Novartis has aborted its latest patent filing at the European Patent Office. (Keystone / Georgios Kefalas) Swiss pharmaceutical giant Novartis has backed down in a patent dispute over the leukaemia therapy Kymriah following opposition from NGOs. The Swiss NGO Public Eye is claiming victory in the European Patent Officeexternal link battle, but Novartis says the patent in question was only one of several it has in place on the (CAR)-T cell therapy treatment it had...

Read More »FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

After last week’s flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the amount of agriculture...

Read More »EM Preview for the Week Ahead

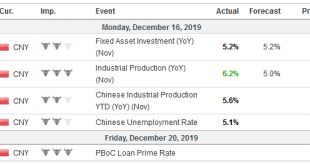

Risk assets such as EM got a big boost last week, as tail risks from a hard Brexit and the US-China trade war have clearly ebbed. Still, the initial lack of details on the Phase One deal as well as uncertainty regarding the next phases have left the markets a bit jittery and nervous. Hopefully, this week may bring some further clarity and the good news is that the December 15 tariffs have been canceled. AMERICAS Brazil COPOM minutes will be released Tuesday. It cut...

Read More »A “Market” That Needs $1 Trillion in Panic-Money-Printing by the Fed to Stave Off Implosion Is Not a Market

It was all fun and games enriching the super-wealthy but now the karmic cost of the Fed’s manipulation and propaganda is about to come due. A “market” that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery? The decisions and actions of buyers and sellers set the price of everything: assets, goods, services, risk and the price of borrowing...

Read More »Embrace Unilateral Free Trade with the UK — Right Now

Boris Johnson’s Conservatives won an outright majority in yesterday’s general election, pushing the Tories to an 80-strong Commons majority in what the Daily Mail called a “staggering election landslide.” Given that the Conservatives employed an election slogan of “Get Brexit Done,” it appears the election was largely a referendum on Brexit. The Conservative victory suggests Johnson will now move forward much more quickly on putting a UK-EU agreement in place for UK...

Read More »Banana Republic Money Debasement In America

Addicted to Spending There are many falsehoods being perpetuated these days when it comes to money, financial markets, and the economy. But when you cut the chaff, three related facts remain: Uncle Sam needs your money. He needs a lot of your money. And he needs it bad! The inescapable logic of tax & spend: empty vault… empty pockets… gimme more! PT According to the Congressional Budget Office, the federal budget deficit for the first two months of fiscal year...

Read More »Nationalbank ist vom Nutzen der Negativzinsen überzeugt

Die SNB hält am negativen Leitzins von −0,75% unverändert fest. Die Schweizerische Nationalbank (SNB) belässt den Leitzins und den Zins auf Sichtguthaben bei der SNB unverändert bei -0,75%, wie sie an ihrer geldpolitischen Lagebeurteilung am Donnerstag mitteilte. Sie ist weiterhin bereit, bei Bedarf am Devisenmarkt zu intervenieren und berücksichtigt dabei die gesamte Währungssituation. Die expansive Geldpolitik sei angesichts der Inflationsaussichten in der Schweiz...

Read More »Digitales Zentralbankgeld bringt laut Bundesrat gegenwärtig keinen Zusatznutzen

Der Bundesrat hat in einem am Freitag genehmigten Bericht Möglichkeiten, Chancen und Risiken eines Kryptofrankens oder e-Frankens analysieren lassen. Den Auftrag dazu hatte der Nationalrat mit der Überweisung eines Postulates von Cédric Wermuth (SP/AG) erteilt. Viele zahlen bar Mit dem Begriff “digitales Zentralbankgeld” ist Geld gemeint, dass im konkreten Fall die Schweizerische Nationalbank (SNB) schaffen würde, um es der breiten Bevölkerung zugänglich zu machen....

Read More »Swiss economy tipped to remain stagnant next year

The 2020 Olympic Games is expected to raise the bar for the economy – but only temporarily. (Keystone / Lukas Coch) The Swiss economy is not expected to see any sustainable growth until 2021 at the earliest, according to government forecasters. The Swiss National Bank (SNB) agreed, keeping negative interest rates unchanged. A government expert group concluded that economic growth would rise only 0.9% this year, 1.7% in 2020 and 1.2% in 2021. However, much of the...

Read More »The Most Important UK Election of the Century So Far

There’s only one story in the UK this morning – it’s the day Britain goes to the polls. It’s no exaggeration to say that this election is probably the most important of the century so far. If the ruling Conservative party wins a clear majority, then some form of Brexit is almost certain to go ahead. If the Conservatives fail to win a majority, then, depending on the final makeup of any government, Brexit will likely be delayed or even derailed, with a second...

Read More » SNB & CHF

SNB & CHF