Watch executives are betting on growth in China (Keystone) - Click to enlarge The majority of Swiss watch executives surveyed by consulting firm Deloitte are positive about new rules requiring at least 60% of a watch’s manufactured costs to be incurred in Switzerland. According to the Deloitte Swiss Watch Industry Study 2017external link, released on Wednesday, 44% of 60 watch executives surveyed consider the new...

Read More »Why The Fed’s Balance Sheet Reduction Is As Irrelevant As Its Expansion

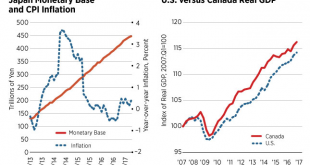

The FOMC is widely expected to vote in favor of reducing the system’s balance sheet this week. The possibility has been called historic and momentous, though it may be for reasons that aren’t very kind to these central bankers. Having started to swell almost ten years ago, it’s a big deal only in that after so much time here they still are having these kinds of discussions. My own view on the topic is the same as...

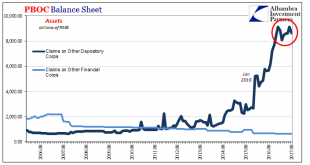

Read More »PBOC RMB Restraint Derives From Experience Plus ‘Dollar’ Constraint

Given that today started with a review of the “dollar” globally as represented by TIC figures and how that is playing into China’s circumstances, it would only be fitting to end it with a more complete examination of those. We know that the eurodollar system is constraining Chinese monetary conditions, but all through this year the PBOC has approached that constraint very differently than last year.The updated balance...

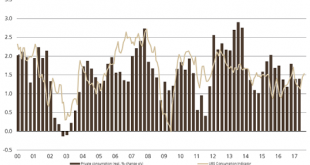

Read More »Switzerland UBS Consumption Indicator August: A pleasant end to summer

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS consumption indicator increased to 1.53 points in August thanks to robust new car registrations and encouraging numbers of hotel stays by Swiss residents, indicating consumption growth slightly above the...

Read More »Lost Greek temple found by Swiss scholars

A Swiss-led team of archaeologists in Greece has made a spectacular find: the temple of Artemis, a famous open-air sanctuary of antiquity. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More »FX Daily, September 26: Weekend Election and North Korea Rhetoric Helps Greenback Remain Firm

Swiss Franc The Euro has fallen by 0.01% to 1.1446 CHF. EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firmer against most major currencies today. The implications the Jamaica coalition in Germany is understood to be less likely to support a new vision for Europe in the aftermath of Brexit and the Great Financial Crisis....

Read More »Les Suissesses et les Suisses disent OUI à leurs paysans! ATS

Les Suisses ont accepté par 78,7% de compléter la Constitution par un article sur la sécurité alimentaire. Les Romands ont été les plus enthousiastes. Les Suisses sont très attachés à la sécurité alimentaire. Dimanche, 78,7% d’entre-eux ont dit «oui». Aucun canton n’a refusé. Environ 1’943’000 citoyens ont déposé un «oui» dans l’urne, contre un peu moins de 525’000 «non». Les cantons les moins convaincus ont été Schwyz...

Read More »“Backdrop For Gold Today Is As Bullish As It Has Been In A Long Time” – GoldCore Dublin

Gold finished sharply higher on Monday, recouping roughly half of last week’s loss, as declines in the U.S. stock market and growing tensions between the U.S. and North Korea lifted prices for the yellow metal to the highest settlement in more than a week. December gold rose $14, or 1.1%, to settle at $1,311.50 an ounce. Prices, which lost about 2.1% last week, saw their highest finish since Sept. 15, according to...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

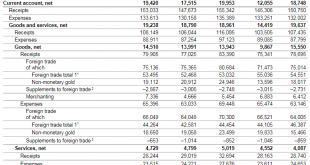

Read More »Swiss Balance of Payments and International Investment Position: Q2 2017

Q2/2017 Change vs. Q2/2016 Changein % Current Account +18.7 bn. +19.4 bn. -3.7% of which Goods Trade net +19.6 bn. +19.2 bn. +2.0% of which Services Trade net +4.1 bn. +4.7 bn. -14.6% of which Investment Income net +7.4 bn. +9.6 bn. -29.7% Financial Account +12.5 bn. +6.0 bn. +52% of which Direct Investments net -63.0 bn. +6.4 bn. -89.8% of which Portfolio Investments net +26.5 bn. -0.5 bn. +98.1% of...

Read More » SNB & CHF

SNB & CHF