Switzerland’s economic conditions make it attractive for financial flows from developing countries © Keystone / Gaetan Bally It’s an economist’s conundrum: global capital, instead of flowing from rich countries to poor countries, actually moves in the other direction. Each year hundreds of billions of dollars leave developing countries and land in the coffers of rich countries like Switzerland. An “unprecedented” $160 billion (CHF149 billion) – about the same amount...

Read More »Swiss unemployment down, especially among young

© Mcherevan | Dreamstime.com Unemployment fell from 2.7% to 2.6% in September 2021 in Switzerland, with a sharp drop among those aged 15 to 24, reported RTS. By the end of September 2021, just over 200,000 people were looking for employment in Switzerland according to Switzerland’s standard measure, which is focused on those registered with the official unemployment office, something required to collect unemployment benefits. However, it means some who run out the 2...

Read More »SHIBA INU Rallye stellt Bitcoin in den Schatten

Der Dogecoin Clone SHIBA INU (SHIB) hat die Top 15 der Cryptocoins erreicht. Mit einer intensiven Rallye hat SHIB sogar das aktuelle Bitcoin-Plus in den Schatten gestellt – in der Spitze legte SHIBA INU um 400 Prozent zu. Crypto News: SHIBA INU Rallye stellt Bitcoin in den Schatten Im Wochenvergleich konnte SHIB immerhin noch fast 300 Prozent zulegen. Der Hunde-Coin wurde damit in den letzten Tagen zum heißesten Eisen des Marktes. Doch wieder einmal waren es nichts...

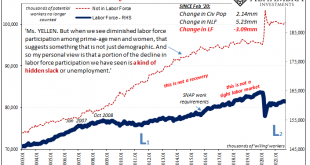

Read More »For The Love Of Unemployment Rates

Here we are again. The labor force. The numbers from the BLS are simply staggering. During September 2021, the government believes it shrank for another month, down by 183,000 when compared to August. This means that the Labor Force Participation rate declined slightly to 61.6%, practically the same level in this key metric going back to June. Last June. These millions, yes, millions (see: below), are being excluded from the official labor force therefore...

Read More »Biden Bizarrely Claims That Government Spending Is Costless

There is only one way to describe the fiscal mindset of those in the White House and in Congress who are proposing new federal budgetary expenditure and taxing increases in the trillions of dollars: a fantasy land of financial irrationality. The Biden administration insists on additions to the already bloated American welfare state that will see an expansion in entitlement programs and increased societal dependency on government largess not implemented since Lyndon...

Read More »FX Daily, October 11: Rate Expectation Adjustment Continues

Swiss Franc The Euro has fallen by 0.07% to 1.0717 EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are softer and yields higher to start the new week. The dollar is mixed. Oil and industrial metals are higher. There are several developments over the weekend, but the focus seems to be on central bank action, inflation reports by the US and China, and the start of the Q3...

Read More »Age-Adjusted Mortality Is at 2004 Levels. Yet They Tell Us Covid Is Worse Than the 1918 Flu.

Last week, the media again tried to ratchet up the public’s fear over covid-19 by labeling it more deadly than the 1918 flu epidemic. “COVID-19 Is Now the Deadliest Disease in U.S. History,” reads one headline from an NBC TV affiliate. Considering the realities of cancer and heart disease, that headline is absurdly false. Perhaps the author meant “communicable disease.” A TIME headline was at least arguably factual, declaring, “COVID-19 Is Now the Deadliest Pandemic...

Read More »‘Fantasy Basel’ re-opens after a two-year Covid break

V for Vaccine? One of many masked guests at Fantasy Basel on Saturday Keystone / Peter Klaunzer The three-day Fantasy Basel festival for fans of films, games, comics, cosplay and manga has re-opened its doors after a two-year break. Fantasy BaselExternal link, also known as the Swiss Comic Con, is one of the biggest events of its kind in Switzerland. Fans of pop culture are drawn to the exhibition halls in Basel, where many visitors dress up in flashy costumes...

Read More »Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it. When nominal rates fell from April through July, real rates fell right along with them. The nominal bond yield fell by 63 basis points and the 10 year TIPS yield fell by 57....

Read More »The Market Likes the Dollar and the Loonie even More

US rates and the dollar hardly responded to the disappointing jobs report. The 194k rise in the nonfarm payrolls was the least this year, but of course, it is subject to revisions the way the August series was revised by more than 50% to 366k. One critical problem was that hiring by local governments for the start of the school season was less than usual, and with the seasonal adjustment, it turned into a decline. On the other hand, the private sector added 317k,...

Read More » SNB & CHF

SNB & CHF