Swiss Franc The Euro has fallen by 0.13% at 1.1311 EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF and USD/CHF, ) - Click to enlarge FX Rates Overview: Sentiment has improved since the volatility last month spooked investors and, perhaps, some policymakers. Global equities are rallying. The Shanghai Composite and the Nikkei are at their best levels in almost a month, while the Dow Jones Stoxx 600 is at...

Read More »Swiss and Italian leaders discuss cross-border tax deal

Swiss Foreign Affairs Minister Ignazio Cassis, left, with his Italian counterpart, Enzo Moavero Milanesi, in Lugano By spring, the Italian government is expected to clarify its position on a new tax system for cross-border commuters between Italy and Switzerland. “It is a delicate issue that must be digested sufficiently, with both administrative and political evaluations. It takes time, but spring is not far away,”...

Read More »Spreading Sour Not Soar

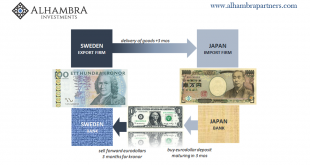

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve. There are real economic processes underneath....

Read More »The Strongest Season for Silver Has Only Just Begun

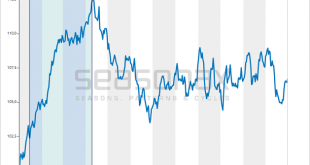

Commodities as an Alternative Our readers are presumably following commodity prices. Commodities often provide an alternative to investing in stocks – and they have clearly discernible seasonal characteristics. Thus heating oil tends to be cheaper in the summer than during the heating season in winter, and wheat is typically more expensive before the harvest then thereafter. Precious metals are also subject to seasonal...

Read More »Charles Hugh Smith JAN 18, 2019 We Already Passed The Point Of No Return Collapse is Inevitable !

Thank You

Read More »FX Daily, January 17: Risk Assets Underperform as Investors Await Fresh Developments

Swiss Franc The Euro has risen by 0.32% at 1.1319 EUR/CHF and USD/CHF, January 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets remain relatively subdued as fresh trading incentives are awaited, including US corporate earnings. Some of the enthusiasm for risk-assets has diminished. The MSCI Emerging Markets Index has stalled after...

Read More »Learn to ski in three lessons!

Learn to ski in three lessons! --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe: http://www.youtube.com/subscription_center?add_user=swissinfovideos

Read More »Learn to ski in three lessons!

Learn to ski in three lessons! --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos Subscribe: http://www.youtube.com/subscription_center?add_user=swissinfovideos

Read More »Outlook for euro periphery bonds

Economic fundamentals should come back into focus, but politics still a factor. After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy. In both countries, the political...

Read More »Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies – Physical demand for gold coins and bars has picked up in the UK and Ireland,...

Read More » SNB & CHF

SNB & CHF