It is now very close to the best time to buy Swiss Francs with pounds since May 2018. The stronger pound and a reduced global risk appetite has seen the move on the GBP/CHF pairing. This is presenting a much improved opportunity to buy Swiss Francs with pounds. Any client wishing to buy or sell on this pairing might benefit from a quick review with our team to best understand what is next, and the potential outcomes....

Read More »What Sort of “Democracy” Do We Have If Everyone’s Goal Is Maximizing Their Government Swag?

The “marketplace” of individuals and entities all seeking to maximize their share of the central-state swag doesn’t make a democracy. A democratic republic is a government in which power flows from citizens to their elected representatives. The American revolutionaries did not make a big distinction between republic and democracy, for in the context of the late 1700s, the dominant political structure was monarchy, and...

Read More »UBS fined and denied right to sponsor IPOs in Hong Kong

The Hong Kong SFC accused UBS of substandard due diligence and failure to address red flags. (Keystone) Swiss bank UBS has been fined HK$375 million (CHF48 million) for irregularities involving three IPOs it had help list on the Hong Kong stock exchange in 2009. Its licence to sponsor IPOs in the city was also suspended for one year. On Thursday, Hong Kong’s Securities and Futures Commission (SFC) announced the measures...

Read More »FX Daily, March 14: Another UK Vote, but No Closure

Swiss Franc The Euro has fallen by 0.19% at 1.1346 EUR/CHF and USD/CHF, March 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Brexit drama continues to play out, and the Withdrawal Bill that has been twice defeated is ironically not dead yet. Today’s vote, in fact, is predicated on another “meaningful vote” before seeking an extension. Sterling remains firm...

Read More »Swiss Producer and Import Price Index in February 2019: -0.7 percent YoY, +0.2 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

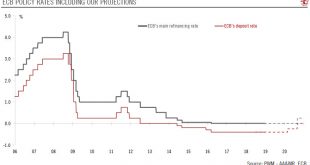

Read More »ECB Forward Guidance: the Devil is in the Detail

Following the changes to its forward guidance, we have revised our forecast for ECB policy rates. Last week, the European Central Bank (ECB) announced a new long-term refinancing package for banks (called TLTRO-III) and made clear that interest rates would not be raised this year. While these measures were expected, they have come earlier than we thought. We were also taken aback by the extent of the downside revisions...

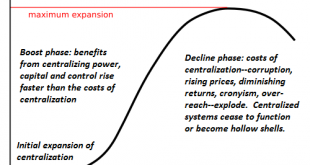

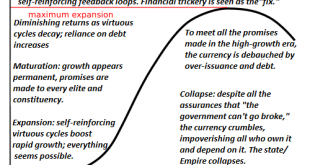

Read More »How States/Empires Collapse in Four Easy Steps

The promises cannot be met, and so society decays into warring elites and competing constituencies. There is a grand, majestic tragedy in the inevitable collapse of once-thriving states and empires: it all seemed so permanent at its peak, so godlike in its power, and then slowly but surely, too many grandiose, unrealistic promises were made to too many elites and constituencies, and then as growth decays to stagnation,...

Read More »Court confirms legal weed should be taxed as tobacco

A ‘real’ cannabis plant, which remains illegal. It’s low-THC sibling is taxed. (Keystone / Alessandro Della Bella) The Federal Administrative Court has upheld a decision by Swiss customs to tax legal marijuana leaves to the same extent as tobacco. In its decision published on Wednesdayexternal link, the St Gallen court said that “fake” marijuana – i.e. cannabis containing less than 1% tetrahydrocannabinol (THC) – was...

Read More »FX Daily, March 13: Still Waiting for Brexit Climax

Swiss Franc The Euro has fallen by 0.04% at 1.1368 EUR/CHF and USD/CHF, March 13(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Brexit drama continues to command attention. A vote on leaving without an agreement will be held today, and if that fails, there will be a vote tomorrow on an extension. Meanwhile, the first increase in headline US CPI in four...

Read More »1000-Franc Note Enters Circulation Today

Updated SNB banknote app available Issuance of the new 1000-franc note presented a week ago begins today, 13 March. The Swiss National Bank’s ‘Swiss Banknotes’ app has now been updated to include the new note. 1000-Franc Banknotes Circulation Today - Click to enlarge The app, which has been downloaded some 110,000 times, can be obtained free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com)...

Read More » SNB & CHF

SNB & CHF