging the dance talents of tomorrow

There is no magic formula to make it to the top in the world of dance. One thing that's for certain, is that it needs innate talent and relentless hard work. The Zurich Dance Academy trains young dancers with an all-round approach that has brought the school international acclaim. (Carlo Pisani, swissinfo.ch) Diana Georgia Ionescu from Romania and Michele Esposito from Italy have a few things in common: they are both 17-year-olds for whom dance is their life, but they don’t have wealthy...

Read More »Against Irredeemable Paper – Precious Metals Supply and Demand

The Antidote Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal. When we write to debunk the conspiracy theories that say manipulation is keeping gold from hitting $5,000 (one speaker here at Freedom Fest...

Read More »FX Daily, July 25: Summer Markets Ahead of FOMC

Swiss Franc EUR/CHF and USD/CHF, July 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets are subdued today; a dearth of fresh news and tomorrow’s FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European...

Read More »Adult habits in line with global average

An employee packages cigarettes in Switzerland (Keystone) In Switzerland, 21% of the adult population on average are daily smokers, according to a report from the World Health Organisation. That is firmly in line with average rates of current smoking among adults globally, which have declined to 21% in 2015 down from 24% in 2007. But among high-income countries like Switzerland, there’s a striking gender difference: the...

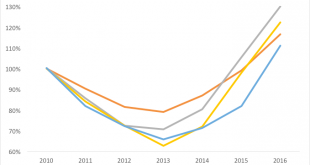

Read More »Commercial Property Market Is Inflated and May Burst Again – McWilliams

Commercial Property Market Is Inflated and May Burst Again Dublin property investors had better hope that Brexit happens soon. They should also hope that it’s not just a ‘hard’ Brexit, but a granite Brexit — a Brexit that’s as hard as possible. They should be betting on the buffoonery of Boris Johnson, down on both knees praying for a massive barney between Davis and Barnier. A granite Brexit might prompt the migration...

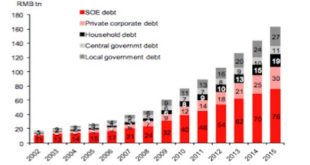

Read More »There Is Only One Empire: Finance

Any nation-state that meets these four requirements is fully exposed to a global loss of faith in its economy, debt, balance of payments and currency. There’s an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the “global empire” / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously...

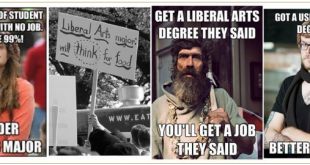

Read More »The Student Loan Bubble and Economic Collapse

The Looming Last Gasp of Indoctrination? The inevitable collapse of the student loan “market” and with it the take-down of many higher educational institutions will be one of the happiest and much needed events to look forward to in the coming months/years. Whether the student loan bubble bursts on its own or implodes due to a general economic collapse, does not matter as long as higher education is dealt a death...

Read More » SNB & CHF

SNB & CHF