For years, people blamed the global financial crisis on greed. Doesn’t this make you want to scream out, “what, were people not greedy in 2007 or 1997??” Greed utterly fails to explain the phenomenon. It merely serves to reinforce a previously-held belief. Far be it from us to challenge previously-held beliefs (OK, OK, we may engage in some sacred-ox-goring from time to time), but this is not a scientific approach to...

Read More »FX Weekly Preview: Europe Moves to the Center Ring

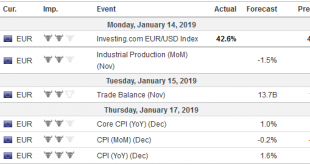

In recent weeks, the macro story focused on the shifting outlook for Fed policy and the Sino-American trade relationship. There is unlikely to be further progress on either issue in the week ahead. The Fed won’t raise interest rates until toward the middle of the year at the earliest. The government shutdown will limit new readings on the US economy. US and Chinese officials just met. Mid-level Chinese officials can...

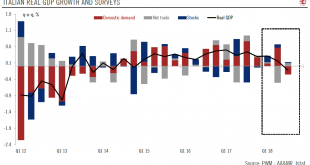

Read More »Concerns about Italy have not gone away

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy. After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP). To avoid...

Read More »Lenders pay to lend money to Switzerland

© Byvalet | Dreamstime.com On 28 December 2018, Italy issued government bonds maturing in 2028 at an effective interest rate of 2.7%1. Interest rates like this combined with the scale of Italian public debt (157% of GDP) mean Italian taxpayers spend more on public debt interest than they do on education. In 2015, Italy spent 4.1% of GDP on public debt interest and only 2.8% of GDP on education. This week, Switzerland...

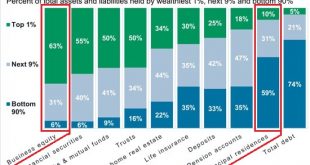

Read More »Where Will You Be Seated at the Banquet of Consequences?

To get a good seat at the banquet of consequences, the owner of capital has to shift his/her capital into scarce forms for which there is demand. The Banquet of Consequences is being laid out, and so the question is: where will you be seated? The answer depends on two dynamics I’ve mentioned many times: what types of capital you own and the asymmetries of our economy. One set of asymmetries is the result of the system...

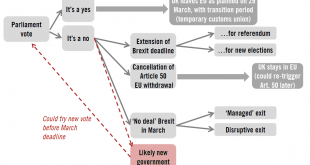

Read More »UK Politicians remain stuck in the mire

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March. The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support. The problem is that there remains no...

Read More »Nestlé now Europe’s most valuable company

© Alexey Novikov | Dreamstime.com Volatile markets have been reshuffling the ranking of the world’s most valuable companies. Over the course of the last six months, Nestlé overtook Royal Dutch Shell to become Europe’s most valuable company. At the end of June 2018, Royal Dutch Shell had Europe’s highest market capitalisation (US$ 293 billion), making it the world’s 13th most valuable company, while Nestlé ranked 21st...

Read More »Rate of Change

We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way. In January 2019, especially the past few days, there are so many examples of flighty birds. Here’s an especially obvious, egregious one...

Read More »CHARLES HUGH SMITH: What We Want To Do Is Make Society Rich | Global Economic

☀☀☀☀ Please Click Below to SUBSCRIBE for More "Global Economic" Videos https://www.youtube.com/channel/UCV-UIza2EiL0s3Pd5GmawDw Thanks for watching!!! ******************************************* Please help me to reach 1k subscribers. Thanks you very much!!!

Read More »Germany is Stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP. German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009. While some idiosyncratic factors were likely at play, such as below-average water levels on...

Read More » SNB & CHF

SNB & CHF