Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax...

Read More »When Do We Know These Are Delusional Markets

Latest Investment Outlook In his latest investment outlook, Fasanara Capital’s Franceso Filia, who two months ago explained in one chart how the “fake market” operates… … discuss what happens when a “Twin Bubble meets quantitative tightening” and answers why record-low volatility breeds market fragility and precedes system instability. We’ll have more to share on that shortly, but for now, here is Filia with his take...

Read More »FX Daily, July 27: Dollar Remains on the Defensive

Swiss Franc The Euro has risen by 0.82% to 1.1244 CHF. EUR/CHF and USD/CHF, July 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and...

Read More »Gold Seasonal Sweet Spot – August and September – Coming

– Gold seasonal sweet spot – August and September – is coming– Gold’s performance by month from 1979 to 2016 – must see table– August sees average return of 1.4% and September of 2.5%– September is best month to own gold, followed by January, November & August Looking back at gold’s performance since 1979, August and September are big months for the yellow metal. What is the cause? No one really knows but there are...

Read More »The Two Charts That Dictate the Future of the Economy

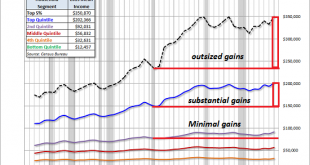

If you study these charts closely, you can only conclude that the US economy is doomed to secular stagnation and never-ending recession. The stock market, bond yields and statistical measures of the economy can be gamed, manipulated and massaged by authorities, but the real economy cannot. This is espcially true for the core drivers of the economy, real (adjusted for inflation) household income and real disposable...

Read More »Progress in St. Petersburg

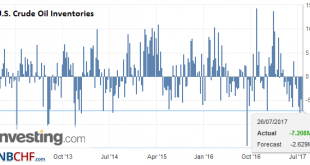

Expectations going into the OPEC monitoring meeting in St. Petersburg were low. The OPEC agreement to reduce output appeared to be fraying. June output appeared to have increased in several countries, and private sector estimates suggest output rose further in July. Russia expressed reluctance to extend the agreement further. Ecuador announced it would no longer participate in the output restraint. Hopes that...

Read More »Zurich airport reports record passenger numbers

Last year more than 100,000 passengers passed through Zurich airport in a day, last Sunday a new record was set (Keystone) Switzerland’s main airport of Zurich is going from strength to strength, setting a new daily record. On Sunday about 107,000 passengers travelled through the airport in just one day, a spokeswoman said. The figure compares with the average daily figure of 30,000 passengers. Travellers flying to a...

Read More »Latest articles by Mark O’Byrne: Gold Seasonal Sweet Spot – August and September – Coming

FX Daily, July 26: Quiet Fed Day without Yellen

Swiss Franc The euro is up by 0.56% to 1.1152 CHF EUR/CHF and USD/CHF, July 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month’s rate hike, there is practically no chance of a new policy initiative either on the balance sheet...

Read More »Stories making the Sunday papers

A Migros truck to be loaded at a distribution center in Dierikon (Keystone) Employee work hours, more storm damage in Switzerland and electricity companies’ fears of cyber attacks are among the main headlines in the Sunday papers. Not all younger employees in Switzerland prefer the freedom of more flexible work hours as companies try to adapt quickly to an increasingly digital world, reports the Swiss newspaper...

Read More » SNB & CHF

SNB & CHF