US Dollar Index erases daily recovery gains ahead of American session. European equity indexes stay in the negative territory. Coming up: Building Permits, Housing Starts and Industrial Production data from US. The USD/CHF lost its traction in the last couple of hours and retraced its daily recovery gains pressured by the sour market mood and the broad USD weakness. As of writing, the pair was down 0.02% on the day at 0.9818. The USD recovery during the early trading...

Read More »Paper reports new surveillance case involving Credit Suisse executive

In October of this year the bank cleared Credit Suisse CEO Tidjane Thiam of snooping on former wealth management boss Iqbal Khan in an episode that saw suicide, scandal and espionage invade the secretive world of Swiss private banking. (© Keystone / Ennio Leanza) A senior Credit Suisse human resources executive was tailed by private investigators in February, the Neue Zuercher Zeitung (NZZ) newspaper reported on Tuesday. The Swiss bank was rocked by a highly damaging...

Read More »Léman Express to cut Geneva traffic jams

[embedded content] Commuters got their first proper taste on Monday of what’s been hailed as the largest cross-border regional rail network in Europe, the Léman Express. The network, which opened officially on Sunday, is the result of decades of planning and almost eight years of construction work. It offers a fast cross-city rail link from Geneva’s central train station to Annemasse in France. The regional cross-border network is much bigger, extending across...

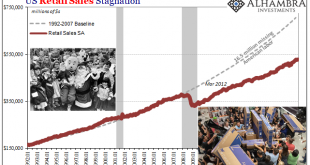

Read More »If The Best Case For Consumer Christmas Is That It Started Off In The Wrong Month…

Gone are the days when Black Friday dominated the retail calendar. While it used to be a somewhat fun way to kick off the holiday shopping season, it had morphed into something else entirely in later years. Scenes of angry shoppers smashing each other over the few big deals stores would truly offer, internet clips of crying children watching in horror as their parents transformed their local Walmart into Thunderdome. Two shoppers enter, one shopper leaves…with the...

Read More »The “Trade Deal”: A Pathetic Parody, Credibility Squandered

Anyone who thinks this bogus “deal” has resolved any of the issues or uncertainties deserves to be fired immediately. Here’s a late-night TV parody of a trade deal: The agreement won’t be signed by both parties, though each might sign their own version of it, and the terms of the deal will never ever be revealed to the public, which includes everyone doing any business in the nations doing the “deal.” How is this “deal” not a pathetic parody of a real deal? A real...

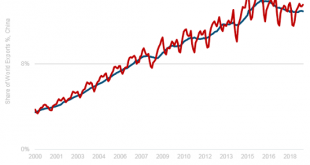

Read More »The US Economy Is Being Japanified — Thanks to the Fed

Japan has not recovered fully from the lost decade of the 1990s. The Asian financial crisis was exacerbated by the dot-com crash and then a few years later the global economic collapse. Tokyo has tried everything to combat anemic growth and deflation, and resolve the zombification of the Japanese economy through an immense buildup of government debt and a dramatic loosening of monetary policy, including subzero interest rates. This has become known as...

Read More »Gold Coins Worth Thousands Generously Donated To Salvation Army

Salvation Army volunteer James Bond found a gold coin valued at $1,500 inside his kettle in Noblesville. Source: Salvation Army via USA Today ◆ Gold coins worth thousands generously gifted to the charity again this year ◆ It just means so much … because it means that they went out of their way to do something extra special…” ◆ Salvation Army gold donors keep giving gold coins including Gold Krugerrands anonymously every year ◆ At least three gold coins worth some...

Read More »Keith Weiner: Uncle Sam’s Debt-Money System Is Immoral, Tantamount to Theft

Interview Begins ?️at 6:29 Full transcript ?: https://www.moneymetals.com/podcasts/2019/12/13/debt-money-system-is-immoral-001925 Live gold and silver prices ?? https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤...

Read More »Keith Weiner: Uncle Sam’s Debt-Money System Is Immoral, Tantamount to Theft

Interview Begins ?️at 6:29 Full transcript ?: https://www.moneymetals.com/podcasts/2019/12/13/debt-money-system-is-immoral-001925 Live gold and silver prices ?? https://www.moneymetals.com/precious-metals-charts ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤...

Read More »FX Daily, December 16: China Data Surprises to the Upside while Europe’s Manufacturing PMI Disappoints

Swiss Franc The Euro has risen by 0.05% to 1.095 EUR/CHF and USD/CHF, December 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Despite better than expected Chinese data, and last week’s investor-friendly developments, Asia Pacific equities were mixed. Australia led the advancing bourses with a 1.6% gain, its largest for the year despite the government revising down growth and wages. China, Taiwan, and Indian...

Read More » SNB & CHF

SNB & CHF