The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB. WHAT ELSE CAN THE SNB DO? The SNB meets quarterly in March, June, September, and December. At the March 19 meeting, the SNB took a series of measures to help mitigate the impact of the pandemic. Whilst SNB officials have always said that rates...

Read More »Coronavirus: latest antibody study suggests 10.8 percent of Geneva infected in first wave

© Eduard Goricev | Dreamstime.com A recently published update to the ongoing study in Geneva to assess the extent of SARS-CoV-2 infection suggests 10.8% of the population may have been infected in the first wave of infections. The study, which tests a sample of the population over time for IgG SARS-CoV-2 antibodies, started in early April 2020. The latest figures come from the fifth week of testing, which was concluded on 9 May 2020. In the first week, 4.8% tested...

Read More »Dollar Suffers as Stimulus Efforts Boost Market Sentiment

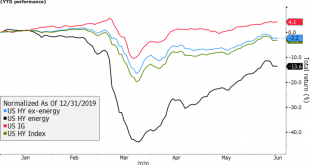

Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight Comments from UK and EU officials have sparked optimism about Brexit talks; UK...

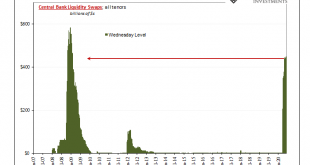

Read More »Fed Balance Sheet: Swap Me Update

Just a quick update to add a little more data and color to my last Friday’s swap line criticism so hopefully you can better see how there is intentional activity behind them. Since a few people have asked, I’ll break them out with a little more detail. While the volume of swaps outstanding at the Fed has, in total, remained relatively constant (suspiciously, if you ask me), the underlying tenor of them has not. Meaning, there is purpose. It’s not like everyone...

Read More »Keynesians on the Cause of, and Cure for, Depressions

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] In chapter 8 we presented Ludwig von Mises’s explanation of how bank credit expansion causes the boom-bust cycle, what is now known as Austrian business cycle theory. However, the reigning view today in both academia and the popular media is the Keynesian explanation, derived from John Maynard Keynes’s famous 1936 book The...

Read More »FX Daily, June 17: Correction Phase does not Appear Over

Swiss Franc The Euro has fallen by 0.48% to 1.066 EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the...

Read More »SoftBank invests in Credit Suisse funds financing technology bets

SoftBank has quietly poured more than $500m into Credit Suisse investment funds. Copyright 2018 The Associated Press. All Rights Reserved. SoftBank has quietly poured more than $500m into Credit Suisse investment funds that in turn made big bets on the debt of struggling start-ups backed by the Japanese technology conglomerate’s Vision Fund. SoftBank made the investment into the Swiss bank’s $7.5bn range of supply-chain finance funds, said three people familiar with...

Read More »Growing Dollar Demand, Silver Weirdness, Market Report, 15 June

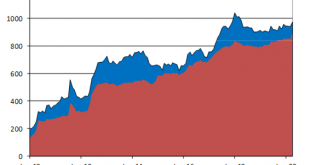

The Federal Reserve has become more aggressive again, after several years of acting docile. As you can see on this chart of the Fed’s balance sheet, it has very rapidly expanded from a baseline from (prior to) 2015 through 2018, of about $4.4 trillion. After which, it had attempted to taper, getting down to $3.8 trillion last summer. Then it was obliged to reverse itself well before responding to the COVID lockdown. Since then, its balance sheet has gone vertical....

Read More »Inequality is Overstated—and Overrated

Whining and complaining about inequality is a growth industry. Thomas Piketty’s book (or perhaps a large virtue-signaling paperweight), about how the rich are getting richer, achieved bestseller status and is now a movie. Understanding the flaws in the wealth inequality argument is increasingly important, because the communist wing of the Democratic Party is now openly advocating a wealth tax. In this article I will explain why measures of wealth inequality...

Read More »Investing Fees could cost you your early retirement!

(Disclosure: Some of the links below may be affiliate links) When you are investing, you want to minimize your investing fees. It is something most people already realize. But what most people do not realize is how expensive fees can be in the long-term. In this article, we are going to see precisely how much investing fees are hurting you! Not only will we see that they are more expensive than they seem. We will also see that investing fees have a significant...

Read More » SNB & CHF

SNB & CHF